Endowment policies in the UK are not taxable for the policyholder upon maturity or surrender. However, if the policyholder sells the policy to a third party, any profit made may be subject to capital gains tax.

Endowment policies in the UK serve as a type of insurance and investment hybrid. They offer a savings element along with life coverage, maturing after a specific term to provide a lump sum. While the proceeds from the policy are typically tax-free, certain scenarios such as selling the policy may lead to tax implications.

Understanding the tax treatment of endowment policies is crucial for policyholders to make informed decisions about their investments. Let’s delve deeper into how endowment policies work and their tax implications in the UK.

What Are Endowment Policies?

Endowment policies in the UK are a popular form of investment that combines both life insurance and savings. Let’s dive into the details of what endowment policies are and how they are taxed in the UK.

Definition

An endowment policy is a financial product that requires the policyholder to make regular payments, typically monthly, over a specified term, usually 10 to 25 years. It provides a savings or investment element and a life insurance component with a payout upon maturity or in the event of the policyholder’s death.

Types Of Endowment Policies

There are mainly two types of endowment policies:

- Unit-Linked Endowment Policies: These policies invest in a range of funds and allow the policyholder to choose their investment strategy. The value of the policy is directly linked to the performance of these funds.

- With-Profit Endowment Policies: These policies offer guaranteed bonuses and share in the profits of the insurance company. They provide a more stable but potentially lower return compared to unit-linked policies.

Tax Treatment Of Endowment Policies

Endowment policies in the UK have specific tax implications that policyholders need to be aware of. Understanding the tax treatment of these policies is crucial for making informed financial decisions.

Taxation On Premiums

Premiums paid on endowment policies are generally not tax-deductible for the policyholder. This means that you cannot claim back the amount you pay as premiums on your endowment policy as a tax deduction.

Taxation On Maturity Payouts

When an endowment policy matures, the payout received is typically taxed as income. This means that the amount you receive at the end of the policy term may be subject to income tax based on your tax bracket.

Tax Benefits Of Endowment Policies

Endowment policies in the UK offer several tax benefits that can help individuals save money and maximize returns. Whether it’s income tax advantages or inheritance tax benefits, understanding how these policies work within the UK tax system is crucial. In this article, we will delve into the tax benefits of endowment policies and explore the potential savings they can provide.

Income Tax Advantages

Endowment policies are designed to help individuals accumulate savings by regularly paying premiums over a specified term. One of the key advantages of these policies is the potential for income tax savings.

- Tax-free growth: Any growth within the policy is typically tax-free, allowing your savings to build up more rapidly compared to taxable investments.

- Basic rate tax relief: If you’re a basic rate taxpayer, endowment policies may offer you tax relief on your premiums.

- Potential for higher-rate tax relief: For higher-rate taxpayers, endowment policies can provide additional tax relief, enabling you to reduce your tax liability.

Inheritance Tax Benefits

Endowment policies can also provide potential advantages when it comes to inheritance tax planning, helping you preserve your assets for future generations.

- Potential for exemption: Under current UK tax rules, if your endowment policy qualifies as a qualifying policy, it may be exempt from inheritance tax.

- Using trusts: Placing your endowment policy within a properly structured trust can further enhance the inheritance tax benefits, ensuring your loved ones receive the maximum benefits from your policy.

- Flexibility for gifting: Endowment policies can allow for gifting, enabling you to transfer ownership of your policy to your beneficiaries, potentially reducing your inheritance tax liability.

Understanding and utilizing the tax benefits of endowment policies is essential for individuals looking to optimize their savings and reduce their tax obligations. By taking advantage of income tax advantages and inheritance tax benefits, you can potentially enjoy greater returns and preserve your wealth for future generations.

Taxable Endowment Policies

Taxable endowment policies in the UK are subject to taxation, impacting policyholders’ returns. Understanding the tax implications is crucial for effective financial planning. Endowment policies can be taxable based on individual circumstances, so consulting with a tax advisor is recommended.

Criteria For Taxability

In order to determine whether an endowment policy is taxable in the UK, certain criteria must be met. These criteria include:

- Period of Ownership: The policy must be owned for a specific period of time, generally exceeding 10 years.

- Payment and Maturity: The policy must involve regular premium payments and mature at a specified date in the future.

- Investment Component: The policy must have an investment component, allowing the policyholder to accumulate a cash value over time.

If all three criteria are met, then the endowment policy is considered taxable under UK law.

