Renters insurance judgment is important because it provides financial protection for tenants against property damage and liability claims. It covers the cost of repair or replacement of personal belongings and can also help with legal expenses if someone gets injured on the rented property.

Renters insurance judgment is a crucial safeguard for tenants as it offers peace of mind and financial security in case of unexpected events or accidents. Renting a home or apartment is a popular choice for many people. It provides flexibility and convenience without the long-term commitment and financial responsibilities of homeownership.

However, living as a tenant also comes with its own set of risks. While the landlord is responsible for insuring the building itself, renters are typically responsible for their own personal belongings and may also be liable for any accidents or injuries that occur in their rented space. This is where renters insurance judgment becomes crucial. Renters insurance judgment, also known as renters insurance, is a type of insurance policy designed specifically for tenants. It provides coverage for personal belongings such as furniture, electronics, and clothing in case of damage or theft. Additionally, it offers liability coverage in the event that someone gets injured on the rented property and the tenant is deemed responsible. Having renters insurance judgment is important for several reasons. First, it can help cover the cost of replacing or repairing personal belongings that are damaged due to events like fire, theft, or natural disasters. Without insurance, tenants would have to bear these expenses out of pocket. Second, renters insurance judgment can provide protection against liability claims. If a visitor to the rented property gets injured and the tenant is found responsible, the insurance policy can help cover the legal expenses and potential medical costs. Renters insurance judgment is an essential safeguard for tenants. It offers financial protection and peace of mind by covering the cost of replacing or repairing personal belongings and protecting against liability claims. It is a wise investment for any renter to ensure they are adequately protected in case of unexpected events or accidents.

:max_bytes(150000):strip_icc()/IncrementalAnalysisV1-deb2566b68c246c7b53c076fd9c4032a.jpg)

Credit: http://www.investopedia.com

The Basics Of Renters Insurance

Renters insurance provides valuable protection for individuals who rent a home or apartment. One crucial aspect of renting a property is understanding the importance of having renters insurance. Let’s delve into the essentials of renters insurance:

What Is Renters Insurance?

Renters insurance is a type of insurance policy that provides financial protection for belongings and liability coverage for renters.

Importance Of Renters Insurance

- Protects belongings: In case of theft, damage, or loss, renters insurance helps cover the cost of replacing personal belongings.

- Liability coverage: Renters insurance can protect you if someone is injured in your rental property, covering medical expenses and legal fees.

- Temporary accommodations: If your rental becomes uninhabitable due to a covered event, renters insurance may help with temporary living expenses.

- Affordable coverage: Renters insurance is relatively inexpensive, offering peace of mind for a small monthly premium.

Common Misconceptions

When it comes to renters insurance, there are several common misconceptions that can prevent individuals from obtaining the coverage they need. Let’s address these misconceptions and shed some light on why renters insurance is a wise investment.

Renter’s Beliefs About Coverage

Many renters mistakenly believe that their landlord’s insurance policy will cover any damages or losses to their personal belongings. However, this is a common misconception. The landlord’s policy typically only covers the physical structure of the building and not the renter’s personal belongings.

Renters may also believe that their belongings aren’t valuable enough to warrant insurance coverage. It is important to remember that it’s not just about the monetary value of your items, but the sentimental value as well. Losing cherished possessions due to theft, fire or other unforeseen events can be devastating both emotionally and financially.

Another misconception is that renters insurance only provides coverage for personal property. While it is true that renters insurance primarily covers the cost of replacing or repairing personal belongings, it also offers liability coverage. This means that if someone is injured in your rental property, renters insurance can help cover medical expenses and legal costs if you are found liable.

Renter’s Perspective On Cost

One common reason renters overlook insurance coverage is the perceived cost. Some renters mistakenly believe that renters insurance is expensive and not worth the investment. However, the reality is that renters insurance is surprisingly affordable, with policies often costing less than a cup of coffee per day.

It’s important to consider the potential financial ramifications of not having insurance. If your belongings are damaged, destroyed, or stolen, you would be responsible for replacing them out-of-pocket. This can add up to a significant amount, far exceeding the cost of a renters insurance policy.

Additionally, renters insurance covers more than just personal belongings. It also includes liability protection, which can be invaluable in case of accidents or injuries on your property. Without this coverage, you could be held financially responsible for medical expenses, legal bills, and more.

In conclusion, renters insurance is a crucial component of protecting yourself and your belongings. Don’t let common misconceptions or the perceived cost deter you from obtaining the coverage you need. It’s a small investment for peace of mind and financial security.

Understanding Liabilities

Renters insurance provides crucial protection for tenants, including coverage for liabilities. Understanding liabilities and the importance of liability coverage can help renters make informed decisions and ensure they have adequate protection in place.

