An endowment policy value represents the amount of money that an individual can receive upon the maturity of their endowment policy. This value is determined by various factors, including the premium amounts paid, the length of the policy term, and the performance of the investment funds chosen within the policy.

Understanding Endowment Policy Value

Endowment policy value indicates the monetary worth of the policy, influenced by factors like premiums and investment performance. Understanding this value helps policyholders gauge their investment returns over time and make informed financial decisions. It is crucial to regularly review and assess the endowment policy value for better financial planning.

Components Of Endowment Policy Value

Factors Influencing Policy Value

Understanding Endowment Policy Value is crucial for policyholders to grasp the intricacies of their investment. The value of an endowment policy is influenced by various components and external factors. Let’s delve deeper into what constitutes the value of an endowment policy.

Components Of Endowment Policy Value

An endowment policy’s value comprises the sum of the total premiums paid by the policyholder over the term of the policy and the investment returns generated by the underlying assets.

- Total Premiums: The cumulative amount of money paid by the policyholder towards the endowment policy.

- Investment Returns: The returns generated from the invested premiums in assets such as stocks, bonds, and real estate.

Factors Influencing Policy Value

The value of an endowment policy is influenced by several key factors that determine its growth and overall worth.

- Market Performance: Fluctuations in the financial markets directly impact the investment returns of the policy.

- Policy Term: The length of the endowment policy term affects the total premiums paid and the accumulation of investment returns.

- Economic Conditions: Economic stability and growth play a significant role in determining the policy value.

Credit: fastercapital.com

Maximizing Returns On Endowment Policy

When it comes to investments, maximizing returns is always a top priority. This holds true for endowment policies as well, making it crucial to understand how to make the most of your policy. In this article, we will discuss two important aspects that can help you in maximizing returns on your endowment policy.

Choosing The Right Policy

Choosing the right endowment policy is the first step towards maximizing returns. It is important to carefully evaluate the available options before making a decision. Here are some key factors to consider:

- Policy Term: Determine the duration of the policy based on your financial goals and investment horizon.

- Sum Assured: Ensure that the sum assured is sufficient to meet your financial needs in the future.

- Additional Benefits: Look for policies that offer additional benefits such as maturity bonuses, loyalty additions, or riders that can enhance the overall returns.

- Flexibility: Opt for policies that provide flexibility in terms of premium payment frequency, policy surrender options, and partial withdrawals.

- Company Reputation: Choose a policy from a reputable insurance company with a strong track record of fulfilling policyholder obligations.

Utilizing Policy Benefits Efficiently

Once you have chosen the right endowment policy, it is equally important to utilize the policy benefits efficiently. Here are some strategies to consider:

- Regular Premium Payments: Ensure that you pay your premiums regularly and on time to prevent policy lapses, which can result in a loss of benefits.

- Policy Revival: In case your policy has lapsed due to non-payment of premiums, consider reviving it as soon as possible to avoid losing out on the benefits you have accumulated.

- Maturity Payout Options: Understand the different payout options available at the maturity of your policy. Carefully evaluate the options and choose the one that best fits your financial needs and future plans.

- Partial Withdrawals: If your policy allows partial withdrawals, consider utilizing this feature wisely to meet any financial emergencies or provide for important milestones in your life.

- Stay Informed: Regularly review your policy to stay updated on any changes or additional benefits offered by the insurance company. This will enable you to take advantage of any new features that can maximize your returns.

By choosing the right policy and utilizing the benefits efficiently, you can maximize the returns on your endowment policy and achieve your financial goals effectively. Remember to consult with a financial advisor to ensure that your decisions align with your individual circumstances and risk appetite.

