Renters insurance premiums may increase due to factors such as increased claim frequency, changes in insurance company rates, or changes in the value of your personal property. Renters insurance premiums may go up because of various reasons, including more frequent claims, adjustments in insurance rates, or fluctuations in the value of your possessions.

It is important to understand the factors behind these premium increases to ensure you are adequately protected while also managing your budget effectively. This article will explore some of the possible reasons for a rise in renters insurance premiums and provide guidance on how to address and mitigate such increases.

By understanding these factors, you can make informed decisions to help keep your insurance costs at a reasonable level.

Credit: http://www.latimes.com

Factors Contributing To Increased Renters Insurance Premiums

Location Changes

Moving to a different area affect renters insurance due to varying risk levels.

Personal Claims History

Your own claims could impact your renters insurance premium.

Insurance Company Rate Adjustments

Insurance providers may adjust rates based on various factors.

Credit: http://www.deerparktx.gov

Impact Of Location Changes On Renters Insurance Premiums

If you’ve noticed that your renters insurance premium has gone up, one factor that could be driving this increase is a change in location. Insurance companies take various factors into account when determining the cost of your policy, and where you live plays a significant role in their risk assessment. In this blog post, we’ll explore how location changes can impact your renters insurance premiums, focusing on risk assessment by insurers, natural disaster-prone areas, and crime rates in the neighborhood.

Risk Assessment By Insurers

When setting premiums for renters insurance policies, insurers conduct a risk assessment based on several factors, including the location of the insured property. They consider the likelihood of potential risks and the frequency of insurance claims in different areas. If you’ve recently moved to a new location that is deemed to have higher risks, such as a higher crime rate or a greater likelihood of natural disasters, your insurance premium may increase accordingly. Insurance companies aim to reflect the potential risks they face when covering your property, and this can be impacted by your new location.

Natural Disaster Prone Areas

Living in an area prone to natural disasters can significantly affect your renters insurance premium. Insurers evaluate the likelihood of events such as hurricanes, earthquakes, floods, or wildfires occurring in a particular location. If you move to an area with a higher risk of these types of disasters, your insurance company may adjust your premium to account for the increased potential for claims related to property damage or loss. The higher the risk of natural disasters, the higher your renters insurance premium is likely to be, as insurers need to ensure they can cover the potential costs associated with such events.

Crime Rates In The Neighborhood

Another factor that can impact your renters insurance premium is the crime rate in your new neighborhood. Insurers consider the likelihood of theft, burglary, and vandalism when determining the cost of your policy. If you move to an area with a higher crime rate, you may see an increase in your insurance premium to compensate for the increased risk of property damage or loss due to criminal activity. Conversely, moving to a safer neighborhood with lower crime rates may result in a decrease in your renters insurance premium. Insurers want to ensure they can cover potential losses resulting from criminal acts, and your new location plays a significant role in this assessment.

If you’ve noticed a change in your renters insurance premium, understanding the impact of location changes on your policy cost can help you make informed decisions. Keep in mind that there are other factors that may influence your premium, such as the type and amount of coverage you have, your deductible, and your personal circumstances. By understanding the factors insurers consider when pricing a policy, you can better navigate the changes in your renters insurance cost and potentially reduce your premium by choosing a location with lower risks or exploring other available options.

Understanding The Influence Of Personal Claims History

When it comes to understanding the fluctuations in your renters insurance premium, delving into the influence of your personal claims history is crucial. By examining the frequency, severity, and overall impact of your filed claims, you can gain insights into why your renters insurance rates have increased.

Frequency Of Claims Made

The frequency of claims made plays a significant role in determining your renters insurance premium. Frequent claims can indicate a higher level of risk and potential for future claims, contributing to premium increases.

Severity Of Claims Filed

In addition to the frequency, the severity of claims filed also influences the cost of your renters insurance. Large or costly claims may lead insurance providers to adjust your premium to account for the higher potential for future claims.

Effect On Policyholder’s Risk Profile

Ultimately, the frequency and severity of your claims can impact your overall risk profile as a policyholder. Excessive claims can result in an increased perception of risk, prompting insurers to adjust your premium to reflect this elevated level of potential liability.