Liabilities Covered By Renters Insurance

Renters insurance typically covers liabilities related to property damage and bodily injury. This includes scenarios such as accidental damage to a neighbor’s property or a guest slipping and getting injured in the rented unit. Without liability coverage, renters may be personally responsible for any resulting expenses or legal claims.

Importance Of Liability Coverage

Liability coverage is crucial for renters as it provides financial protection in the event of unforeseen accidents or incidents that cause harm to others or their property. In today’s litigious society, having liability coverage can safeguard renters from costly legal proceedings and potential settlement payments, providing peace of mind and financial security.

Personal Belongings Protection

Renters insurance is crucial for protecting personal belongings. In the event of unforeseen circumstances, having this coverage can provide peace of mind and financial security. It ensures that belongings are safeguarded against damages or loss, offering a sense of security for tenants.

Coverage For Personal Belongings

When it comes to renting a place, your personal belongings hold great value. Whether it’s your furniture, electronics, or clothing, protecting these items is essential. That’s where renters insurance comes in. This type of insurance provides coverage for your personal belongings in case of damage or loss due to covered events, such as theft, fire, or vandalism.Factors Affecting Coverage

Several factors can affect the coverage you receive for your personal belongings with renters insurance. Understanding these factors helps ensure you have the right protection for your valuable items. 1. Policy Limit: Renters insurance typically has a policy limit, which is the maximum amount the insurance company will pay for covered losses. It’s crucial to have an accurate estimation of the value of your possessions to make sure you have sufficient coverage. 2. Deductible: The deductible is the amount you need to pay before your insurance coverage kicks in. Choosing a higher deductible can help lower your premium, but it means you’ll have a larger out-of-pocket expense when making a claim. 3. Type of coverage: Renters insurance offers two types of coverage for personal belongings: actual cash value (ACV) and replacement cost value (RCV). ACV coverage takes into account the depreciation of your belongings over time, while RCV coverage allows you to replace them with new items of similar kind and quality. 4. Location: The location of your rental property can also affect your coverage. Certain areas may be prone to specific risks, such as flooding or theft, which could impact the cost of your insurance or the coverage available to you. 5. Additional endorsements: Depending on the nature of your personal belongings, you may need additional endorsements to ensure full coverage. For example, if you own expensive jewelry or collectibles, you may need to add a separate rider to your policy.Ensuring Adequate Coverage

To ensure you have adequate coverage for your personal belongings, follow these steps: 1. Take inventory: Make a detailed list of all your possessions, including their estimated value, purchase dates, and receipts. This inventory will help you determine the right coverage amount for your belongings. 2. Review your policy regularly: As years go by, your personal belongings may change, and so should your coverage. Periodically review your policy to ensure it reflects any new additions or changes in value. 3. Consider replacement cost coverage: While ACV coverage may cost less, choosing RCV coverage can provide the peace of mind that you’ll be able to replace your items with new ones if they’re damaged or lost. 4. Work with an insurance agent: An insurance agent can help guide you through the process of selecting the right renters insurance policy for your needs. They can answer your questions and ensure you have the appropriate coverage for your personal belongings. Renters insurance with personal belongings protection is a valuable investment that can provide financial security and peace of mind. By understanding the factors that can affect your coverage and taking the necessary steps to ensure adequate protection, you can safeguard your possessions and face unforeseen events with confidence.Additional Living Expenses Coverage

Renters insurance provides critical coverage for tenants, including protection for personal belongings, liability, and additional living expenses.

Explanation Of Additional Living Expenses Coverage

- Coverage for expenses of living elsewhere if your rental unit becomes uninhabitable due to a covered peril.

- Expenses may include temporary housing, meals, and other incurred costs

- Policy limits dictate the maximum amount that can be reimbursed.

Scenarios When It Is Useful

- Natural disasters, such as fires or floods, force you to temporarily relocate.

- Structural damage makes your apartment uninhabitable for a period.

- Repair work after a burst pipe makes your rental unlivable temporarily.

Policy Exclusions

Common Exclusions In Renters Insurance Policies

Renters insurance offers valuable protection, but there are key exclusions to be aware of to avoid surprises.

- Earthquake coverage typically requires an additional policy.

- Flood damage may not be covered under standard renters insurance.

How To Address Policy Gaps

Understanding policy exclusions can help renters address potential gaps in their coverage.

- Speak to your insurer to clarify any unclear exclusions in your policy.

- Consider additional riders or endorsements for specific coverage needs.

