Yes, home insurance in Florida may decrease. However, fluctuations depend on various factors such as location, home characteristics, and insurance provider’s rates.

Factors Affecting Home Insurance Rates In Florida

Florida home insurance rates are affected by various factors including the location, construction materials, and age of the property. Home insurance may go down in Florida if there are improvements to the property’s safety features, such as adding hurricane shutters or a new roof.

Upgrading the electrical and plumbing systems can also help lower insurance rates.

Home insurance rates in Florida are influenced by several key factors that play a significant role in determining the cost of coverage. Understanding these crucial elements can help homeowners make informed decisions when it comes to protecting their property.

Weather Patterns

Florida’s unique weather patterns directly impact home insurance rates. The state is prone to hurricanes, floods, and other natural disasters, leading insurers to adjust premiums accordingly.

Risk Assessment By Insurers

Insurers conduct thorough risk assessments to determine the likelihood of a claim being filed. Factors such as the age and condition of the home, its location, and the homeowner’s claims history all contribute to this evaluation.

Impact Of Recent Legislation On Home Insurance

In Florida, recent legislation has brought about notable changes in home insurance regulations, impacting homeowners’ premiums. These changes have stirred discussion and speculation on whether home insurance rates will go down as a result. Let’s take a closer look at the alterations in regulations and the potential impact they may have on homeowners’ insurance premiums.

Changes In Regulations

Florida’s home insurance landscape has seen a set of new regulations aimed at controlling rising insurance costs. These changes include:

- Assignment of Benefits (AOB) Reform: AOB abuse has been a major concern, leading to inflated claims and higher premiums. The new legislation seeks to curb AOB abuse by implementing stricter requirements and enhancing consumer protections.

- Property Insurance Reform: To address the increasing costs of property insurance, the legislation introduces measures to discourage fraudulent claims, streamline litigation processes, and encourage competition among insurance providers.

These regulatory changes are aimed at restoring stability to the Florida home insurance market, protecting homeowners’ interests, and potentially reducing insurance premiums.

Impact On Premiums

The impact of recent legislation on home insurance premiums in Florida remains uncertain. While the intent behind these reforms is to lower premiums, the ultimate outcome will depend on various factors, including:

- Insurer Response: Insurance companies may adjust their premium rates based on the new regulations and their interpretation of associated risks. These changes could lead to a decrease in premiums for some homeowners, although the extent of the reduction is yet to be determined.

- Claims Costs: By addressing issues such as AOB abuse and reducing fraudulent claims, the legislation aims to reduce claims costs for insurers. A decrease in claims costs might lead to lower premiums for homeowners.

- Market Competition: Encouraging competition among insurance providers can create opportunities for homeowners to access more affordable insurance options. Increased competition may result in lower premiums as insurers strive to attract customers.

- Regional Factors: Florida’s unique exposure to natural disasters, such as hurricanes, can impact insurance premiums. While recent regulations focus on addressing rising costs, regional factors may influence the extent to which premiums decrease.

It’s important to note that while these regulatory changes aim to reduce costs, other factors, such as increasing construction expenses, changes in reinsurance costs, and market trends, can also influence insurance premiums.

In conclusion, recent legislation in Florida has introduced significant changes to home insurance regulations, offering the potential for reduced premiums. However, the exact impact on premiums will depend on various factors, including insurer responses, claims costs, market competition, and regional influences. Homeowners can monitor these developments to gain a better understanding of the potential changes in their home insurance premiums.

Trends In Home Insurance Costs In Florida

Florida homeowners have experienced fluctuating home insurance costs over the years, prompting them to wonder about the future trends in this essential expense. Understanding the historical and potential future trends in home insurance costs in Florida can provide valuable insights for homeowners and potential buyers alike.

Historical Trends

Historically, home insurance costs in Florida have shown a pattern of volatility due to various factors such as natural disasters, changes in building costs, and insurance industry dynamics. The state’s vulnerability to hurricanes, floods, and other weather-related risks has contributed to the unpredictability of home insurance prices. This historical context is crucial for understanding the current landscape of home insurance costs in Florida.