Exceptions

While most endowment policies are taxable, there are a few exceptions that should be noted. These exceptions include:

- Qualifying Policies: Certain policies may qualify for tax exemptions, such as qualifying life assurance policies.

- Minimal Premiums: Policies with minimal premium payments may be exempt from taxation.

- Specific Timeframes: Some policies that were taken out prior to a certain date may be exempt from taxation.

It’s important to consult with a tax advisor or financial professional to fully understand the exceptions and implications of endowment policy taxation in the UK.

Case Studies

Endowment policies in the UK may or may not be taxable, depending on various factors. Case studies provide real-life examples of how endowment policies can be affected by tax regulations, offering valuable insights for individuals seeking to understand their tax obligations in this context.

Exploring impact on policyholders and tax planning strategies can shed light on the implications of endowment policies being taxable in the UK.

Impact On Policyholders

For policyholders, taxable endowment policies can lead to reduced returns.

Policyholders may face increased tax liabilities impacting their overall savings.

Investors may need to reconsider their investment choices due to taxation.

Tax Planning Strategies

Policyholders can utilize tax-efficient investment vehicles to mitigate tax impact.

Regular reviews of financial portfolios can aid in tax planning for endowment policies.

Consulting with financial advisors is crucial to develop effective tax strategies.

Credit: http://www.zawya.com

Regulatory Perspective

When it comes to understanding the taxation of endowment policies in the UK, it is essential to consider the regulatory perspective. The Financial Conduct Authority (FCA) plays a crucial role in establishing regulations and compliance requirements for these financial products.

Fca Regulations

The FCA regulates financial firms and markets to ensure that they operate with integrity and in the best interests of consumers. In the context of endowment policies, the FCA sets out guidelines for the marketing, sale, and ongoing management of these products to protect policyholders from potential risks.

Compliance Requirements

- Policy terms disclosure: Insurers must clearly communicate the terms and conditions of endowment policies to customers, including any potential tax implications.

- Transparency in marketing: Firms are required to provide transparent and accurate information about the tax treatment of endowment policies in their marketing materials.

- Customer suitability assessment: Financial advisers must conduct thorough assessments to ensure that endowment policies are suitable for the individual circumstances of the customer, including tax considerations.

- Record-keeping obligations: Firms are mandated to maintain detailed records of sales and advice provided, including documentation related to tax advice given to customers.

Adhering to these compliance requirements is essential for firms operating in the UK’s financial services industry and ensures that endowment policies are marketed and managed in a responsible and transparent manner.

Comparative Analysis

When it comes to the tax implications of endowment policies, a comparative analysis between the UK and other jurisdictions is essential to understand the different tax treatments.

Uk Vs. Other Jurisdictions

In the UK, endowment policy proceeds are generally not subject to income tax. This favorable tax treatment makes them an attractive savings and investment option for UK residents.

Conversely, in certain other jurisdictions such as the United States, endowment policy proceeds may be subject to tax, creating a disparity in tax treatment between different regions.

Tax Implications

Understanding the tax implications specific to each jurisdiction is pivotal for individuals holding or considering an endowment policy. For instance, in the UK, policyholders may be eligible for tax breaks, while in other jurisdictions, the tax treatment may be less favorable.

Credit: http://www.ft.com

Conclusion And Recommendations

Endowment policies in the UK are generally not taxable, provided they meet specific criteria. It is important to review the terms and conditions of the policy and seek professional advice to ensure compliance with tax regulations. Considering potential tax implications is crucial when making recommendations or decisions related to endowment policies in the UK.

Tax-efficient Investment Considerations

When it comes to endowment policies in the UK, understanding the tax implications is crucial. Endowment policies are subject to certain tax rules in the UK, and it is important to be aware of these considerations before making any investment decision.

One of the key advantages of an endowment policy in terms of taxation is the ability to enjoy tax-free growth on the investment. This means that any returns earned on the policy are not subject to income tax or capital gains tax. Consequently, investing in an endowment policy can be a tax-efficient way to grow your wealth over the long term.

However, it is important to note that the tax treatment of endowment policies can vary depending on the specific circumstances and the type of policy held. For example, some policies may be subject to inheritance tax upon death. Additionally, if the policyholder decides to cash in the endowment policy before a specific period, they may be liable to pay income tax on the gains.