Claim Process Simplified

Renting a home comes with its own set of challenges and risks. It’s essential to protect your belongings and cover yourself in the event of unexpected losses. This is where renters insurance plays a crucial role. Understanding the claim process can simplify the experience and ensure that you receive the support you need when you need it. Let’s take a closer look at the steps involved in filing a claim and the role that documentation plays in the success of your claim.

Steps To Take When Filing A Claim

When filing a claim for renters insurance, it’s important to follow a clear and organized process to ensure a smooth and efficient resolution. The following steps can guide you through the claim process:

- Document the incident: Take photos and make a detailed list of the items that have been damaged or stolen.

- Contact your insurance provider: Notify your insurance company as soon as possible to initiate the claim process.

- Provide necessary information: Be ready to provide details about the incident, including the date, time, and circumstances surrounding the loss.

- Cooperate with the investigation: Assist the insurance company in their assessment of the claim, providing any additional documentation or information as requested.

- Receive settlement: Once the claim is approved, you will receive the settlement to help replace or repair your damaged or stolen belongings.

Role Of Documentation In Successful Claims

Documentation plays a vital role in the success of your renters insurance claim. Comprehensive and organized documentation of the incident and your belongings can significantly increase the likelihood of a successful claim. Here’s how effective documentation can impact your claim:

- Evidence of loss: Photographs and detailed lists of your belongings provide physical evidence to support your claim.

- Accuracy and clarity: Well-documented information ensures that there are fewer discrepancies or misunderstandings during the claim assessment.

- Claim processing speed: Clear documentation can expedite the processing of your claim, leading to faster resolution and reimbursement.

- Peace of mind: Thorough documentation gives you confidence and assurance that your claim will be handled efficiently and fairly.

Credit: http://www.cnbc.com

Comparing Insurance Providers

Renters insurance judgment can be a significant factor when comparing insurance providers. Evaluating coverage limits, deductibles, and customer reviews can help renters make an informed choice.

Factors To Consider When Choosing A Renters Insurance Provider

When it comes to protecting your belongings and providing financial security, selecting the right renters insurance provider is crucial. With numerous options available, it can be overwhelming to determine the best fit for your needs. However, by comparing insurance providers based on a few key factors, you can make an informed decision that offers you peace of mind. Below are some important considerations to keep in mind when evaluating renters insurance providers.

1. Policy Coverage

The first factor to consider is the extent of policy coverage offered by the insurance provider. Ensure that the policy covers the types of perils most relevant to your location and living situation. Whether you reside in a high-risk area prone to natural disasters or simply want protection against theft and accidents, examining the policy coverage is imperative.

2. Premiums And Deductibles

Another crucial factor to evaluate is the cost of premiums and deductibles. Look for an insurance provider that offers competitive rates without compromising on coverage. While a lower premium may appear attractive at first glance, make sure to review the deductible amount as well. A higher deductible may result in lower monthly payments but could also mean higher out-of-pocket expenses if you need to file a claim. Consider your budget and coverage needs to strike the right balance.

3. Customer Service And Support

The level of customer service and support provided by the insurance provider can greatly impact your overall experience should you need to file a claim. Reviewing customer feedback and ratings is an effective way to gain insight into the company’s reputation and their commitment to customer satisfaction. Look for an insurance provider that is known for prompt and efficient claims processing, helpful staff, and responsive communication.

4. Additional Benefits And Discounts

Some insurance providers offer additional benefits and discounts that can help save you money or enhance your overall coverage. It’s worth exploring if an insurance provider offers any unique features such as identity theft protection, pet damage coverage, or coverage for high-value items like jewelry or electronics. Additionally, inquire about any available discounts for factors like bundling your renters insurance with other policies or installing security systems in your rental property.

5. Financial Stability And Reputation

Lastly, it is crucial to assess the financial stability and reputation of the insurance provider. Verify that the company has a strong financial standing and is capable of fulfilling their policy obligations in the long run. Look for an insurance provider that is well-established and has a positive track record in the industry. This will help ensure that you can rely on them to provide the support you need in the event of a claim.

By considering these essential factors, you can make an informed decision when it comes to selecting a renters insurance provider. Remember that each person’s needs and circumstances are unique, so take the time to compare different insurance providers to find the one that aligns best with your specific requirements and offers you the most comprehensive coverage.

