Umbrella insurance provides extra liability coverage beyond what’s included in your regular insurance policies. It offers added protection in case of unexpected large claims or lawsuits.

Umbrella insurance is a crucial supplement to your existing policies, as it provides additional liability coverage beyond what typical policies offer. This extra protection can shield your assets from substantial financial loss in the event of a large claim or lawsuit.

It acts as a safety net, protecting you and your family from potential financial ruin. In today’s litigious society, having umbrella insurance can provide peace of mind and a layer of security that standard policies may not fully offer. This added layer of protection is especially important for those who have significant assets or are at a higher risk of being sued, making it a valuable investment for your financial well-being.

What Is Umbrella Insurance?

What is Umbrella Insurance?

Coverage Beyond Basic Insurance Policies

Umbrella insurance provides additional coverage beyond your basic insurance policies.

Protection Against Liability Claims

It offers protection against liability claims, covering expenses that exceed your primary policy limits.

Additional Coverage Limits, Ensuring

Umbrella insurance provides extra coverage limits, ensuring you are safeguarded in case of major claims.

Reasons To Get Umbrella Insurance

Reasons to Get Umbrella Insurance:

Protection Against Lawsuits

Umbrella insurance safeguards you from costly legal battles.

It provides additional liability coverage beyond your existing policies.

Coverage For Various Liability Risks

Umbrella policy covers a wide range of liabilities to protect your assets.

It ensures you are financially secure in case of unexpected incidents.

Peace Of Mind

Umbrella insurance brings peace by offering extra protection for uncertainties.

You can relax knowing you have added security against unforeseen events.

Affordable Coverage

Umbrella insurance offers extensive coverage at an affordable price.

It is a cost-effective way to enhance your overall liability protection.

Factors To Consider

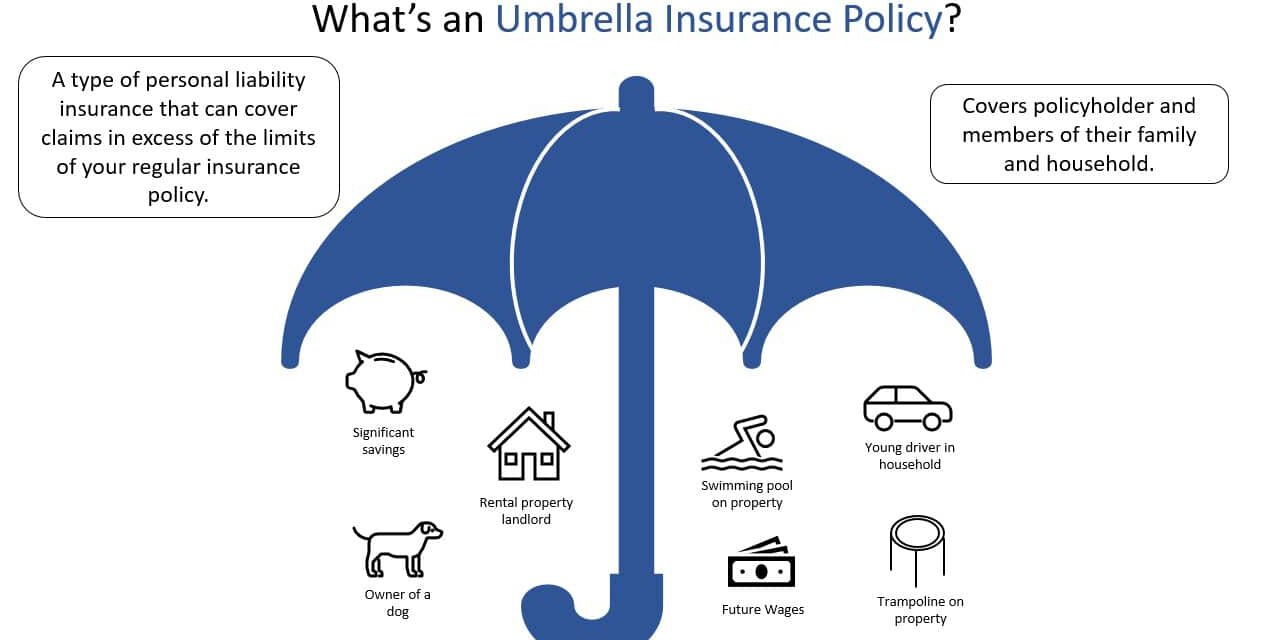

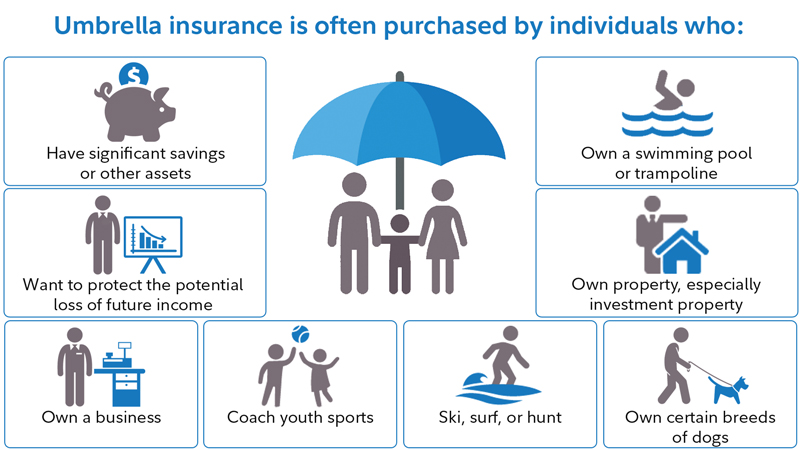

When it comes to protecting your assets and minimizing your financial risks, having umbrella insurance is essential. Umbrella insurance provides an additional layer of liability coverage beyond what your existing policies offer, giving you peace of mind and protection in case of unexpected events.