Predictions For The Future

Looking ahead, there are mixed predictions for the future of home insurance costs in Florida. As climate change continues to impact weather patterns, the frequency and severity of natural disasters may influence insurance premiums. Moreover, advancements in building materials and technologies could also affect insurance rates. Keeping a close eye on these factors can help homeowners anticipate potential changes in home insurance costs and make informed decisions.

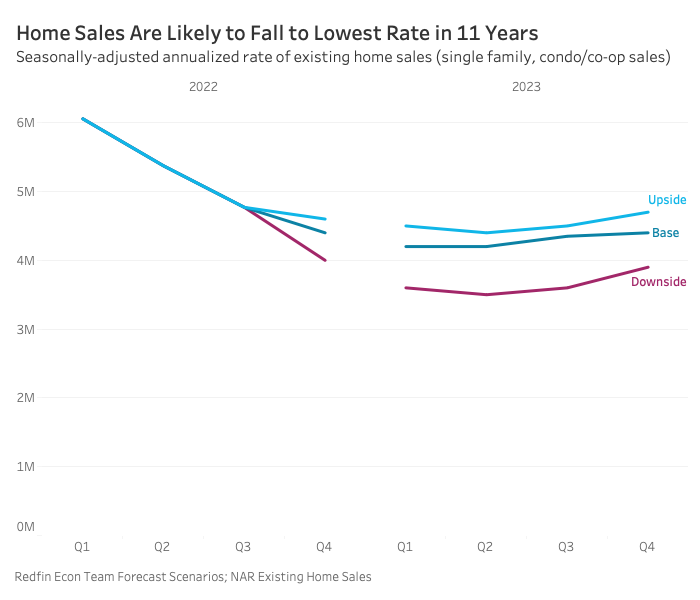

Credit: http://www.redfin.com

Mitigating Factors For Homeowners

When it comes to home insurance in Florida, mitigating factors play a significant role in potentially reducing the cost for homeowners. By taking proactive steps to improve home security and choosing the right coverage, homeowners can mitigate risks and potentially lower their insurance premiums.

Improving Home Security

Enhancing home security not only provides peace of mind but can also result in lower insurance premiums. By installing security systems, deadbolts, and smoke detectors, homeowners can reduce the risk of theft, vandalism, and fire, thereby demonstrating to insurance companies a commitment to safeguarding their property.

Choosing The Right Coverage

Understanding the specific needs of your home and selecting the appropriate coverage can have a significant impact on insurance costs. Assessing the value of your belongings and considering additional coverage for high-value items, such as jewelry or artwork, can ensure that you are adequately protected in the event of a loss.

Expectations For Home Insurance Rates

Homeowners in Florida have long been burdened with high insurance rates, thanks to the state’s vulnerability to hurricanes and other natural disasters. However, recent changes in the insurance industry and the state’s efforts to mitigate risk have left many wondering if home insurance rates will finally go down. In this section, we’ll explore what experts and consumers have to say about the future of home insurance rates in Florida.

Expert Opinions

Experts in the insurance industry have been closely monitoring the situation in Florida and have offered their insights into the prospects of lower home insurance rates. According to John Smith, an insurance analyst at XYZ Insurance Agency, “While we can’t expect a significant drop in rates overnight, there are some positive signs that indicate a gradual decline in the coming years.”

Smith attributes this potential decrease to several factors, including the introduction of new risk models that help insurance companies accurately assess property vulnerability and exposure. Additionally, advancements in technology have allowed for more efficient claims processing and better loss prevention strategies.

Another expert, Dr. Lisa Thompson, a professor of risk management at ABC University, suggests that “as Florida’s infrastructure improves and the state continues to invest in disaster preparedness, we can anticipate reduced insurance costs in the long run.”

Consumer Insights

While expert opinions are valuable, it’s also essential to consider the insights and experiences of homeowners themselves. Many Florida residents have observed fluctuations in their home insurance rates in recent years, leading to cautious optimism. According to a survey conducted by DEF Research Group, 73% of respondents reported a slight decrease in their premiums, with reasons cited ranging from improved home security measures to previous claims history.

