Insurance coverage for Xiidra varies depending on the individual’s plan and provider. It may be covered under some insurance plans, while others may require out-of-pocket expenses.

Xiidra is a prescription eye drop used to treat dry eye disease, and some insurance plans may cover part or all of the cost. It’s recommended to check with your insurance provider to determine your specific coverage for Xiidra. Dry eye disease is a common condition that affects many individuals, causing discomfort and irritation in the eyes.

Xiidra can be an effective treatment for managing symptoms and improving overall eye health. Understanding your insurance coverage for Xiidra can help you manage your healthcare costs and ensure access to necessary treatment.

What Is Xiidra?

Xiidra is a prescription eye drop that helps relieve dry eye symptoms. Most insurance plans cover Xiidra, but coverage can vary. Contact your insurance provider for specific details on Xiidra coverage under your plan.

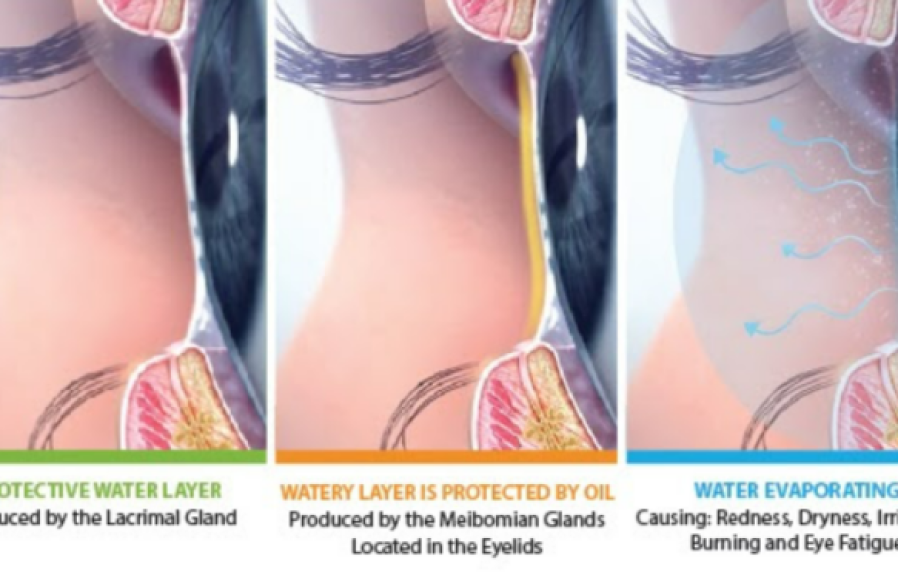

What is Xiidra? Xiidra is a prescription eye drop used to treat dry eye disease by reducing inflammation. It works by blocking certain enzymes involved in the body’s inflammatory response, helping to decrease symptoms like dryness, irritation, and discomfort in the eyes. Overview Xiidra is an FDA-approved medication for managing dry eye symptoms through its anti-inflammatory properties. How does it work? Xiidra’s active ingredient targets enzymes related to inflammation in the eyes.

