Disability insurance zones provide coverage for individuals who are unable to work due to a disability. These zones offer financial protection, ensuring that individuals receive income replacements and necessary support in the event of a disability.

Disability insurance zones play a critical role in safeguarding individuals against the financial implications of a disability. When facing the possibility of being unable to work due to a disability, having appropriate insurance coverage becomes crucial. These zones restrict the geographic area in which a person must live to qualify for disability benefits, ensuring that the coverage is directed towards the intended individuals and providing a level of consistency in terms of eligibility requirements.

Disability insurance zones offer a safety net to protect against the loss of income and the resulting financial strain that may arise from a disability. We will explore the importance of disability insurance zones and why they are essential for individuals seeking financial security in case of disability.

The Importance Of Disability Insurance

It’s crucial to understand the significance of disability insurance in safeguarding your financial stability in the face of unforeseen circumstances.

Understanding Disability Insurance

Disability insurance protects your income in case you are unable to work due to an illness or injury.

Types Of Disability Insurance

There are two main types: short-term disability insurance and long-term disability insurance.

- Short-term disability insurance: Provides financial coverage for a limited period if you are unable to work.

- Long-term disability insurance: Offers protection over an extended period if you suffer a severe disability.

Credit: store.nolo.com

Benefits Of Disability Insurance

Disability insurance provides financial security if you are unable to work due to injury or illness. It offers peace of mind and ensures that you can meet your financial obligations during difficult times. With disability insurance, you can protect your income and maintain your standard of living in case of unforeseen circumstances.

Disability insurance provides crucial benefits that can help protect your income and provide essential medical coverage in the event of a disability. Understanding the benefits of disability insurance can help you make an informed decision about whether it is the right option for you. Below are two key benefits to consider:

Income Protection

Disability insurance offers a vital layer of protection to your income when you are unable to work due to a disability. This insurance provides a portion of your regular income, allowing you to meet your financial obligations and maintain your standard of living even when you are unable to earn a paycheck. By ensuring a steady stream of income, disability insurance provides peace of mind, ensuring that you are not financially devastated by unexpected disabilities.

Some key aspects of income protection through disability insurance include:

| Protection from Financial Hardships | Financial Stability |

|---|---|

| Disability insurance safeguards you from facing financial hardships, such as the inability to pay bills, loans, or mortgage. | With a steady income through disability insurance, you can maintain financial stability and continue to meet your financial commitments. |

Medical Coverage

Disability insurance also provides essential medical coverage, ensuring that you have access to the necessary healthcare services and treatments to aid in your recovery. This medical coverage can include reimbursement for doctor visits, hospital stays, surgeries, prescription medications, therapies, and other medical expenses related to your disability.

Key advantages of medical coverage in disability insurance include:

- Ease of Access: Disability insurance gives you peace of mind by ensuring easy access to quality healthcare services without the burden of excessive medical costs.

- Comprehensive Coverage: With disability insurance, you can receive coverage for a wide range of medical expenses, including hospital stays, medications, and therapies.

- Financial Relief: By covering medical expenses, disability insurance offers financial relief, allowing you to focus on your recovery rather than worrying about the cost of necessary treatments.

Factors To Consider When Choosing Disability Insurance

When considering disability insurance, it’s crucial to weigh various factors to ensure the policy aligns with your specific needs and circumstances. By carefully examining the coverage amount and waiting period, you can make an informed decision that will provide financial security in the event of disability.

Coverage Amount

Determining the appropriate coverage amount is fundamental when selecting disability insurance. The coverage amount should ideally replace a significant portion of your income if you become disabled. It’s essential to calculate your monthly expenses and income to identify the most suitable coverage amount.

Waiting Period

The waiting period, also known as the elimination period, is the duration you must wait after becoming disabled before receiving benefits. It’s important to consider your savings and ability to endure a waiting period without income. Shorter waiting periods typically result in higher premiums, so it’s essential to strike a balance based on your financial situation.

Credit: http://www.facebook.com

Common Misconceptions About Disability Insurance

When it comes to disability insurance, there are common misconceptions that often lead individuals to underestimate its value. Let’s debunk these misconceptions and shed light on the true importance of disability insurance.

Costly Premiums Vs. Financial Security

While some may view disability insurance premiums as expensive, it’s essential to consider the invaluable financial security it provides.

Investing in disability insurance ensures that you have a safety net in the event of a disability, offering peace of mind and preserving your financial stability.

Employer Coverage

Many individuals assume that their employer’s coverage is sufficient to protect them in the event of a disability. However, employer coverage may not always be comprehensive enough to fully address your needs.

Securing personal disability insurance alongside employer coverage can fill in the gaps and provide additional protection tailored to your specific circumstances.

The Impact Of Disability On Financial Stability

When faced with a situation of disability, financial stability can be greatly impacted. It’s crucial to understand how the loss of income and increased expenses play a significant role in maintaining financial well-being.