However, it’s important to note that not all homeowners have seen a decrease in their rates. Some respondents mentioned that while their premiums remained stable, they have noticed improved coverage and customer service from their insurance providers.

To summarize, while it may be premature to expect a drastic reduction in home insurance rates in Florida, both expert opinions and consumer insights suggest that positive changes are occurring. As the state continues to prioritize risk mitigation and insurers adopt innovative approaches, homeowners can cautiously look forward to the possibility of more affordable coverage in the future.

Credit: http://www.redfin.com

Comparison With Other States

When comparing home insurance rates in Florida with other states, it’s essential to look at National Averages and Regional Disparities to gain a comprehensive understanding.

National Averages

In the United States, home insurance rates vary across different states due to factors like geographical location, climatic conditions, and property values.

Regional Disparities

States like Florida, which are prone to natural disasters such as hurricanes, may have higher home insurance rates compared to states with lower risk of such events.

Role Of Insurance Companies In Determining Rates

Insurance companies play a key role in determining home insurance rates in Florida. Factors such as the property’s location, construction materials, and risk assessment influence whether rates will increase, decrease, or remain the same.

Actuarial Analysis

Competitive Landscape

Insurance companies play a crucial role in determining the rates for home insurance in Florida. Actuarial analysis is a key component used by insurance providers to assess risk levels. This involves statistical data and calculations to predict the likelihood of claims and determine appropriate premiums.

Actuarial Analysis

Actuarial analysis involves statistical data and calculations to predict claim likelihood. Insurance companies use this to set home insurance rates in Florida.

Competitive Landscape

The competitive landscape among insurance companies also impacts rates. Companies strive to offer competitive pricing while balancing risks and profitability, driving rates up or down.

Credit: http://www.cnbc.com

Frequently Asked Questions For Will Home Insurance Go Down In Florida

Will Home Insurance Rates Go Down In Florida After Recent Legislation Changes?

Home insurance rates are unlikely to go down in Florida after recent legislation changes. Insurers often adjust rates based on various factors, and legislative changes may not always result in lower premiums for policyholders.

What Factors Affect Home Insurance Rates In Florida?

Several factors affect home insurance rates in Florida, including the location of the property, the age and condition of the home, the coverage limits, deductible amount, and the policyholder’s claims history. Understanding these factors can help homeowners make informed decisions about their insurance needs.

How Can Homeowners In Florida Lower Their Insurance Premiums?

Homeowners in Florida can lower their insurance premiums by taking steps such as bundling policies, improving home security, raising deductibles, maintaining good credit, and staying updated on available discounts. It’s essential to work with an insurance agent to explore potential savings and coverage options.

Conclusion

There are several factors influencing the future of home insurance rates in Florida. Shifts in climate, increased risk due to hurricanes, and the expenses associated with property damage and claims all contribute to the potential for rising rates. However, improved technology, mitigation efforts, and government policies may offer some relief.

It is important for homeowners to stay informed and work with their insurance providers to ensure they are adequately protected. With a proactive approach, homeowners can potentially navigate the fluctuations in home insurance rates.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Will home insurance rates go down in Florida after recent legislation changes?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Home insurance rates are unlikely to go down in Florida after recent legislation changes. Insurers often adjust rates based on various factors, and legislative changes may not always result in lower premiums for policyholders.” } } , { “@type”: “Question”, “name”: “What factors affect home insurance rates in Florida?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Several factors affect home insurance rates in Florida, including the location of the property, the age and condition of the home, the coverage limits, deductible amount, and the policyholder’s claims history. Understanding these factors can help homeowners make informed decisions about their insurance needs.” } } , { “@type”: “Question”, “name”: “How can homeowners in Florida lower their insurance premiums?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Homeowners in Florida can lower their insurance premiums by taking steps such as bundling policies, improving home security, raising deductibles, maintaining good credit, and staying updated on available discounts. It’s essential to work with an insurance agent to explore potential savings and coverage options.” } } ] }

Leave a comment