Your motorcycle insurance may be high due to your young age, expensive motorcycle, or multiple accidents. Motorcycle enthusiasts often find themselves puzzled by the soaring costs of their insurance premiums.

Pondering over this issue, riders strive to uncover the reasons behind the steep prices. From the thrill of the open road to the convenience of navigating through traffic, motorcycles offer a unique experience. However, these benefits come with a price tag – one that often results in hefty insurance bills.

Understanding the factors that contribute to the high insurance costs is crucial for riders seeking to strike a balance between protection and affordability. Let’s delve deeper into the nuances of motorcycle insurance premiums and explore why they tend to be on the higher side.

Credit: calmatters.org

Understanding Motorcycle Insurance

Understanding Motorcycle Insurance is crucial for every rider to comprehend why their insurance rates may be high. Let’s break down essential aspects of motorcycle insurance to help you make informed decisions.

Coverage Types

Motorcycle insurance typically offers several coverage types. These include liability coverage, collision coverage, comprehensive coverage, uninsured/underinsured motorist coverage, and medical payments coverage.

Importance Of Motorcycle Insurance

Motorcycle insurance is vital as it provides financial protection in case of accidents, theft, or damage to your bike. It ensures that you can cover repair costs and medical expenses if you’re involved in a collision.

Credit: http://www.cbc.ca

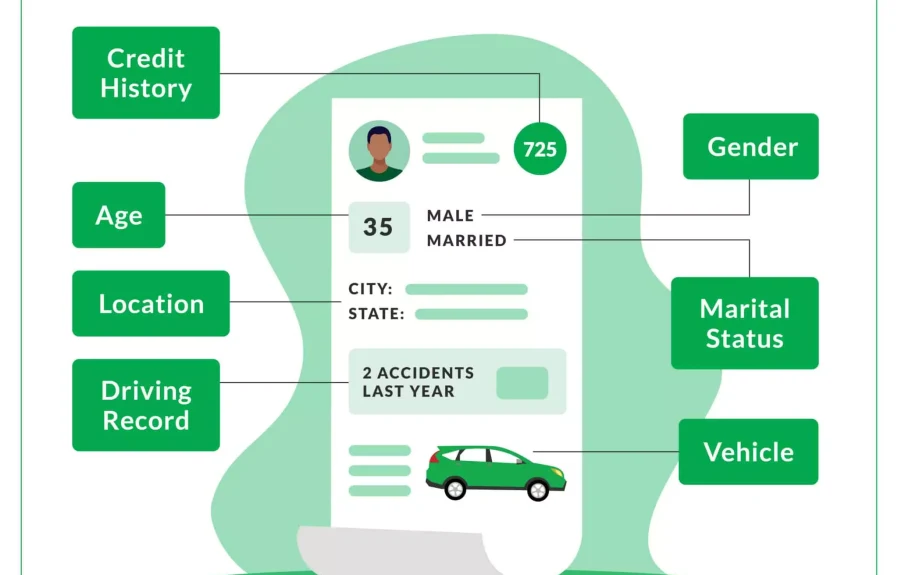

Factors Affecting Motorcycle Insurance Cost

Understanding why your motorcycle insurance premium is high involves considering various key factors that significantly influence insurance rates. Here are some crucial elements to keep in mind:

Age And Experience

Your age and experience as a rider play a fundamental role in determining the cost of your motorcycle insurance. Typically, younger and less experienced riders face higher insurance rates due to the perceived higher risks associated with this demographic.

Type Of Motorcycle

The type of motorcycle you ride directly impacts your insurance premiums. Sport bikes and high-performance motorcycles are generally more expensive to insure compared to standard cruisers or touring bikes.

Driving Record

Your driving record is a critical factor considered by insurance companies. Having a clean driving history with no accidents or traffic violations can lead to lower insurance rates, whereas a record with infractions may result in increased premiums.

Location

Location plays a vital role in determining your motorcycle insurance cost. Urban areas with higher rates of accidents or theft may lead to higher premiums compared to rural areas with lower risk factors.

Annual Mileage

The annual mileage you ride is another factor that influences insurance premiums. Riders who cover longer distances may face higher rates as they are exposed to more time on the road and potentially increased risk of accidents.

Additional Cost Factors

When it comes to motorcycle insurance, there are several factors that can contribute to high premium rates. Understanding these additional cost factors can help you make informed decisions and potentially lower your insurance costs. Let’s take a closer look at two key factors that can affect your motorcycle insurance rates.

Customizations And Modifications

Customizing and modifying your motorcycle can give it a personal touch and enhance its performance. However, it’s important to note that these additions can increase your insurance premiums. Insurance providers consider customizations and modifications as factors that increase the risk of accidents and theft, and as a result, they adjust the premium accordingly. For example, installing aftermarket parts or accessories might require additional coverage. It’s crucial to inform your insurance provider about any customizations you have made and discuss how they will affect your rates.

Storage And Security

Where you store your motorcycle and the security measures you have in place can greatly impact your insurance rates. Motorcycles that are kept in garages or secured parking areas are less likely to be stolen or damaged, which lowers the insurance risk. On the other hand, if you park your bike on the street overnight or in an area with high crime rates, your insurance premiums are likely to be higher. Installing security devices such as alarms, immobilizers, or tracking systems can also help reduce the risk of theft and potentially lower your premium. Make sure to discuss these factors with your insurance provider to see how they can affect your rates.

