Liability insurance typically does not cover deer damage. It’s advisable to consider comprehensive insurance.

Deer damage is a common concern for property owners, especially in areas with high deer populations. While liability insurance won’t cover deer-related damages to your property, comprehensive insurance can provide coverage for such incidents. Understanding the nuances of insurance coverage can help you protect your property and finances in case of unexpected events.

We will explore the specifics of liability and comprehensive insurance, how they differ, and the importance of being adequately insured against deer damage. Stay informed to make informed decisions and safeguard your property effectively.

What Is Liability Insurance

Liability insurance provides coverage for damages caused to third parties by an individual or entity. This insurance is designed to protect policyholders from legal and financial liabilities resulting from accidents, injuries, or property damage that they are held responsible for.

Coverage For Third-party Damages

Liability insurance helps cover the costs associated with property damage or injuries caused to third parties. In the case of deer damage, liability insurance may cover the expenses incurred if a deer collides with a vehicle and causes damage or injury to another party.

Types Of Liability Insurance

There are different types of liability insurance policies available, each offering varying levels of coverage. Some common types include:

- General Liability Insurance: Covers basic liability risks for businesses or individuals.

- Auto Liability Insurance: Provides coverage for damages resulting from accidents involving vehicles.

| Liability Insurance Type | Coverage |

|---|---|

| General Liability | Covers basic liability risks for businesses or individuals |

| Auto Liability | Provides coverage for damages from vehicle accidents |

Understanding Deer Damage

Deer damage can pose significant challenges for property owners, and it’s essential to know what your liability insurance covers. Commonly caused by factors such as deer population growth and urban sprawl, understanding the nuances of deer damage can help protect your property and financial well-being.

Common Causes Of Deer Damage

- Habitat loss due to development

- Increase in deer population

- Habitat destruction from wildfires

- Change in food availability

Types Of Property Damage Caused By Deer

- Vehicle collisions leading to car damage

- Crop destruction in agricultural areas

- Garden and landscaping damage

- Fence and property structure destruction

Does Liability Insurance Cover Deer Damage

Liability insurance typically does not cover deer damage to your property. Comprehensive coverage in your auto insurance policy may help with deer-related vehicle damage. It’s essential to review your insurance policy details to understand your coverage for deer incidents.

Coverage For Property Damage

Liability insurance primarily covers bodily injury and property damage caused by the insured party to others. When it comes to deer damage, liability insurance generally does not cover damage caused by deer to your own property.

However, if a deer causes damage to someone else’s property, such as their garden, landscaping, or fences, your liability insurance may provide coverage. This coverage can help protect you financially from potential legal claims or lawsuits if the deer damage occurred on someone else’s property.

If you have liability insurance as part of your homeowners’ or renters’ insurance policy, it is advisable to review the terms and conditions with your insurance provider to understand the extent of coverage for property damage caused by deer.

Coverage For Vehicle Damage

Liability insurance coverage for deer-related vehicle damage can vary depending on the type of insurance policy you have. In general, liability insurance for vehicles covers damage to other people’s vehicles or property caused by your vehicle, but it typically does not cover damage to your own vehicle.

However, some auto insurance policies offer optional coverage for collisions with animals, including deer. This coverage, commonly known as comprehensive insurance, can help pay for repairs or replacement of your vehicle if it is damaged by a deer or other wildlife.

If you live in an area with a high risk of deer collisions, such as rural or wooded areas, it may be worth considering comprehensive insurance coverage for added protection against deer-related vehicle damage.

| Property damage coverage | Vehicle damage coverage |

|---|---|

| May cover damage caused by deer to someone else’s property. | May not cover damage to your own vehicle, but optional comprehensive insurance can provide coverage. |

It’s important to remember that insurance policies can vary, and the extent of coverage for deer damage may depend on the specific terms and conditions of your policy. To fully understand the coverage available to you, it is recommended to consult with your insurance provider and review your policy carefully.

Remember, if you have any doubts or questions about your coverage, it’s always best to reach out to your insurance provider for clarification so you can make informed decisions about what coverage options are most suitable for your needs.

Factors Affecting Coverage

When it comes to determining whether liability insurance covers deer damage, there are several key factors that come into play. Understanding these factors can help you ensure that you have the right coverage in place to protect yourself in case of deer-related incidents.

Specific Policy Language

Insurance policies may vary in their specific language regarding coverage for deer damage. It is essential to carefully review the terms and conditions of your liability insurance policy to determine whether it includes protection for damage caused by deer. Look for any explicit mention of wildlife or animal-related incidents in the policy wording.

Location And Geography

Geographical factors play a significant role in determining coverage for deer damage. Depending on your location, the likelihood of encounters with deer may vary. Areas with higher deer populations or where deer-related accidents are more common may have different insurance considerations compared to regions with lower risk.

Additional Coverage Options

In addition to standard liability insurance, there may be additional coverage options available to protect against deer damage. Some insurance providers offer specific endorsements or add-on policies that address the risks associated with deer-related incidents. These options can provide supplementary coverage beyond the basic liability insurance policy.

Steps To Take In Case Of Deer Damage

In the unfortunate event of a collision with a deer, dealing with the aftermath can be overwhelming. It’s important to understand the necessary steps to take in case of deer damage. From documenting the damages to contacting your insurance provider, following these steps can help ensure a smoother claims process.

Document Damages

After a collision with a deer, it’s crucial to document the damages to your vehicle. Start by taking photographs of the affected areas, capturing any dents, scratches, or other visible damage. Make a detailed note of the date, time, and location of the incident, along with any relevant details such as weather conditions and the speed at which the collision occurred. This documentation will be valuable when filing an insurance claim.

