Yes, pet insurance can cover vet bills. Pet insurance helps with veterinary expenses for your furry friend.

Pets are like family, and ensuring they have proper healthcare coverage is essential. Vet bills can quickly add up, especially in emergencies or for ongoing treatments. Having pet insurance can provide financial peace of mind and ensure your pet receives the necessary care without breaking the bank.

It’s important to understand the coverage options, exclusions, and limitations of pet insurance policies to select the best plan for your pet’s needs. By investing in pet insurance, you can protect your pet’s health and well-being while managing unexpected veterinary costs.

Credit: http://www.lemonade.com

What Is Pet Insurance?

What is Pet Insurance?

Definition

Pet insurance is a financial product that helps pet owners cover the cost of medical expenses related to their pets, ensuring they can provide necessary veterinary care without financial strain.

Types Of Pet Insurance

- Accident-Only Insurance: Covers injuries resulting from accidents, such as broken bones or poison ingestion.

- Accident and Illness Insurance: Provides coverage for accidents and illnesses, including infections or chronic conditions.

- Comprehensive Insurance: Offers coverage for accidents, illnesses, routine care, and other veterinary services.

Credit: http://www.nwaonline.com

Why Consider Pet Insurance?

Considering pet insurance is essential to provide financial protection and peace of mind for unexpected veterinary expenses. Let’s delve into the benefits of having pet insurance.

Financial Protection

Pet insurance serves as a safeguard against unforeseen medical costs, ensuring your pet’s health without breaking the bank.

Peace Of Mind

By enrolling in pet insurance, you can rest assured that your furry friend will receive the necessary medical care when needed, easing your worries.

How Does Pet Insurance Work?

Pet insurance is a valuable investment for pet owners as it provides financial protection against unexpected veterinary expenses. Understanding how pet insurance works is crucial to make an informed decision for your furry friend’s health. Let’s take a closer look at the key aspects of pet insurance:

Coverage Options

Pet insurance plans typically offer a range of coverage options tailored to meet the specific needs of your pet. These options often include:

- Accident-only coverage: Provides coverage for veterinary expenses related to accidental injuries.

- Illness coverage: Covers the cost of vet bills resulting from illnesses and diseases.

- Wellness coverage: Includes preventive care, such as vaccinations and annual check-ups.

- Chronic condition coverage: Offers coverage for ongoing conditions like diabetes or arthritis.

It’s important to carefully consider which coverage options best fit your pet’s needs and your budget.

Claims Process

Filing a claim for pet insurance reimbursement is a simple and straightforward process. Here’s how it typically works:

- Visit the vet: When your pet requires medical attention, take them to a licensed veterinarian.

- Pay the vet bill: Pay the vet directly for the services rendered.

- Submit a claim: Collect all necessary documents, including the invoice and medical records, and submit them to your pet insurance provider.

- Review and reimbursement: The insurance provider will review the claim and reimburse you based on the coverage and policy limits.

It’s important to familiarize yourself with the specific claims process of your chosen pet insurance provider to ensure a smooth reimbursement experience.

In conclusion, pet insurance offers financial protection and peace of mind for the unexpected medical expenses your pet may incur. By understanding the coverage options and claims process, you can make an informed decision to provide the best care for your furry friend.