Asset Value

One of the main factors to consider when deciding if umbrella insurance is right for you is the value of your assets. This includes your home, vehicles, savings, investments, and any other valuable possessions you own. Remember, if you’re sued for an amount that exceeds your current liability coverage, your assets could be at risk.

Risk Exposure

Another important consideration is your risk exposure. Think about the activities you participate in, both personally and professionally, that could potentially put you at a higher risk of being sued. For example, if you own a rental property or have a swimming pool, your chances of facing a lawsuit may be higher. By evaluating your risk exposure, you can better determine if umbrella insurance is necessary to protect yourself from potential financial losses.

Existing Insurance Coverage

Take a look at your existing insurance coverage and identify any gaps or limitations in your policies. Your umbrella insurance should work in conjunction with your underlying policies, such as auto, homeowners, or renters insurance. Make sure to review the coverage limits and exclusions of your current policies, as this will help you assess the need for additional protection offered by an umbrella policy.

Moreover, it’s important to consider how an umbrella insurance policy complements your existing coverage. In the event of a catastrophic incident, such as a severe car accident or a serious injury on your property, your umbrella insurance can provide an extra layer of liability protection that kicks in when your other policies have reached their limits.

In conclusion, when determining whether umbrella insurance is right for you, it’s crucial to evaluate the value of your assets, assess your risk exposure, and review your existing insurance coverage. By carefully considering these factors, you can make an informed decision and ensure you have the proper protection needed to safeguard your financial future.

Credit: http://www.answerfinancial.com

Coverage Details

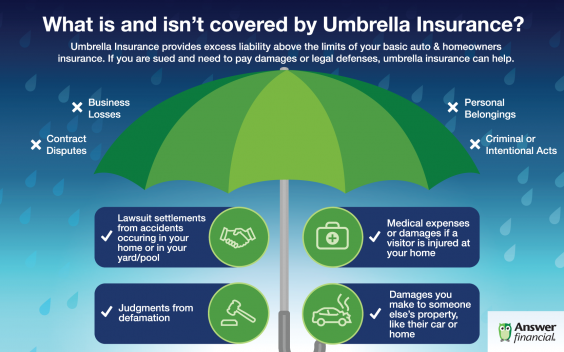

When it comes to protecting yourself from unexpected financial liabilities, umbrella insurance offers invaluable coverage details that go beyond what typical insurance policies provide. Here’s a breakdown of the specific coverage details included in umbrella insurance:

Liability Coverage

Umbrella insurance provides additional liability coverage that kicks in when the liability limits of your primary insurance policies, such as auto or homeowners insurance, are reached. This means that if you’re found responsible for causing an accident or injury that results in damages exceeding your primary policy limits, umbrella insurance can provide an extra layer of protection.

Property Damage Coverage

In addition to liability coverage, umbrella insurance also includes property damage coverage. If you accidentally cause damage to someone else’s property and the costs exceed your primary policy’s limits, umbrella insurance can help cover the remaining expenses, protecting your assets and finances.

Legal Defense Costs

Legal disputes can be costly, but umbrella insurance can provide coverage for legal defense costs in the event that you’re sued for a covered liability. This coverage can include attorney fees, court costs, and other legal expenses, offering you peace of mind knowing that you have financial protection in legal matters.

Common Misconceptions

Many misunderstand the significance of umbrella insurance, assuming it duplicates coverage. However, it offers additional protection beyond standard policies, safeguarding against unexpected financial liabilities. Understanding its unique benefits is essential for comprehensive risk management.

Umbrella Insurance Duplicates Existing Policies

Many people believe that umbrella insurance simply duplicates their existing policies, such as homeowners or auto insurance. However, this is a misconception.

In reality, umbrella insurance provides an extra layer of liability coverage above and beyond the limits of your existing policies, offering additional protection in case of a major lawsuit or claim.

Expensive And Unnecessary

Another prevalent misunderstanding about umbrella insurance is that it is expensive and unnecessary.

Contrary to this belief, umbrella insurance is remarkably affordable given the considerable coverage it offers. It acts as a safety net, protecting your assets and future earnings in the event of a costly lawsuit or liability claim.

Only For Wealthy Individuals

One of the most common misconceptions is that umbrella insurance is only for the wealthy.

However, the reality is that anyone can benefit from umbrella insurance, as unexpected accidents or lawsuits can happen to anyone. This additional layer of protection can safeguard your assets and provide peace of mind, regardless of income level.