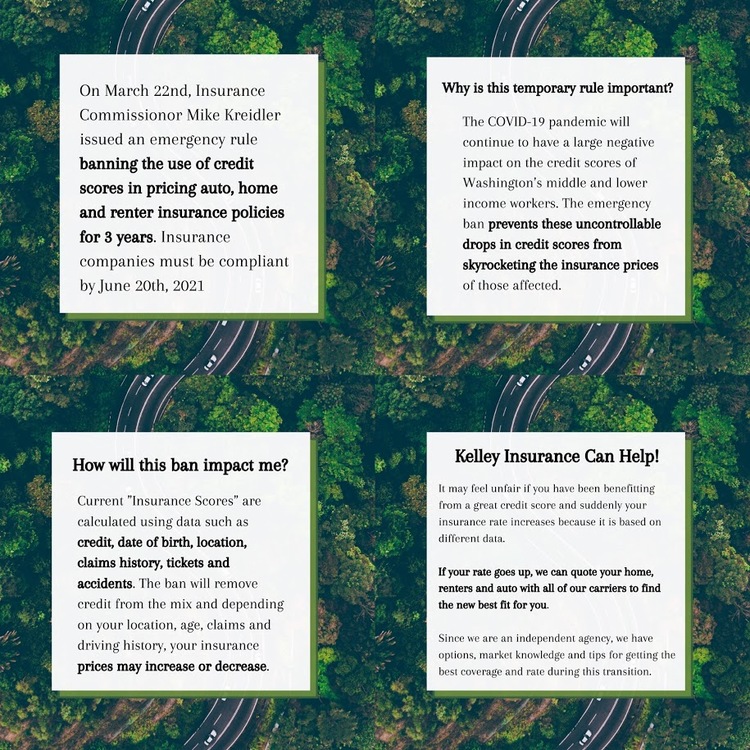

Credit: http://www.kelleyinsure.com

Insurance Company Rate Adjustments And Their Impact

Renters insurance rates can increase due to various factors, including insurance company rate adjustments. It’s essential to understand the reasons behind these adjustments and how they can impact your policy. Let’s delve into some key factors that influence insurance company rate adjustments:

Market Trends

Market trends play a significant role in influencing insurance company rate adjustments. Fluctuations in the housing market, regional disasters, and changes in property values can impact the overall insurance landscape. Insurers may need to adjust their rates to reflect these market trends and ensure the adequacy of coverage. These fluctuations can directly affect the cost of your renters insurance policy as insurers seek to mitigate their exposure to market instabilities.

Regulatory Changes

Regulatory changes imposed by state or federal authorities can lead to adjustments in insurance rates. Legislation regarding insurance practices, coverage requirements, or claims procedures may prompt insurers to re-evaluate and adjust their rates. Compliance with updated regulations may result in increased operational costs for insurers, reflecting in the form of higher premiums for policyholders.

Company Profitability

Insurers’ financial performance is a crucial factor in determining rate adjustments. Company profitability directly impacts the ability of insurance providers to maintain competitive pricing. If an insurance company’s profitability is affected by high claims payouts or operating expenses, they may need to adjust rates to sustain financial viability. Policyholders can experience rate increases as insurers strive to maintain sustainable profitability.

Strategies To Lower Renters Insurance Costs

Are you experiencing a sudden increase in your renters insurance premium? Don’t worry, there are strategies you can employ to lower your costs without compromising the coverage you need. By shopping around for better rates, increasing deductibles, and bundling policies, you can find ways to reduce your renters insurance expenses.

Shopping Around For Better Rates

If your renters insurance premium has increased, it’s essential to explore other options and compare rates from different insurers. By shopping around, you can potentially find a policy with similar coverage at a lower cost. One effective way is to use online insurance comparison websites, which allow you to compare quotes from multiple insurers quickly. It’s important to remember that price should not be the only factor in your decision-making process. Ensure that the insurer is reliable and has a good reputation for customer service.

Increasing Deductibles

Another strategy to lower your renters insurance costs is to consider increasing your deductible. A deductible is the amount you will pay out of pocket before your insurance coverage kicks in. By opting for a higher deductible, you may be able to lower your premium significantly. However, keep in mind that you should choose a deductible that you can comfortably afford in case of a claim. It’s always wise to weigh the potential savings against the potential financial burden when considering this option.

Bundling Policies

Bundling your renters insurance policy with other policies, such as auto or life insurance, can often lead to substantial savings. Insurance companies offer discounts to customers who choose to consolidate their policies with one provider. By bundling, you not only simplify your insurance paperwork and payment process but also take advantage of potential discounts. Before making any decisions, though, it’s important to compare the overall costs and coverage across different insurers to ensure that bundling truly benefits you financially.

