Landlord insurance typically does cover rent loss in the event of a covered peril, such as fire or natural disaster. As a landlord, protecting your investment is crucial, and one unforeseen event can lead to significant financial loss.

While landlord insurance provides coverage for property damage and liability, it may also include provisions for rent loss. If your rental property becomes uninhabitable due to a covered peril, such as a fire or storm damage, landlord insurance can reimburse you for the lost rental income during the time it takes to make necessary repairs.

However, it’s essential to review your policy carefully to understand the specific coverage limits and exclusions. By having landlord insurance in place, you can have peace of mind knowing that rent loss is covered should an unfortunate event occur.

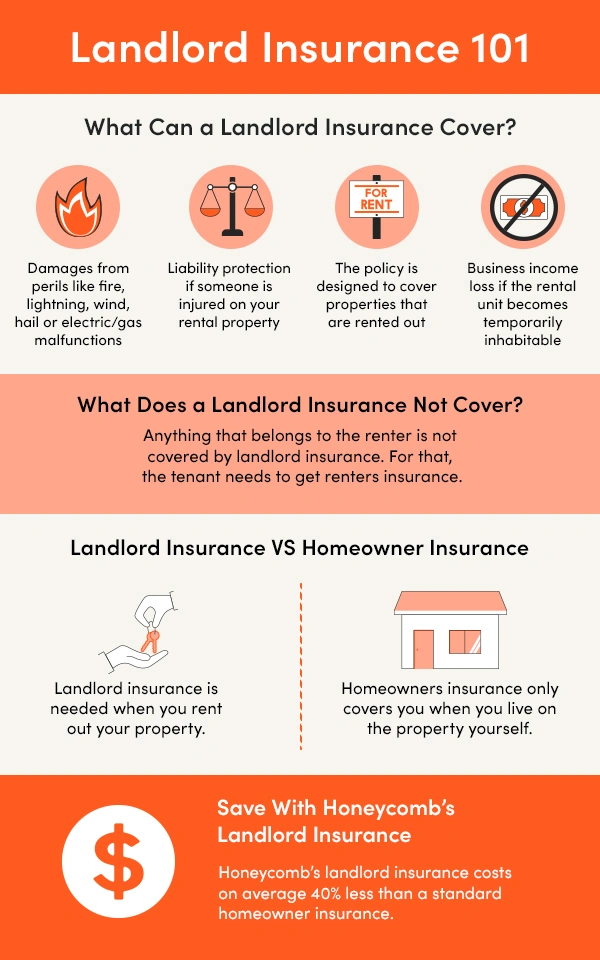

Importance Of Landlord Insurance

Landlord insurance is essential for property owners to safeguard their investment and mitigate risks. It provides protection against various liabilities and unforeseen circumstances that may arise.

Protection For Property Damage

Landlord insurance covers damage to your rental property caused by unforeseen events such as natural disasters or tenant negligence.

Liability Coverage

Liability coverage included in landlord insurance protects you from legal and medical expenses in case someone is injured on your rental property.

Understanding Rent Loss Coverage

When it comes to protecting your investment property, landlord insurance plays a vital role. It provides coverage for various risks and damages that may occur on your property. Among the coverage options offered by landlord insurance, rent loss coverage is an essential component. This coverage is designed to protect landlords from financial loss due to the inability of tenants to pay rent.

Definition And Scope

Rent loss coverage, also known as rental income coverage or rental property insurance, is a provision included in landlord insurance policies to protect property owners from financial loss as a result of rental income interruption. This coverage typically kicks in when a covered loss occurs, such as fire, vandalism, or natural disasters, leading to a tenant’s inability to pay the rent.

The scope of rent loss coverage extends beyond scenarios where the property is no longer habitable. It also covers instances where tenants fail to pay rent due to job loss, bankruptcy, or eviction. Whether the property is temporarily uninhabitable or the tenant is simply unable to pay, rent loss coverage can provide landlords with financial compensation to compensate for the lost income.

Exclusions And Limitations

As with any insurance policy, rent loss coverage also has its exclusions and limitations. It’s essential to review these details in your specific policy to understand the extent of coverage and any potential gaps. Some common exclusions that may apply include loss caused by tenant negligence, intentional acts, or voluntary vacancies.