How To Get Umbrella Insurance

When it comes to protecting your financial future, umbrella insurance can play a crucial role. This extra layer of coverage goes beyond the limits of your existing policies, providing added security against potential lawsuits and costly claims. If you’re looking for guidance on how to get umbrella insurance, here are the essential steps to follow:

Assessing Coverage Needs

Before diving into the process of obtaining umbrella insurance, it’s important to assess your coverage needs. Consider the value of your assets, future earnings, and level of risk. An umbrella policy typically starts with a minimum coverage limit of $1 million, and depending on your individual circumstances, you may want to increase this limit. Evaluate the type of assets you own, such as your home, vehicles, or investments, and determine the level of liability coverage required to protect them adequately.

Contacting Insurance Providers

Once you have a clear understanding of your coverage needs, it’s time to reach out to insurance providers. Start by contacting your current insurance company, whether it’s for your auto, home, or any other type of policy. Inquire about the availability of umbrella insurance and ask for a quote based on your specified coverage limit. Alternatively, you can explore other insurance providers to compare the offerings and find the best fit for your needs. Utilize online resources, such as insurance comparison websites, to gather information on different companies and their umbrella policies.

Comparing Quotes

After gathering quotes from multiple insurance providers, it’s essential to compare them carefully. Look beyond the price and pay attention to the coverage details. Evaluate the policy limits, exclusions, and additional benefits. Consider the reputation and financial stability of the insurance company as well. A simple way to organize and compare the quotes is by creating a table:

| Insurance Company | Policy Limit | Premium | Additional Benefits |

|---|---|---|---|

| Company A | $1 million | $500 | 24/7 claims assistance |

| Company B | $2 million | $600 | Personal injury coverage |

| Company C | $5 million | $800 | Worldwide coverage |

Purchasing The Policy

Once you’ve compared the quotes and have identified the most suitable umbrella insurance policy, it’s time to make the purchase. Contact the insurance provider either through their website or customer service hotline. Provide them with the necessary information, such as your personal details, desired coverage limit, and any specific endorsements or additions you may require. Review the policy terms and conditions carefully before proceeding with the purchase. Ensure that all the information provided is accurate and complete. Once the transaction is complete, you can have peace of mind knowing that your assets and future earnings are better protected against unforeseen events.

Claim Process

When it comes to the claim process for umbrella insurance, there are several key steps you need to follow to ensure a smooth and efficient resolution.

Contacting The Insurance Company

Contact your insurance company immediately after an incident to start the claims process. Provide all relevant information and details promptly.

Reporting The Incident

Report the incident in detail to your insurance company. Include all necessary information such as date, time, location, and description of the incident.

Providing Necessary Documentation

Gather and provide all required documentation to support your claim. This may include police reports, medical records, and any other relevant evidence.

Claim Evaluation And Settlement

Your insurance company will evaluate your claim based on the provided documentation. Once evaluated, they will offer a settlement for the damages incurred.

Credit: assetplanningcorp.com

Credit: http://www.fidelity.com

Frequently Asked Questions For Why Umbrella Insurance

What Is Umbrella Insurance And Why Do I Need It?

Umbrella insurance provides extra liability coverage that goes beyond the limits of your homeowners or auto insurance. It offers protection in case of a lawsuit or liability claim against you, providing peace of mind and financial security.

How Much Umbrella Insurance Coverage Do I Need?

The amount of umbrella insurance coverage you need depends on various factors such as your assets, income, and potential risks. It’s recommended to have enough coverage to protect your assets and future earnings in case of a lawsuit or liability claim.

Does Umbrella Insurance Cover Legal Fees In Addition To The Settlement Amount?

Yes, umbrella insurance typically covers legal fees in addition to the settlement amount, providing financial protection in case of a lawsuit. This can include attorney’s fees, court costs, and other legal expenses, offering comprehensive coverage for potential liability claims.

Conclusion

Considering the unpredictable nature of life, having umbrella insurance is a prudent decision. With this additional coverage, you can protect your assets and safeguard your financial future. By providing an extra layer of protection beyond your primary policies, umbrella insurance offers peace of mind and safeguards against potential lawsuits.

Don’t wait for an unfortunate incident to occur; consider umbrella insurance today to ensure comprehensive coverage for you and your loved ones.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is umbrella insurance and why do I need it?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Umbrella insurance provides extra liability coverage that goes beyond the limits of your homeowners or auto insurance. It offers protection in case of a lawsuit or liability claim against you, providing peace of mind and financial security.” } } , { “@type”: “Question”, “name”: “How much umbrella insurance coverage do I need?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The amount of umbrella insurance coverage you need depends on various factors such as your assets, income, and potential risks. It’s recommended to have enough coverage to protect your assets and future earnings in case of a lawsuit or liability claim.” } } , { “@type”: “Question”, “name”: “Does umbrella insurance cover legal fees in addition to the settlement amount?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, umbrella insurance typically covers legal fees in addition to the settlement amount, providing financial protection in case of a lawsuit. This can include attorney’s fees, court costs, and other legal expenses, offering comprehensive coverage for potential liability claims.” } } ] }

Leave a comment