Credit: http://www.seattletimes.com

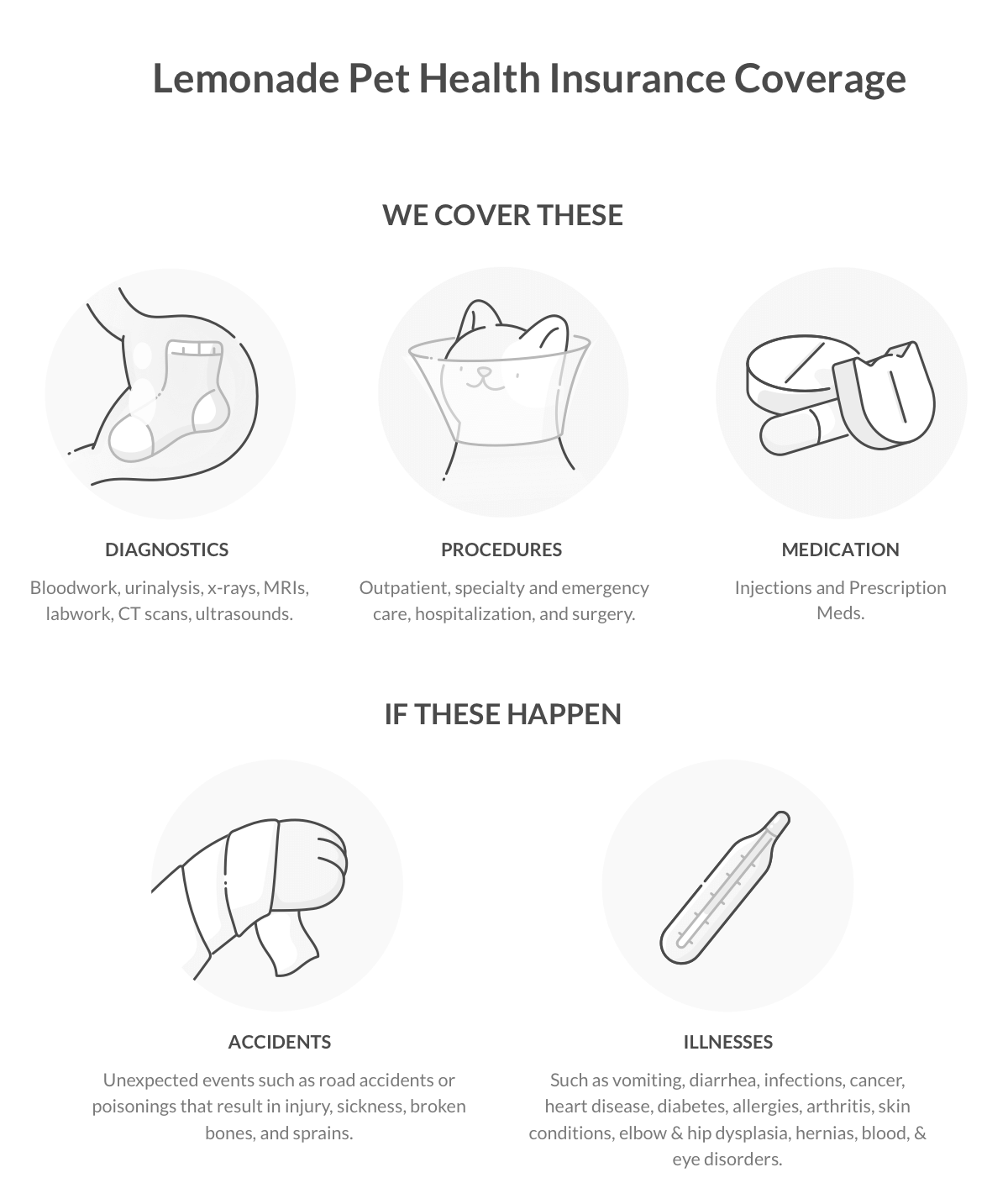

What Does Pet Insurance Cover?

When considering pet insurance, one of the most critical aspects to understand is what it covers. Having a clear grasp of the coverage offered by pet insurance can help pet owners make informed decisions about their furry companions’ healthcare. Let’s delve into the key areas that pet insurance can cover and provide peace of mind for pet owners.

Routine Care

Routine care refers to preventive services such as annual check-ups, vaccinations, flea and tick prevention, and dental cleaning. Some pet insurance plans offer coverage for routine care, helping pet owners manage the costs of these ongoing pet health needs.

Accidents And Injuries

Pet insurance can cover the costs associated with unexpected accidents and injuries, including fractures, wounds, and ingestion of foreign objects. This coverage ensures that pet owners can afford the necessary medical treatment in the event of an unforeseen mishap.

Illnesses And Diseases

Whether it’s a common illness like an ear infection or a more severe condition such as diabetes or cancer, pet insurance can provide coverage for the treatment of various illnesses and diseases. This coverage can offer financial support during challenging times when a pet falls ill.

Hereditary And Congenital Conditions

Hereditary and congenital conditions are genetic or developmental health issues that pets may inherit. Some pet insurance plans cover the treatment of these conditions, offering support for managing chronic health issues that may require ongoing care.

What Is Not Covered By Pet Insurance?

Understanding what is not covered by pet insurance is essential for pet owners to make informed decisions about their pets’ healthcare. While pet insurance provides valuable financial assistance for unexpected veterinary expenses, there are certain situations and treatments that are typically not covered.

Pre-existing Conditions

Pet insurance generally does not cover pre-existing conditions, which are health issues that existed before the insurance policy was purchased. This includes any illness or injury that showed symptoms or was diagnosed before the coverage started.

