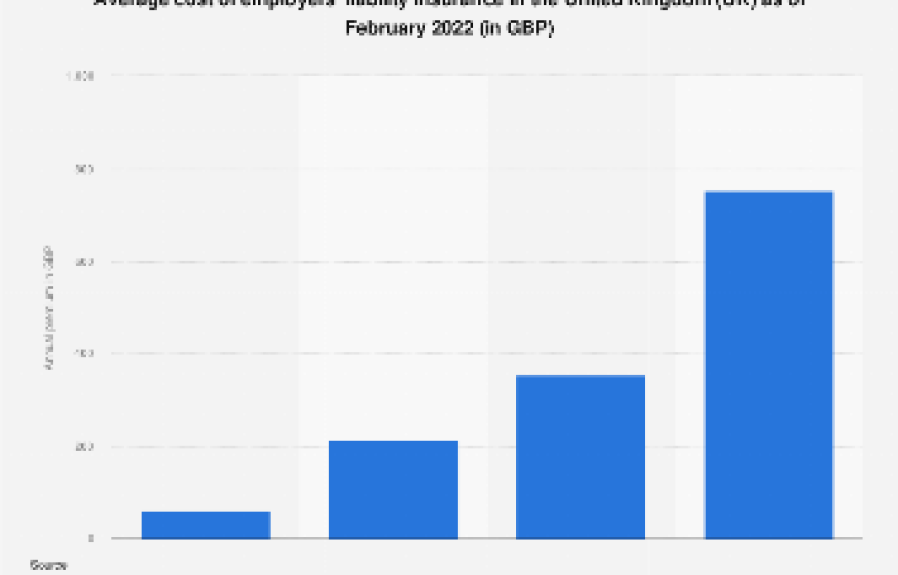

Employers liability insurance cost in the UK varies depending on the size of the business, number of employees, and level of coverage required. Factors such as industry risk and claims history also impact the cost.

Employers liability insurance is a crucial financial protection for businesses against claims from employees who suffer workplace injuries or become ill due to their work. In the UK, the cost of this insurance is determined by various factors, including the size of the business, the number of employees, and the level of coverage needed.

Additionally, industry risk and claims history can influence the premium. Understanding the costs associated with employers liability insurance is vital for businesses to ensure adequate protection for their employees and their financial security.

Credit: http://www.statista.com

Understanding Employers Liability Insurance

Employers Liability Insurance is crucial for businesses in the UK to protect themselves from financial and legal risks related to workplace injuries or illnesses. It provides coverage in case an employee sues the employer for negligence.

What Is Employers Liability Insurance?

Employers Liability Insurance is a type of insurance policy that is required by law for most businesses in the UK. It protects businesses from financial losses resulting from claims made by employees who have suffered work-related injuries or illnesses.

Importance Of Employers Liability Insurance

- Legal Compliance: Mandatory for most businesses in the UK.

- Financial Protection: Covers legal expenses and compensation payouts.

- Employee Welfare: Demonstrates care for employees’ well-being.

- Business Reputation: Enhances trust and credibility with employees.

Credit: http://www.forbes.com

Factors Affecting The Cost Of Employers Liability Insurance

The cost of employers’ liability insurance in the UK is influenced by various factors, including the size and scope of the business, the industry’s risk level, and the company’s claims history. Additionally, the number of employees and their work environment are crucial in determining the overall cost.

Number Of Employees

Having a larger workforce typically translates to a higher premium for Employers Liability Insurance due to increased risk.

Nature Of Business

The type of industry your business operates in can impact insurance costs. More hazardous industries can expect higher premiums.

Claims History

Past claims can influence the cost of insurance – having a history of claims may result in higher premiums.

Calculating The Cost Of Employers Liability Insurance

One important aspect to consider when obtaining Employers Liability Insurance is the cost. Understanding how the cost is calculated will help business owners make informed decisions about their insurance needs. Several factors influence the cost, including the premium rate, annual payroll, and risk assessment. Let’s look at each of these factors in detail:

Premium Rate

The premium rate is a key component in calculating the cost of Employers Liability Insurance. It is the percentage of the total employee payroll that businesses must pay as insurance premium. The premium rate varies depending on various factors, such as the industry type, location, and claims history. Businesses operating in high-risk industries, such as construction or manufacturing, may have a higher premium rate compared to low-risk industries. Insurers consider the likelihood of accidents or injuries occurring in different industries when determining the premium rate. Therefore, it is essential for employers to accurately classify their business activities to ensure the premium rate accurately reflects the risk profile of their industry.