Loss Of Income

A disability can abruptly result in a cessation of earning capability, jeopardizing the primary source of income.

Increased Expenses

Disabilities often lead to unforeseen and mounting costs, including medical bills, rehabilitation expenses, and specialized equipment purchases.

Disability Insurance Zones Explained

Understanding Disability Insurance Zones is crucial for individuals seeking financial protection in case of unexpected disabilities. Disability Insurance Zones are distinct geographical areas that play a significant role in determining the terms and availability of disability insurance coverage.

Definition And Purpose Of Disability Zones

Disability Insurance Zones are categorized regions that define the risk levels of disability occurrence based on factors like demographics and health statistics. The primary purpose of these zones is to assess the likelihood of disability claims and set appropriate insurance rates accordingly. Zones help insurers in determining accurate premiums based on the regional disability risks.

How Disability Zones Work

In essence, Disability Zones work by dividing geographical locations into risk categories that help insurance companies calculate premiums tailored to each area’s risk profile. Insurers use data from these zones to understand regional risk factors and offer suitable coverage to individuals in those areas. This segmentation ensures that policyholders receive adequate coverage based on their specific location and its associated risks.

Choosing The Right Disability Insurance Zone

When it comes to ensuring financial security in the face of unexpected circumstances, disability insurance is a crucial consideration. By providing income replacement in the event of disability, this insurance offers peace of mind and a safety net for individuals and their families. However, it’s important to choose the right disability insurance zone that aligns with your specific needs and economic factors. Evaluating economic factors and the regional cost of living are essential steps in this process.

Evaluating Economic Factors

Before deciding on a disability insurance zone, it’s essential to evaluate the economic factors that may impact your coverage. This means taking into account factors such as national and regional economic stability, employment rates, and industry trends. By considering these factors, you can ensure that your disability insurance provides sufficient coverage in case of job loss or career changes.

Regional Cost Of Living

The regional cost of living is another crucial aspect to consider when choosing a disability insurance zone. This factor directly affects the amount of coverage you require to sustain your lifestyle in case of disability. The cost of housing, groceries, transportation, and healthcare vary significantly across different regions. By understanding the cost of living in potential disability insurance zones, you can ensure your coverage adequately meets the financial demands of your chosen location.

| Factors to Consider | Explanation |

|---|---|

| National and regional economic stability | Determines the reliability of the disability insurance market in different areas. |

| Employment rates | Affects the likelihood of job security and the need for disability insurance. |

| Industry trends | Helps identify areas with potential growth opportunities and higher job security. |

| Cost of housing | A major expense that varies greatly across different regions. |

| Cost of groceries | Varies depending on the region’s cost of living. |

| Cost of transportation | Impacts daily commuting expenses and accessibility to essential services. |

| Cost of healthcare | Varies significantly and may affect your budget in case of disability. |

- Evaluate the economic stability and job opportunities in potential disability insurance zones.

- Research the cost of housing, groceries, transportation, and healthcare in each region

- Consider industry trends and growth potential to ensure long-term job security

- Calculate the amount of coverage needed based on the regional cost of living.

- Consult with disability insurance experts to understand the nuances of different zones.

By choosing the right disability insurance zone, based on evaluating economic factors and the regional cost of living, you can ensure that your coverage meets your needs both now and in the future. Take the time to research and assess your options to select the ideal disability insurance zone for your financial security.

Steps To Take For Securing Your Financial Future

Securing your financial future is a top priority for individuals and families alike, and disability insurance plays a crucial role in this process. By providing financial protection in the event of illness or injury, disability insurance helps ensure that you can continue to meet your living expenses and maintain a comfortable lifestyle even if you are unable to work. But how can you go about securing the right disability insurance policy for your needs? Let’s explore the key steps to take:

Assessing Your Needs

Assessing your needs is the first and most crucial step in securing a disability insurance policy. To determine the level of coverage required, consider your monthly living expenses, such as rent or mortgage payments, utilities, groceries, and transportation costs. Take into account any outstanding debts, such as loans or credit card balances. It’s also important to evaluate your current savings and financial responsibilities, such as supporting dependents. This assessment will help you understand the amount of coverage you need to maintain your standard of living in the event of disability.

Comparing Policies

Once you have assessed your needs and have a clear understanding of the coverage you require, it’s time to compare disability insurance policies. Different insurance providers offer varying policy options and terms, so it’s essential to research and compare multiple options to find the best fit for you. Consider factors such as the waiting period before benefits kick in, the length of the benefit period, and the definition of disability used by each policy. Additionally, evaluate the reputation and financial stability of the insurance companies offering the policies to ensure you choose a reliable and trustworthy provider.

To make the comparison process more manageable, create a table comparing the key features of each policy, such as monthly premiums, benefit amounts, and any additional benefits included. This allows for a clear and concise comparison, enabling you to make an informed decision based on your individual needs.