Contact Insurance Provider

Following a deer collision, it is essential to contact your insurance provider as soon as possible to report the incident. Provide them with the detailed documentation of the damages, including photographs and any other relevant information. Your insurance representative can guide you through the claims process and provide clarity on the coverage for deer damage under your liability insurance policy.

Credit: britlandautobody.com

Alternatives To Liability Insurance Coverage

While liability insurance covers damage caused by accidents involving your vehicle, it does not typically cover damage caused by deer collisions. However, there are alternative insurance options that can help protect you from the financial burden associated with deer damage. These options include:

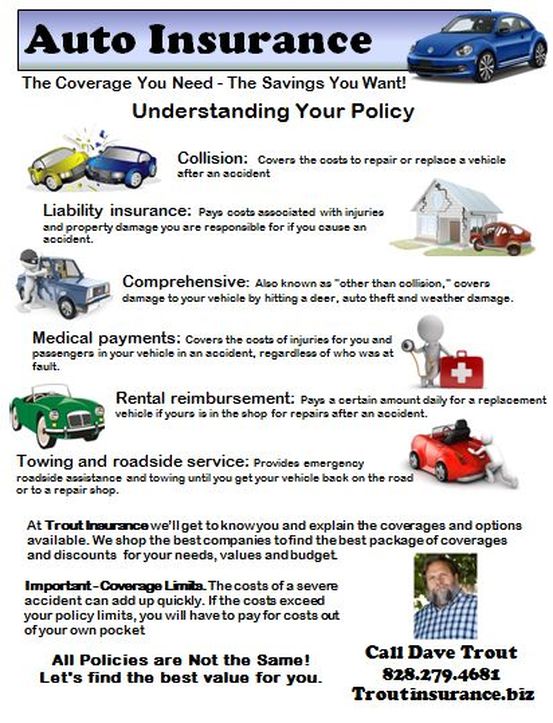

Comprehensive Insurance

If you want to safeguard yourself against deer damage, one option to consider is comprehensive insurance. This type of insurance coverage typically includes protection against damage caused by things other than accidents with other vehicles. Comprehensive insurance often covers damage caused by animal collisions, including deer accidents.

By adding comprehensive insurance to your policy, you can have peace of mind knowing that you are financially protected in the event of a deer-related incident. This coverage will help pay for the repairs needed if a deer jumps in front of your car and causes damage.

Collision Insurance

In addition to comprehensive insurance, collision insurance is another alternative to liability insurance coverage that can help you recover from deer damage. Collision insurance covers repairs to your vehicle when you collide with an object or another vehicle, including accidents involving deer.

Having collision insurance ensures that you have coverage for repairs resulting from deer collisions, eliminating the need to pay for these costly repairs out of your own pocket. This protection can be especially valuable when dealing with the unpredictable movements of deer on the road.

Deer Damage Add-on

Some insurance companies offer specific add-on coverage for deer damage. This add-on is designed to provide protection specifically for collisions with deer, reducing the financial impact of repair costs. It’s worth checking with your insurance provider to see if they offer this type of coverage.

The deer damage add-on can be an affordable and practical choice if you live in an area prone to deer accidents. It provides an additional layer of protection tailored to the specific risks associated with deer damage, giving you peace of mind during your daily commute.

When deciding which alternative is the right fit for you, consider the likelihood of encountering deer on the roads you frequent, as well as your budget and overall insurance needs. Discussing your options with an insurance professional can help you make an informed decision that best suits your circumstances.

Preventing Deer Damage

Deer can cause significant damage if they enter your property. Understanding how to keep them away is crucial in preventing such incidents.

Deer Deterrent Strategies

- Plant deer-resistant plants in your garden.

- Use motion-activated lights or sprinklers to scare deer away.

- Install fencing around vulnerable areas.

Securing Your Property

- Regularly trim vegetation and bushes to remove potential hiding spots.

- Secure garbage cans and eliminate food sources that may attract deer.

- Consider using odor-based deterrents like predator urine.

Credit: georgiatrialfirm.com

Credit: http://www.troutinsurance.com

Frequently Asked Questions On Does Liability Insurance Cover Deer Damage

Will Liability Insurance Cover Damage Caused By Deer?

Yes, liability insurance typically covers vehicle damage caused by hitting a deer. However, coverage may vary depending on the specific insurance policy, so it’s important to review your policy and consult with your insurance provider for detailed information.

How Can I Ensure Coverage For Deer Damage Under Liability Insurance?

To ensure coverage for deer damage under liability insurance, you should review your policy to confirm that it includes comprehensive coverage or specific provisions for collisions with animals. Additionally, consulting with your insurance provider and asking specific questions about deer-related damage coverage can provide clarity on this issue.

What Should I Do If My Vehicle Is Damaged By A Deer?

If your vehicle sustains damage from colliding with a deer, you should document the incident by taking photographs and obtaining evidence. Contact your insurance company to report the incident and initiate the claims process. Additionally, it’s important to seek prompt repair services to address any damages to your vehicle.

Conclusion

Liability insurance typically does not cover deer damage. While liability insurance is designed to protect against damages caused to others, including their property, it usually doesn’t include coverage for vehicle collisions with wildlife such as deer. To protect against deer damage, it is important to consider comprehensive auto insurance options that specifically cover such incidents.

Don’t forget to consult your insurance provider to get all the necessary details and ensure you have the right coverage for your specific needs. Stay informed and stay safe on the road.

Leave a comment