Importance Of Regularly Reviewing Your Coverage

Renters insurance premiums may increase for various reasons. It’s crucial to regularly review your coverage to ensure you are getting the most value out of your policy.

Policy Updates

Insurers may adjust rates due to policy updates. Review your policy to understand changes and updates.

Comparison With Competitors

Research competitors’ rates periodically to ensure you are still getting the best deal on your renters insurance.

Adaptation To Life Changes

Life changes can impact your insurance needs. Review your coverage when major life events occur.

Tips To Maintain Stable Renters Insurance Premiums

Securing windows and doors with quality locks and reinforcing entry points can deter intruders.

- Install smoke detectors in key areas to prevent fire-related damages.

- Regularly check for water leaks to reduce the risk of water damage claims.

Invest in an alarm system or surveillance cameras to enhance the security of your rental property.

- Consider upgrading to impact-resistant windows and storm shutters for added protection.

- Joining a neighborhood watch program can reduce the likelihood of vandalism or theft.

Practice safe habits to minimize the need for claims and maintain a good claims history.

- Regularly maintain appliances and electrical systems to prevent accidents.

- Avoid smoking indoors to reduce the risk of fire damage claims.

Consulting With Insurance Professionals For Guidance

Consulting with insurance professionals for guidance is an important step in understanding the factors that contribute to a potential increase in renters insurance premiums. Seeking advice from knowledgeable professionals can provide invaluable insights and assist in making informed decisions to manage costs effectively.

Understanding Policy Fine Print

Ensure you understand the intricacies of your policy by carefully reviewing the fine print. Identify any changes or updates to coverage, deductibles, or limits that may impact your premium. Familiarizing yourself with the specific details of your policy can help you comprehend the basis for alterations in insurance rates.

Exploring Available Discounts

Look into potential discounts that may be available to you. Many insurance providers offer discounts for various reasons such as having safety features in your rental property, being claim-free, or bundling insurance policies. Explore these opportunities to potentially lower your premium.

Customizing Coverage To Needs

Consider customizing your coverage to reflect your specific needs. Tailoring your policy to include only what is essential can help manage costs while ensuring adequate protection. By consulting with professionals, you can gain a better understanding of how to customize your coverage effectively and avoid unnecessary expenses.

Frequently Asked Questions For Why Did My Renters Insurance Go Up

Why Does Renters Insurance Rates Go Up?

Your renters insurance rates may go up due to changes in the area’s crime rate, inflation, or the insurance company’s business decision. Additionally, making multiple claims or acquiring new items to insure can also impact your rates.

Can I Lower My Renters Insurance Premium?

You can lower your renters insurance premium by increasing your deductible, bundling with other insurance policies, improving home security, maintaining a good credit score, and comparing quotes from different insurance providers.

How Can I Find Affordable Renters Insurance?

To find affordable renters insurance, consider getting quotes from multiple insurers, bundling with other policies, opting for a higher deductible, and maintaining good credit. Also, inquire about available discounts and review your coverage to adapt to your current needs.

Conclusion

Based on the factors mentioned throughout this blog post, it’s clear that there are several reasons why your renters insurance premium may have gone up. These include changes in your coverage, increases in the cost of living, and even your own individual circumstances.

Understanding these factors and staying informed about your policy can help you make the necessary adjustments and find the most cost-effective coverage that meets your needs. Take the time to review your policy periodically and consider shopping around for better rates to ensure that you are getting the best value for your money.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Why does renters insurance rates go up?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Your renters insurance rates may go up due to changes in the area’s crime rate, inflation, or the insurance company’s business decision. Additionally, making multiple claims or acquiring new items to insure can also impact your rates.” } } , { “@type”: “Question”, “name”: “Can I lower my renters insurance premium?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can lower your renters insurance premium by increasing your deductible, bundling with other insurance policies, improving home security, maintaining a good credit score, and comparing quotes from different insurance providers.” } } , { “@type”: “Question”, “name”: “How can I find affordable renters insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To find affordable renters insurance, consider getting quotes from multiple insurers, bundling with other policies, opting for a higher deductible, and maintaining good credit. Also, inquire about available discounts and review your coverage to adapt to your current needs.” } } ] }

Leave a comment