While cost is a significant factor, don’t solely focus on the price tag. Consider the overall value of the policy, including the coverage provided, flexibility, and customer service provided by the insurance provider. Remember, a well-rounded policy that adequately covers your needs is worth the investment and can provide peace of mind for you and your loved ones.

By conducting a comprehensive assessment of your needs, comparing different policies, and considering the value each policy offers, you will be well on your way to securing a disability insurance policy that protects your financial future. Don’t delay taking this crucial step towards establishing financial security; start exploring your options today!

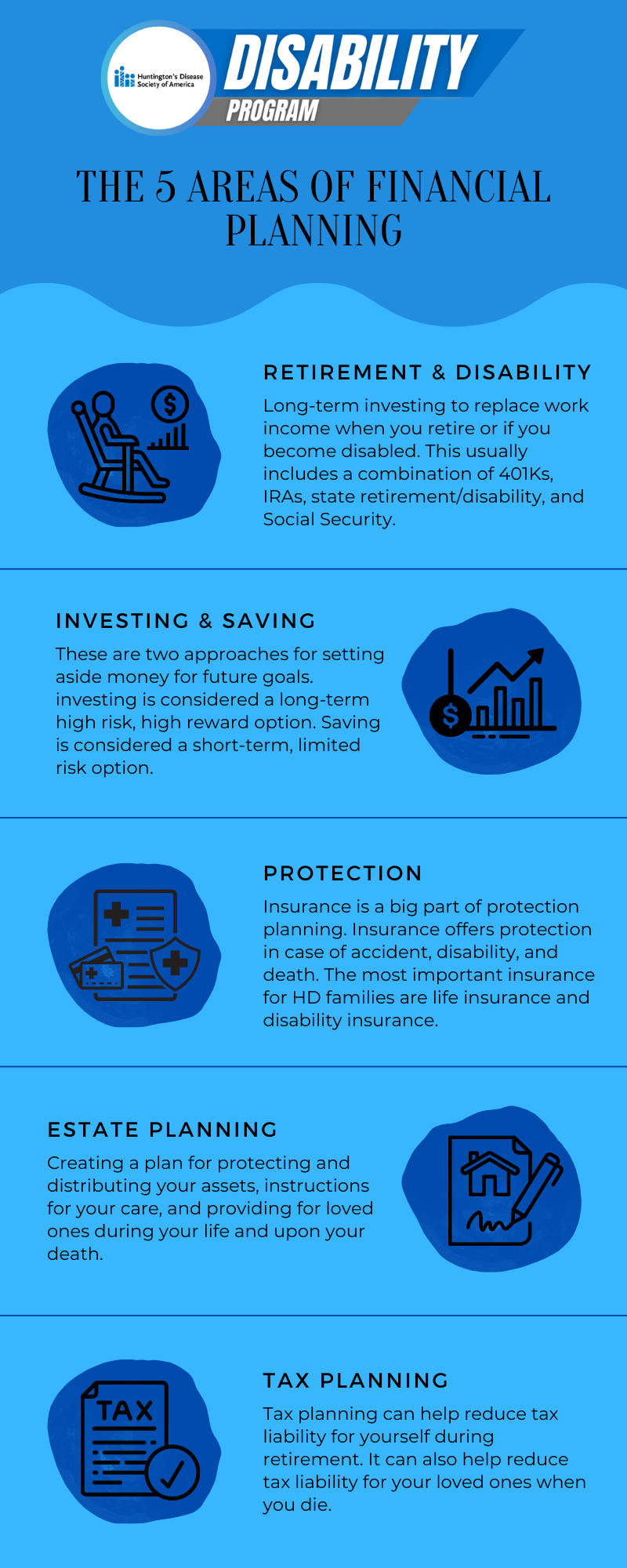

Credit: hdsa.org

Frequently Asked Questions Of Why Disability Insurance Zones

What Is Disability Insurance?

Disability insurance is a form of coverage that provides financial protection for individuals who are unable to work due to an illness or injury. It can help replace lost income and assist with the costs of medical care.

Who Needs Disability Insurance?

Anyone who relies on their income to cover living expenses should consider disability insurance. Whether you’re a working professional, business owner, or sole breadwinner, this coverage can provide crucial financial support if you’re unable to work.

How Does Disability Insurance Work?

Disability insurance pays a percentage of your income if you’re unable to work due to a covered disability. It provides a monthly benefit to help replace lost wages, allowing you to focus on recovery without worrying about financial strain.

Conclusion

To sum up, disability insurance is a crucial investment for individuals due to the unpredictable nature of life. In the event of an unexpected disability, having a safety net in place protects not only financial stability but also offers peace of mind.

By exploring disability insurance options and understanding the need for coverage, individuals can ensure their long-term financial well-being. Don’t delay in securing this essential protection today.

Leave a comment