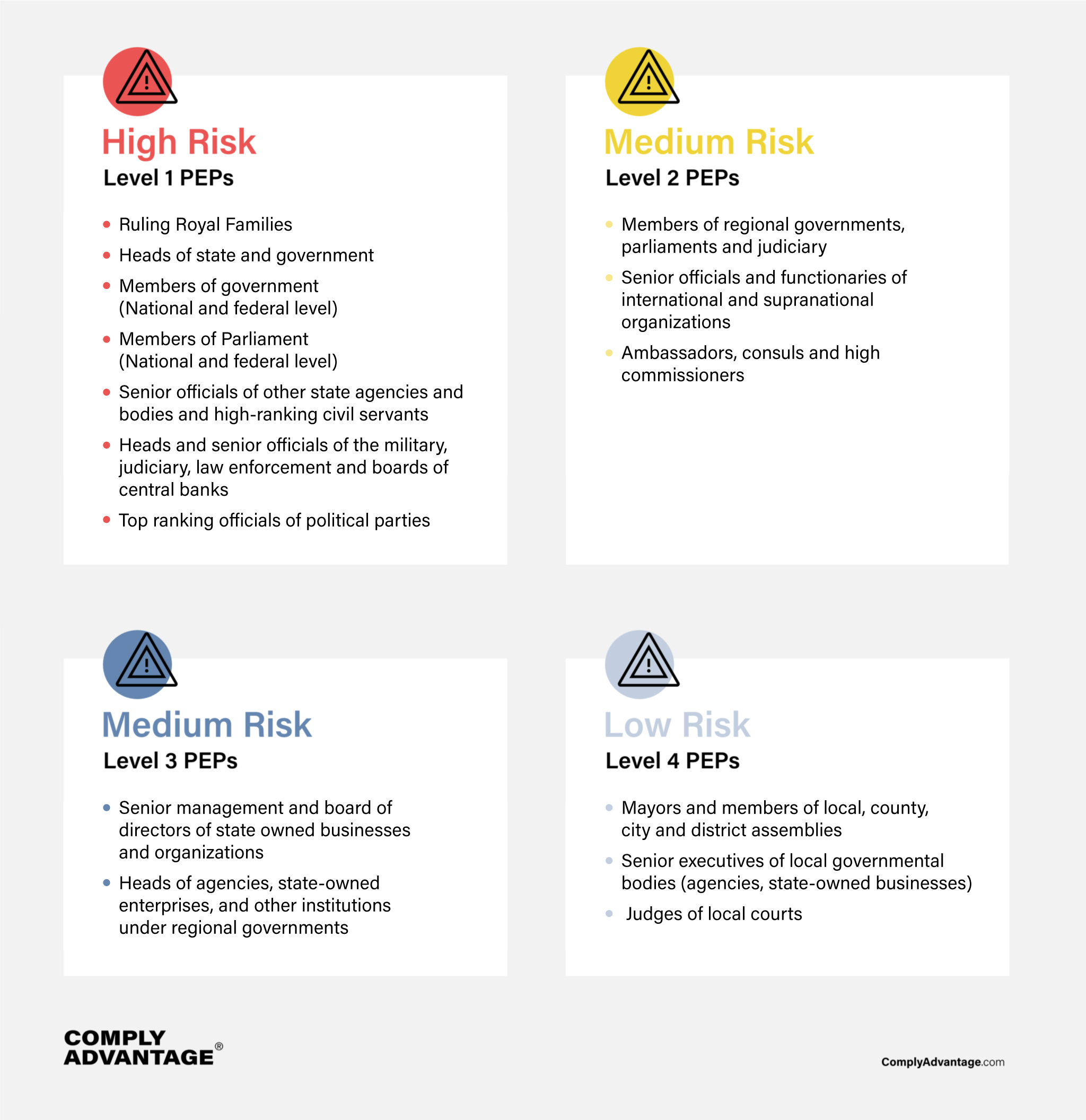

Credit: complyadvantage.com

Frequently Asked Questions Of Why Renters Insurance Judgement

What Is Renters Insurance Judgment?

Renters insurance judgment is a legal decision that can be awarded to a landlord if a tenant causes damage to the rented property.

Why Is Renters Insurance Judgment Important?

Renters insurance judgment is important as it covers the costs of damages caused by the tenant, protecting their assets and preventing financial strain.

How Does Renters Insurance Judgment Benefit Tenants?

Renters insurance judgment benefits tenants by providing financial protection, covering legal fees, and safeguarding their personal belongings in case of damage.

Can Renters Insurance Judgment Be Contested?

Yes, renters insurance judgment can be contested by providing evidence to support your case and showing that the damage was not caused intentionally.

Conclusion

Protecting your belongings is crucial, and renters insurance provides the necessary security for your valuable possessions. By covering damages caused by unforeseen events like theft, fire, or natural disasters, renters insurance allows you to have peace of mind. In addition, it also offers liability coverage, protecting you from potential legal and medical expenses.

Don’t overlook the importance of renters insurance—invest in it now to safeguard your belongings and future.

Leave a comment