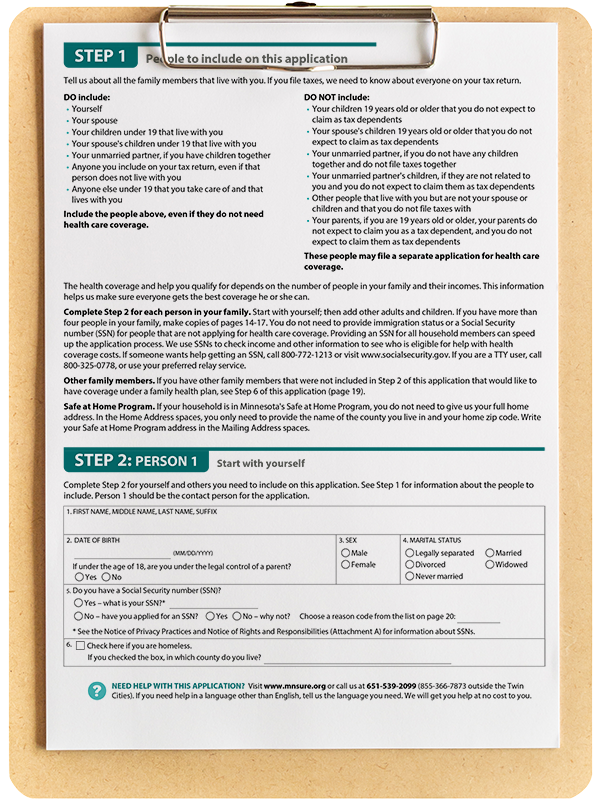

Credit: mn.gov

Understanding Insurance Coverage

Types Of Insurance Plans

The types of insurance plans vary, including health maintenance organizations (HMOs), preferred provider organizations (PPOs), and Medicare.

Does Insurance Cover Xiidra?

Insurance coverage for Xiidra depends on the individual’s plan and the insurance company’s formulary.

Factors That Affect Coverage

- Prior authorization requirements

- Formulary tiers

- Co-payments or coinsurance

Navigating The Insurance Process

Navigate the insurance process regarding coverage for Xiidra. Understand how your insurance plan may or may not provide assistance for this medication. Consult with your provider for clarity on insurance coverage specifics for Xiidra.

Insurance coverage can often be a complicated and confusing process. When it comes to finding out whether or not your insurance covers Xiidra, it’s important to understand the steps involved. This section will guide you through the necessary actions you need to take, from checking your insurance policy to understanding prior authorization. Let’s get started!Checking Your Insurance Policy

The first step in determining if your insurance covers Xiidra is to review your insurance policy. You can find this document by logging into your insurance provider’s website or contacting them directly. Look for information related to prescription medications and eye care. Specifically, search for any terms relating to dry eye treatment or ophthalmic solutions. This will give you an idea of whether or not the cost of Xiidra may be covered under your current plan.Contacting Your Insurance Provider

Once you have reviewed your insurance policy and are still uncertain about Xiidra coverage, it’s essential to reach out to your insurance provider for clarification. Contact their customer service department via phone or email and inquire about the specifics of your plan. Ask about any potential copays, deductibles, or requirements for prior authorization. By directly communicating with your insurance provider, you can get accurate and up-to-date information regarding your coverage.Understanding Prior Authorization

Prior authorization is a common requirement for certain prescription medications. It is a process where your healthcare provider must seek approval from your insurance company before you can receive coverage for a specific medication like Xiidra. Once you have confirmed that your insurance covers Xiidra, consult with your eye doctor. They will guide you through the prior authorization process, which usually involves submitting relevant medical information and documentation. Ensure that all necessary paperwork is complete so that your insurance company can process your request efficiently. By familiarizing yourself with these three steps – checking your insurance policy, contacting your insurance provider, and understanding prior authorization – you’ll be better equipped to navigate the insurance process and determine whether or not your insurance covers Xiidra. Remember, always stay proactive and informed when it comes to your insurance coverage.

Credit: mn.gov

Alternative Options

Insurance coverage for Xiidra may vary, but there are alternative options for obtaining medication assistance. Patients can explore copay cards, patient assistance programs, and other savings offers provided by the manufacturer to help alleviate the cost of Xiidra.