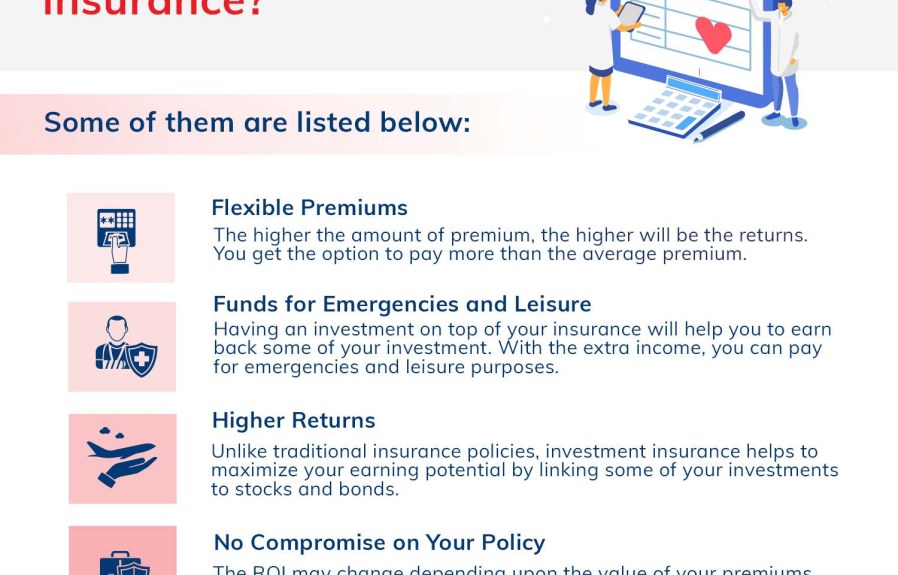

Benefits Of Endowment Policy

Endowment policies deliver various advantages to policyholders, ensuring financial security and capital growth. Understanding the benefits of endowment policies can help individuals make informed decisions about their financial planning. Let’s explore the key benefits of an endowment policy.

Financial Security

Endowment policies provide a guaranteed sum assured to the policyholder or their beneficiaries in the event of the policyholder’s demise during the policy term. This ensures the financial stability of the policyholder’s loved ones, offering peace of mind and security in uncertain times.

Savings And Investment Platform

With endowment policies, individuals can systematically accumulate savings while simultaneously investing in a secure financial instrument. Endowment policies serve as a disciplined and structured approach to savings, enabling individuals to create a financial cushion for future needs and aspirations.

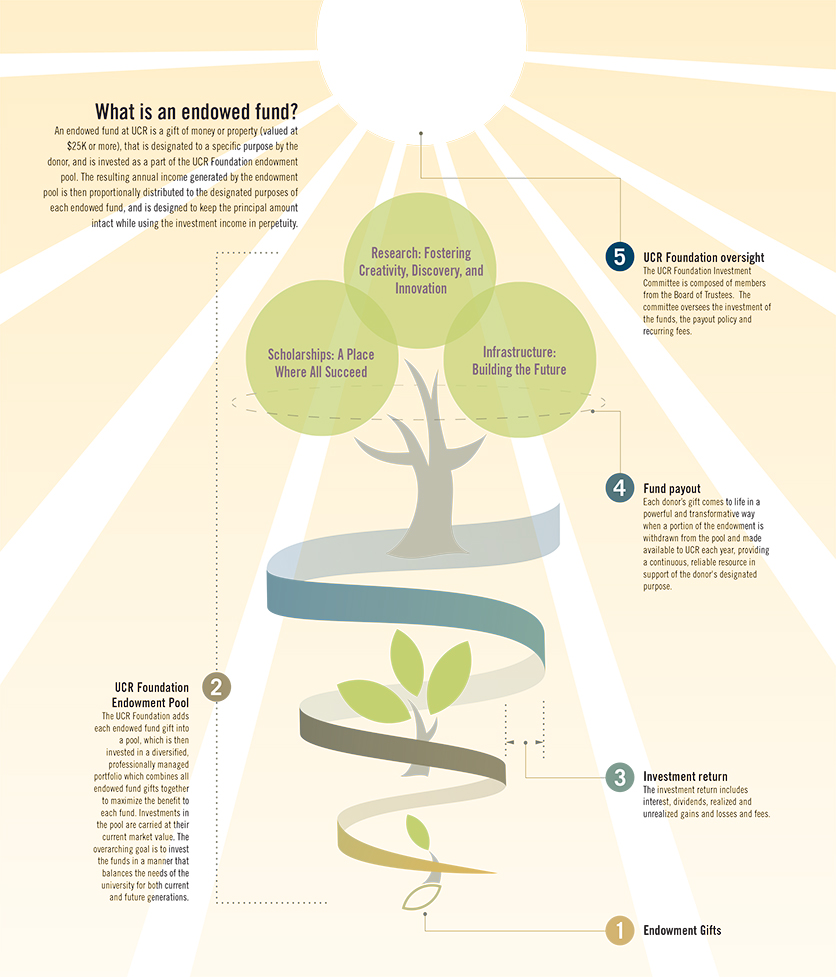

Credit: planmygift.ucr.edu

Strategies To Enhance Endowment Policy Value

An endowment policy is a long-term investment vehicle that provides both protection and a savings element. To maximize the value of this investment, policyholders can implement several strategies to ensure that their endowment policy value grows over time.