Insurance Deductibles

In addition to customizations and storage, insurance deductibles play a significant role in your overall premium costs. A deductible is the amount you agree to pay out of pocket in the event of a claim before your insurance coverage kicks in. If you choose a lower deductible, your premium will generally be higher. Conversely, opting for a higher deductible can lead to lower premium rates. Consider your financial situation and the value of your motorcycle when deciding on the deductible amount. Keep in mind that selecting a high deductible means you will have to pay a larger amount in case of a claim, so ensure it is within your budget.

Understanding these additional cost factors of motorcycle insurance can give you valuable insight into why your premiums may be high. By discussing these factors with your insurance provider and making informed decisions, you can potentially find ways to decrease your rates without compromising on coverage. Remember to always review your policy and compare quotes from different providers to ensure you are getting the best possible deal.

Credit: http://www.google.com

Ways To Lower Motorcycle Insurance Costs

When it comes to motorcycle insurance, the costs can seem disproportionately high. However, there are several effective ways to lower your motorcycle insurance premiums. By taking the following steps, you can potentially reduce your expenses while still maintaining the coverage you need.

Comparison Shopping

Comparison shopping is vital when it comes to finding the best motorcycle insurance rates. Different insurance providers offer varying quotes, so be sure to compare policies from several companies before making a decision. Keep in mind that the cheapest option may not always offer the necessary coverage, so consider the overall value in addition to the price.

Maintain A Clean Driving Record

Insurance companies often offer lower premiums to individuals with clean driving records. By avoiding accidents and traffic violations, you can demonstrate to insurers that you are a responsible and low-risk rider, potentially leading to reduced insurance costs.

Complete A Motorcycle Safety Course

Completing a motorcycle safety course not only enhances your skills and knowledge as a rider but can also qualify you for discounts on your insurance premiums. Many insurance providers offer reduced rates for riders who have completed an approved safety course, making it a valuable investment both for your riding abilities and your finances.

Bundle Insurance Policies

Bundling your motorcycle insurance with other policies, such as auto or home insurance, can often lead to significant savings. Many insurance companies offer multi-policy discounts, so consider consolidating your insurance needs with a single provider to potentially reduce your overall costs.

Tips To Save On Motorcycle Insurance

When it comes to motorcycle insurance, the costs can often be higher than expected. However, there are several strategies you can implement to save money on your motorcycle insurance premiums. Below are some tips to help you reduce your motorcycle insurance costs without sacrificing the coverage you need.

Increase Deductibles

Raising your deductibles can lead to significant savings on your motorcycle insurance premiums. By opting for higher deductibles, you can lower your monthly insurance costs. However, make sure to weigh the potential savings against the financial impact of a higher deductible in the event of a claim.

Consider Liability-only Coverage

If you own an older motorcycle or one with a lower value, you may want to consider opting for liability-only coverage. This coverage typically comes with lower premiums compared to comprehensive coverage, as it only covers damages to other vehicles and property in the event of an accident. Be sure to assess your bike’s value and your personal risk tolerance before choosing this option.

Reduce Mileage

Insurance companies often consider mileage when calculating premiums. By reducing the amount of time you spend on the road, you may be able to negotiate a lower premium. Consider using your motorcycle for recreational rides rather than daily commuting to minimize your yearly mileage and potentially reduce your insurance costs.

Maintain Good Credit Score

Many insurance providers take your credit score into account when determining your rates. By maintaining a good credit score, you can potentially qualify for lower insurance premiums. Ensure that you regularly monitor and improve your credit score to benefit from lower motorcycle insurance rates.

Frequently Asked Questions For Why Is My Motorcycle Insurance So High

Why Do Motorcycle Insurance Rates Tend To Be Higher?

Motorcycle insurance rates are often higher due to the increased risk of accidents, theft, and extensive damage associated with motorcycles. Their open nature also makes them more vulnerable to damage, contributing to the higher rates.

What Factors Contribute To High Motorcycle Insurance Costs?

Several factors influence motorcycle insurance costs, including the rider’s age, driving record, the type of motorcycle, and the coverage required. These factors are used to assess the level of risk, which in turn impacts insurance premiums.

How Can I Lower My Motorcycle Insurance Premiums?

You can lower your motorcycle insurance premiums by improving your driving record, taking a safety course, choosing a bike with anti-theft features, and selecting a higher deductible. Additionally, bundling your motorcycle insurance with other policies can often lead to discounts.

Conclusion

The high cost of motorcycle insurance can be attributed to several factors, including the risk associated with riding a motorcycle, the type of motorcycle you own, your riding experience, and your location. By understanding these factors and taking necessary steps, such as improving your riding skills, choosing a less expensive motorcycle or living in a low-risk area, you may be able to lower your motorcycle insurance premiums.

It’s important to compare quotes from different insurance providers to find the best coverage at the most competitive rates.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Why do motorcycle insurance rates tend to be higher?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Motorcycle insurance rates are often higher due to the increased risk of accidents, theft, and extensive damage associated with motorcycles. Their open nature also makes them more vulnerable to damage, contributing to the higher rates.” } } , { “@type”: “Question”, “name”: “What factors contribute to high motorcycle insurance costs?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Several factors influence motorcycle insurance costs, including the rider’s age, driving record, the type of motorcycle, and the coverage required. These factors are used to assess the level of risk, which in turn impacts insurance premiums.” } } , { “@type”: “Question”, “name”: “How can I lower my motorcycle insurance premiums?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can lower your motorcycle insurance premiums by improving your driving record, taking a safety course, choosing a bike with anti-theft features, and selecting a higher deductible. Additionally, bundling your motorcycle insurance with other policies can often lead to discounts.” } } ] }

Leave a comment