To ensure tax efficiency when considering an endowment policy, it is advisable to consult with a qualified financial advisor or tax specialist who can provide specific guidance tailored to your individual circumstances. They can help you understand the complete picture of tax implications and make informed decisions.

Future Policy Developments

In recent years, there have been discussions about potential changes to the taxation of endowment policies in the UK. While no major developments have taken place thus far, it is always important to stay informed about any future policy changes that may impact your investment.

It is recommended to regularly review the latest updates from HM Revenue & Customs (HMRC) and stay in touch with your financial advisor to ensure you are aware of any changes that may affect your endowment policy. By staying proactive and informed, you can better adapt your investment strategy and maximize its tax efficiency.

Understanding the tax implications and considering tax-efficient investment strategies are essential when it comes to endowment policies in the UK. While these policies offer advantages in terms of tax-free growth, it is important to be aware of potential tax liabilities, such as inheritance tax or taxable gains upon early withdrawal.

To ensure you make the most of your endowment policy and minimize any tax burden, seeking professional advice from a qualified tax specialist or financial advisor is highly recommended. They can provide personalized guidance based on your individual circumstances and help you navigate the complexities of taxation in relation to endowment policies.

Remember, staying informed about future policy developments and regularly reviewing your investment strategy will contribute to optimizing your endowment policy’s tax efficiency over the long term.

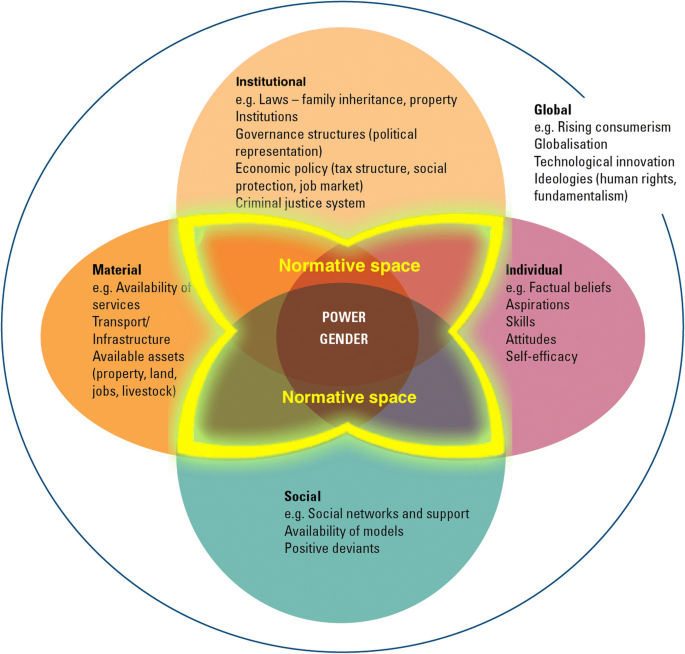

Credit: globalizationandhealth.biomedcentral.com

Frequently Asked Questions On Are Endowment Policy Uk Taxable

Is An Endowment Taxable In The Uk?

Endowments in the UK are generally not taxable for the beneficiary. However, tax may apply on any gains made by the endowment.

Is Endowment Insurance Taxable?

Yes, endowment insurance is taxable.

What Happens When An Endowment Policy Matures Uk?

When an endowment policy matures in the UK, the policyholder receives the sum assured, along with any bonuses earned. This amount can be used freely without any obligations or restrictions.

Are Endowment Contributions Tax-deductible?

Yes, endowment contributions are tax-deductible, provided they are made to qualifying organizations.

Conclusion

Understanding the tax implications of UK endowment policies is crucial for financial planning. Being aware of the taxable aspects can help you make informed decisions to optimize your financial portfolio. Consult with a tax expert for personalized advice tailored to your specific circumstances.

Keep your finances secure and compliant.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Is an endowment taxable in the UK?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Endowments in the UK are generally not taxable for the beneficiary. However, tax may apply on any gains made by the endowment.” } } , { “@type”: “Question”, “name”: “Is endowment insurance taxable?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, endowment insurance is taxable.” } } , { “@type”: “Question”, “name”: “What happens when an endowment policy matures UK?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “When an endowment policy matures in the UK, the policyholder receives the sum assured, along with any bonuses earned. This amount can be used freely without any obligations or restrictions.” } } , { “@type”: “Question”, “name”: “Are endowment contributions tax-deductible?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, endowment contributions are tax-deductible, provided they are made to qualifying organizations.” } } ] }

Leave a comment