Dental Care

Pet insurance often does not cover routine dental care such as teeth cleaning and regular check-ups. It also may not cover treatment for dental issues that are considered part of normal aging, such as tooth decay or periodontal disease.

Alternative Therapies

Many pet insurance policies do not cover alternative therapies, such as acupuncture, chiropractic care, or herbal treatments. These treatments are usually considered as non-traditional and thus excluded from coverage.

Breeding And Pregnancy Costs

Most pet insurance plans do not cover the costs related to breeding, pregnancy, or giving birth. This can include expenses related to cesarean sections, complications during pregnancy, or any issues that arise during the breeding process.

Choosing The Right Pet Insurance

Pet insurance can cover a range of vet bills, including accidents, illnesses, and preventive care. The right pet insurance can help alleviate the financial burden of unexpected vet expenses, giving pet owners peace of mind. It’s important to carefully compare pet insurance policies to find the right coverage for your pet’s needs.

Researching Different Providers

When it comes to choosing the right pet insurance, one of the first steps is researching different providers. Just like with any insurance, you want to make sure you are getting the best coverage and the most bang for your buck when it comes to vet bills. Take the time to gather information about different providers in your area or even nationwide. Look for providers that are well-established, have good customer reviews, and offer comprehensive coverage for a variety of treatments and conditions.

Comparing Coverage And Costs

Once you have narrowed down your options to a few reputable pet insurance providers, the next step is to compare their coverage and costs. This means looking at what each policy covers, including routine check-ups, emergency visits, surgeries, and medications. It’s also important to consider any limitations or exclusions that may be present in the policy. Additionally, you’ll want to compare the costs of each policy, including the monthly premium, deductible, and co-payments. Keep in mind that the cheapest policy may not always provide the best coverage for your pet’s specific needs.

Reading The Fine Print

Before you commit to a pet insurance policy, it’s crucial to read the fine print and understand all the details. This includes carefully reviewing the policy’s terms and conditions, exclusions, waiting periods, and cancellation policies. Pay close attention to any pre-existing conditions that may not be covered under the policy, as this could impact your ability to claim benefits in the future. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider for clarification.

Factors Affecting Pet Insurance Cost

Pet insurance can help cover vet bills, but various factors influence its cost.

Pet’s Age And Breed

The age and breed of your pet can impact insurance cost due to varying health risks.

Location

Your location may affect pet insurance rates, as vet costs differ regionally.

Deductibles And Premiums

The deductible and premium you choose influence the overall cost of pet insurance.

Is Pet Insurance Worth It?

Taking care of your pet’s health should be a top priority. Regular vet visits can help catch issues early. Pet insurance can assist in covering unexpected medical costs. Peace of mind knowing your pet is protected.

Evaluate your financial readiness to handle potential vet bills. Unforeseen emergencies can arise at any time. Pet insurance could provide financial relief in these situations. Protect your finances from unexpected expenses.

Frequently Asked Questions Of Can Pet Insurance Cover Vet Bills

What Is Pet Insurance And How Does It Work?

Pet insurance provides coverage for unexpected veterinary expenses, offering peace of mind to pet owners. Pet insurance helps cover the cost of treatments and surgeries, allowing pet owners to prioritize their pet’s health without financial strain.

What Does Pet Insurance Usually Cover?

Pet insurance typically covers veterinary expenses for accidents, illnesses, and injuries. Depending on the policy, it may also cover routine care, such as vaccinations and wellness exams. Understanding the coverage details is essential to select the most appropriate plan for your pet’s needs.

Are Pre-existing Conditions Covered By Pet Insurance?

Most pet insurance plans do not cover pre-existing conditions, which are ailments or illnesses that already exist before the policy’s start date. It’s important to carefully review the policy details to understand any exclusions and limitations related to pre-existing conditions.

How Can I Choose The Best Pet Insurance For My Pet’s Needs?

When selecting pet insurance, consider your pet’s breed, age, and any pre-existing conditions. Review the coverage options, annual limits, deductibles, and reimbursement percentages offered by different insurance providers to select a plan that best suits your pet’s unique healthcare needs.

Conclusion

Considering the rising costs of veterinarian bills, having pet insurance can be a lifesaver for both pets and their owners. By providing financial coverage for unexpected medical expenses, pet insurance ensures that pets receive the necessary healthcare without putting a strain on the owner’s finances.

With the right pet insurance plan, pet owners can have peace of mind knowing that their furry companions will receive the care they need when they need it. So, don’t wait any longer, explore your options and find the best pet insurance plan for your beloved four-legged friend.

Leave a comment