Additionally, there are limits to the coverage provided for rent loss, which can vary depending on the policy and insurer. It’s crucial to check the policy documentation to determine the maximum amount of compensation available and any applicable deductibles.

While rent loss coverage can be invaluable for landlords, it’s important to note that it does not typically cover loss of rental income due to a tenant breaking the lease voluntarily or defaulting on rental payments. These scenarios may require separate legal actions to recover the owed rent.

| Key Takeaways: |

|---|

| Rent loss coverage is a provision included in landlord insurance policies. |

| It provides financial protection against the interruption or loss of rental income. |

| Exclusions and limitations may apply, such as intentional tenant acts or voluntary vacancies. |

| It’s essential to review your policy’s terms and conditions to understand the coverage details and maximum compensation provided. |

By understanding the definition and scope of rent loss coverage, as well as its exclusions and limitations, landlords can make informed decisions about their insurance needs. Knowing the extent of their financial protection under their landlord insurance policy can give landlords peace of mind, knowing they are safeguarded against potential rent loss in unforeseen circumstances.

Factors Affecting Rent Loss Coverage

Landlord insurance may cover rent loss due to events like fires or natural disasters, but factors such as policy limitations, waiting periods, and deductible amounts can affect the coverage. It’s essential to review and understand the terms of the insurance policy to assess whether rent loss is covered.

Factors Affecting Rent Loss Coverage: With landlord insurance, it’s crucial to understand what it covers when it comes to rent loss. Several factors influence the coverage, including the types of perils covered and the duration of coverage. Let’s delve into each of these factors to gain a clear understanding of how they impact rent loss coverage. Types of Perils Covered: Landlord insurance typically covers specific perils that could lead to rent loss. These perils can include fire, theft, vandalism, water damage, and natural disasters. It’s important for landlords to review their policy to ensure it includes coverage for the most common perils that could affect their rental property. Duration of Coverage: The duration of rent loss coverage can vary among insurance providers. Some policies may offer coverage for a specific period during which the rental property is uninhabitable due to a covered peril. It’s crucial for landlords to understand the exact duration of coverage provided by their insurance policy to make informed decisions. To optimize your landlord insurance coverage for rent loss, it’s vital to be aware of these factors and choose a policy that aligns with your specific needs and priorities.

Credit: http://www.pinterest.com

Claim Process For Rent Loss

Notification Of Loss

When a landlord experiences a rent loss, it is crucial to notify the insurance provider immediately. Typically, landlords are required to report the loss within a specific timeframe to initiate the claim process. This step is vital to ensure a smooth and timely resolution.

Documentation Required

Regarding documentation, landlords should prepare and organize all relevant paperwork related to the rental property and the tenant. This may include lease agreements, rent payment records, communication with the tenant regarding the loss, and any other pertinent documents. Providing comprehensive and accurate documentation is essential for a successful claim.

Tips For Maximizing Rent Loss Coverage

One of the key concerns for landlords is the potential loss of rental income. Luckily, landlord insurance can provide coverage for rent loss in certain situations. However, it is important to understand the terms and conditions of your policy to ensure that you maximize your rent loss coverage.

Regular Inspections

Regular inspections play a crucial role in protecting your rental income. By conducting inspections at regular intervals, you can identify any potential issues that may cause rent loss. This proactive approach allows you to address problems promptly and minimize the impact on your cash flow. Additionally, regular inspections can help you detect any lease violations or unauthorized tenants, ensuring that you maintain a steady stream of rental income.

Thorough Tenant Screening

When it comes to maximizing rent loss coverage, thorough tenant screening is of utmost importance. By conducting a comprehensive background check on potential tenants, you reduce the risk of renting to individuals who may default on their rent payments. A thorough tenant screening process allows you to assess their financial stability, rental history, and creditworthiness. This ensures that you select reliable tenants who are likely to fulfill their rental obligations, minimizing the possibility of rent loss. Additionally, consider requesting references and contacting previous landlords to gain further insight into a prospective tenant’s behavior and payment track record.

Insurance Policy Review

In order to maximize your rent loss coverage, it is essential to carefully review your landlord insurance policy. Pay close attention to the terms and conditions regarding rent loss, including any coverage limits or exclusions. Understanding the specific circumstances under which your policy provides coverage for rent loss allows you to make informed decisions and take necessary precautions. If there are limitations to your coverage, consider discussing options with your insurance provider to increase your protection.