Alternative Options for Xiidra Coverage When it comes to considering other options for treating dry eye, there are several alternatives to Xiidra that may be covered by insurance or available over-the-counter. Explore the following alternatives as potential options for managing dry eye symptoms. Other Prescription Eye Drops Prescription eye drops can offer relief for dry eye symptoms similar to Xiidra, and some options may be covered by insurance. Some other prescription eye drops include: 1. Restasis: A common prescription eye drop that works to increase the eye’s natural ability to produce tears, reducing dryness and irritation. 2. Cequa: A prescription eye drop designed to decrease inflammation and increase tear production in the eyes. Over-the-Counter Alternatives While prescription medications are effective, over-the-counter alternatives can also provide relief for dry eye symptoms. These options can be convenient and accessible for those seeking relief. Some over-the-counter alternatives for dry eye relief include: – Artificial Tears: Non-prescription eye drops that can help lubricate and moisturize the eyes, providing relief from dryness and irritation. – Eye Ointments: Over-the-counter eye ointments can offer longer-lasting relief for dry eye symptoms, especially during sleep. Considering these alternative options for managing dry eye symptoms can provide individuals with potential alternatives to Xiidra, whether through insurance coverage or accessible over-the-counter products.Affording Xiidra Without Insurance

Patients without insurance may find it challenging to afford Xiidra, a prescription medication for dry eye disease. However, there are options available to help alleviate the financial burden. Below are some ways to access Xiidra without insurance.

Patient Assistance Programs

Patient assistance programs, often offered by pharmaceutical companies, can provide financial assistance to eligible individuals who cannot afford their medications. These programs may offer Xiidra at a reduced cost or even for free. Eligibility criteria and application processes vary, so patients should directly contact the manufacturer of Xiidra to inquire about available assistance programs.

Manufacturer Coupons And Discounts

Many drug manufacturers offer coupons, rebates, or discount programs to help patients save on their prescriptions, including Xiidra. Patients can check the official website of Xiidra or contact the manufacturer directly to inquire about any available discounts or coupons. Additionally, some pharmacies may also offer their own discount programs for individuals purchasing medications without insurance.

Credit: crstoday.com

Tips For Maximizing Insurance Coverage

Maximize your insurance coverage with these valuable tips. Discover if your insurance covers Xiidra and ensure you are getting the most out of your policy.

If you are considering using Xiidra for the treatment of your dry eye symptoms, you may be wondering if insurance will cover the cost. While coverage varies depending on your specific insurance plan, there are several tips you can follow to maximize your chances of insurance coverage.

Keeping Detailed Medical Records

One important step in maximizing your insurance coverage for Xiidra is keeping detailed medical records. This includes documenting your dry eye symptoms, any previous treatments you have tried, and any other relevant medical information. By having organized and thorough records, you can provide your insurance company with the necessary documentation to support your need for Xiidra.

Choosing An In-network Eye Doctor

Another crucial factor in maximizing your insurance coverage is selecting an eye doctor who is in-network with your insurance provider. In-network doctors have agreed to provide services at negotiated rates, which can significantly reduce your out-of-pocket costs. Before scheduling an appointment, it is important to check with your insurance company to ensure that your chosen eye doctor is in-network.

Frequently Asked Questions Of Does Insurance Cover Xiidra

What Is Xiidra And How Does It Work?

Xiidra is a prescription eye drop used to treat the signs and symptoms of dry eye disease. It works by blocking certain inflammation-causing substances in the eye to help reduce dryness and discomfort.

Does Insurance Cover The Cost Of Xiidra?

Insurance coverage for Xiidra varies depending on your specific plan and provider. Some insurance plans may cover Xiidra, while others may require prior authorization or have specific criteria for coverage. It’s best to check with your insurance provider for details on coverage.

What Are The Potential Side Effects Of Using Xiidra?

Common side effects of using Xiidra may include eye irritation, discomfort, and blurred vision. It’s important to discuss any concerns about potential side effects with your healthcare provider before starting treatment with Xiidra.

Conclusion

The availability of insurance coverage for Xiidra will depend on various factors such as your insurance plan and specific medical conditions. It is essential to consult with your insurance provider and healthcare professional for accurate and up-to-date information. Understanding the coverage options and potential out-of-pocket expenses can help you make informed decisions regarding Xiidra and the management of your eye condition.

Remember, every individual’s situation may differ, so it’s important to explore all options available to you.

Leave a comment