Regular Review And Adjustments

Regularly reviewing and adjusting your endowment policy helps to ensure that it stays aligned with your financial goals and the current market conditions. By monitoring and assessing the performance of the policy, you can make necessary adjustments to optimize its value over time.

Diversification Of Investments

Diversifying your endowment policy investments across different asset classes, such as equities, bonds, and real estate, can help to spread the risk and potentially increase the overall returns. This strategy can also provide protection against market volatility and help to achieve better long-term growth.

Risks To Consider

When considering an endowment policy, it’s essential to be aware of potential risks that could impact its value over time. Factors such as market volatility, surrender charges, and inflation can affect the overall growth and returns of the policy. Understanding these risks is crucial for making informed decisions about endowment policies.

While endowment policies can provide valuable benefits, it’s important to be aware of the potential risks involved. Understanding these risks can help you make an informed decision about whether an endowment policy is the right choice for you.

Inflation Risk

One of the risks associated with endowment policies is inflation. Inflation refers to the general rise in prices over time, which can erode the value of your money. With an endowment policy, the returns may not keep pace with inflation, leaving you with reduced purchasing power in the future.

Market Fluctuations

Another risk to consider is market fluctuations. The performance of the financial markets can impact the returns on your endowment policy. If the markets experience a downturn, the value of your policy may decrease, which could affect the expected benefits you were counting on.

Credit: http://www.mfin.com

Comparing Endowment Policy With Other Investment Options

When comparing investment options, understanding the pros and cons of endowment policy is essential. Let’s delve into how endowment policies stack up against mutual funds and stocks.

Pros And Cons Of Endowment Policy

An endowment policy offers both savings and insurance benefits within a single product.

- Guaranteed returns over the policy term

- Tax benefits on premiums paid and maturity amount

- Forced savings discipline

However, limited liquidity and lower returns compared to market-linked investments are drawbacks.

Comparison With Mutual Funds And Stocks

Mutual funds provide a diversified portfolio managed by professionals, offering potentially higher returns.

Stocks offer high volatility and potential high returns based on market performance.

| Endowment Policy | Mutual Funds | Stocks | |

|---|---|---|---|

| Risk Level | Low to Medium | Medium to High | High |

| Returns | Guaranteed or predictable | Potentially higher | High, but volatile |

| Liquidity | Low | High | High |

Frequently Asked Questions On Why Endowment Policy Value

What Is An Endowment Policy Value?

An endowment policy value is the sum payable if the policy matures or upon the policyholder’s death. It combines life insurance coverage with an investment fund. The value is determined by the premiums paid, the policy’s duration, and the investment performance.

How Is The Endowment Policy Value Calculated?

The endowment policy value is typically calculated based on the sum assured and the bonuses accumulated during the policy term. Additional factors such as investment returns and the duration of the policy also influence the final value. It’s essential to review the policy terms for a clear understanding.

What Are The Factors That Affect Endowment Policy Value?

Several key factors affect the endowment policy value, including the duration of the policy, the sum assured, bonus additions, and the performance of the underlying investments. Additionally, economic conditions, inflation rates, and the policyholder’s age can also impact the final value.

Understanding these factors is crucial for policyholders.

Conclusion

Ultimately, understanding the value of an endowment policy is crucial for individuals seeking financial security and growth. By providing a combination of life insurance coverage and long-term savings, these policies offer a unique opportunity to secure a stable future for oneself and loved ones.

With the potential to generate substantial returns over time, endowment policies serve as reliable investment vehicles. So, consider the benefits and potential growth opportunities that endowment policies bring and make an informed decision to secure your financial future.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is an endowment policy value?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “An endowment policy value is the sum payable if the policy matures or upon the policyholder’s death. It combines life insurance coverage with an investment fund. The value is determined by the premiums paid, the policy’s duration, and the investment performance.” } } , { “@type”: “Question”, “name”: “How is the endowment policy value calculated?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The endowment policy value is typically calculated based on the sum assured and the bonuses accumulated during the policy term. Additional factors such as investment returns and the duration of the policy also influence the final value. It’s essential to review the policy terms for a clear understanding.” } } , { “@type”: “Question”, “name”: “What are the factors that affect endowment policy value?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Several key factors affect the endowment policy value, including the duration of the policy, the sum assured, bonus additions, and the performance of the underlying investments. Additionally, economic conditions, inflation rates, and the policyholder’s age can also impact the final value. Understanding these factors is crucial for policyholders.” } } ] }

Leave a comment