Emergency Fund

While landlord insurance can provide financial protection in case of rent loss, it is always wise to have an emergency fund as a backup. Setting aside a portion of your rental income each month can help you cover unexpected gaps in rent payments or any temporary loss of rental income. Having an emergency fund provides peace of mind, ensuring that you can continue to meet your financial obligations without unnecessary stress or delays.

Rental Market Analysis

To further safeguard your rental income, it is essential to stay informed about the rental market conditions in your area. Conducting regular rental market analysis allows you to adjust your rental rates to be in line with the prevailing market rates. This ensures that you are not underpricing your property, helping to minimize potential rent loss. Keeping an eye on market trends and adjusting your strategy accordingly can help you attract and retain reliable tenants, reducing the risk of any long-term rental income interruptions.

Communication And Documentation

Effective communication and proper documentation are key components of maximizing your rent loss coverage. Maintain open lines of communication with your tenants to address any concerns or issues promptly. Timely communication can help resolve problems before they escalate and possibly result in rent loss. Additionally, it is crucial to keep detailed records of all rental transactions, including rental payment receipts, lease agreements, and any correspondence with tenants. These documents serve as evidence and can be invaluable in the event of rent disputes or insurance claims related to rent loss.

Additional Coverage Options

Loss Of Rental Income Due To Natural Disasters

Landlord insurance may cover loss of rental income due to natural disasters like hurricanes or wildfires.

Rent Default Insurance

Rent default insurance can provide coverage if your tenant fails to pay their rent.

Cost-effective Ways To Secure Rental Income

Landlord insurance can protect against rent loss, providing a cost-effective way to secure rental income. With coverage for scenarios like tenant default or property damage, it offers peace of mind for property owners.

Comparing Insurance Policies

When assessing landlord insurance, comparing policies is crucial for effective coverage.

- Review Coverage: Assess policies to understand rent loss insurance inclusion.

- Compare Deductibles: Evaluate deductibles among insurance policies for cost estimates.

- Consider Premiums: Compare premium costs for affordability and coverage balance.

Risk Management Strategies

Implementing risk management strategies safeguards rental income stability.

- Renters Screening: Conduct thorough tenant screenings to minimize risks.

- Maintenance Protocols: Regular maintenance reduces property damage risks.

- Emergency Funds: Maintain an emergency fund for unexpected rent loss situations.

Credit: honeycombinsurance.com

Credit: http://www.azibo.com

Frequently Asked Questions On Does Landlord Insurance Cover Rent Loss

What Is Landlord Insurance And How Does It Work?

Landlord insurance is a policy that protects rental properties from financial loss due to damage, theft, or liability claims. It typically covers the physical structure of the rental property as well as loss of rental income if the property becomes uninhabitable.

Does Landlord Insurance Cover Rent Loss Due To Tenant Default?

Yes, if a tenant stops paying rent or suddenly vacates the property, landlord insurance can provide coverage for the lost rental income. This can help landlords mitigate financial losses during periods of vacancy or when dealing with problematic tenants.

Are There Any Exclusions To Rent Loss Coverage In Landlord Insurance?

Some landlord insurance policies may have exclusions for rent loss coverage, such as if the property was unoccupied for an extended period or if the loss of rent was due to a specific reason not covered by the policy. It’s important to review the policy details to understand any exclusions.

How Can A Landlord Maximize Rent Loss Coverage With Insurance?

Landlords can maximize rent loss coverage by selecting a comprehensive insurance policy that offers sufficient coverage limits and includes provisions for rent loss due to various scenarios, such as tenant default, property damage, or natural disasters. It’s crucial to carefully assess the policy options available.

Conclusion

Landlord insurance is an essential safeguard for property owners, offering protection against various risks. However, it’s important to note that standard landlord insurance doesn’t typically cover rent loss. To insure against such situations, landlords need to consider additional coverage such as rent guarantee insurance.

By understanding the specific terms and conditions of your policy, you can ensure comprehensive protection for your rental property. So, when it comes to protecting your investment and minimizing financial loss, it’s crucial to choose the right insurance coverage that includes rent loss protection.

Leave a comment