Annual Payroll

The annual payroll is another crucial factor influencing the cost of Employers Liability Insurance. Insurers usually base the premium rate on the total payroll cost for the employees, including wages, salaries, bonuses, and other remunerations. The greater the annual payroll, the higher the insurance premium. It is important for employers to accurately estimate their annual payroll to ensure they secure the appropriate coverage. Incorrect payroll estimations may result in underinsurance or overinsurance, both of which have financial implications for businesses.

Risk Assessment

Risk assessment is a vital step in calculating the cost of Employers Liability Insurance. Insurers evaluate various risk factors associated with a business to determine the likelihood of accidents, injuries, or claims. Factors such as the nature of the business activities, workplace safety measures, and claims history are considered during the risk assessment. Businesses with a history of frequent accidents or claims may attract higher premium rates. Employers can lower the cost of insurance by implementing robust safety measures, providing adequate training to employees, and maintaining a favorable claims history. By actively managing and reducing risks within the workplace, businesses can potentially secure lower insurance premiums.

Comparing Quotes From Different Insurance Providers

When it comes to securing Employers Liability Insurance, comparing quotes from different insurance providers is essential to find the best coverage at the most competitive cost. Seek multiple quotes, review coverage options, and consider additional benefits to make an informed decision for your business.

Seeking Multiple Quotes

Begin by seeking quotes from several insurance providers to ensure you have a comprehensive view of the available options. Getting quotes from different insurers allows you to compare costs and coverage details, enabling you to make an educated decision regarding the best policy for your business.

Reviewing Coverage Options

Reviewing the coverage options provided by each insurance provider is crucial. Look for key coverage features such as the limit of indemnity, legal costs, and any additional benefits included. Ensure the coverage meets the specific needs of your business and provides adequate protection for your employees.

Considering Additional Benefits

Consider any additional benefits offered by insurance providers. These could include extended coverage for temporary employees, legal assistance services, or flexible payment options. Assessing and comparing these additional benefits can help you choose a policy that goes beyond basic coverage and provides added value for your business.

Ways To Reduce The Cost Of Employers Liability Insurance

Reducing the cost of employers liability insurance is essential for businesses to maintain financial stability while ensuring comprehensive coverage for their employees. By implementing strategies to minimize risk and enhance workplace safety, businesses can effectively lower the cost of their employers liability insurance in the UK. Let’s explore some valuable ways to achieve this:

Implementing Safety Measures

Establishing a safe working environment is crucial for reducing the risk of workplace injuries and claims. By implementing rigorous safety measures and adhering to industry regulations, businesses can significantly lower the likelihood of workplace accidents. This not only protects employees but also serves as a fundamental driver for reducing the cost of employers liability insurance.

Training Programs For Employees

Providing comprehensive training programs for employees equips them with the necessary knowledge and skills to maintain a safe work environment. Training on hazard identification, proper equipment usage, and emergency procedures can effectively minimize workplace incidents. By investing in regular employee training, businesses bolster their risk management efforts, ultimately leading to reduced insurance costs.

Reviewing Insurance Policies

Regularly reviewing insurance policies enables businesses to ensure that coverage is tailored to their specific needs and that they are not paying for unnecessary or redundant coverage. By collaborating with an experienced insurance agent, businesses can optimize their insurance policies, eliminating any superfluous coverage while identifying opportunities to reduce premiums.

Common Mistakes To Avoid When Buying Employers Liability Insurance

When it comes to protecting your business and employees, employers liability insurance is a critical investment. It provides financial coverage in the event of workplace accidents or employees filing claims for injury or illness. However, making mistakes when purchasing this insurance can leave you vulnerable to significant risks. In this article, we will look at some common mistakes you should avoid when buying employers liability insurance.

Underestimating The Amount Of Coverage Needed

Underestimating the amount of coverage needed can have serious consequences for your business. Many employers make the mistake of thinking that a lower coverage limit is sufficient to meet their needs. However, accidents can result in expensive legal fees, medical bills, and compensation claims. It is important to accurately assess your business risks and ensure you have sufficient coverage to protect yourself in worst-case scenarios.

Not Reviewing Policy Exclusions

Ignoring policy exclusions can lead to unexpected gaps in coverage. It is crucial to carefully review the terms and conditions of your employers liability insurance policy. Insurers often include exclusions for specific types of accidents, injuries, or claims. These exclusions may leave you exposed to financial liabilities that you assumed were covered. By understanding the exclusions, you can take necessary measures to address any gaps in coverage.

Failing To Update Policy

Failure to update your employers liability insurance policy can result in inadequate coverage. As your business grows and changes, so do your insurance needs. Expanding your workforce, introducing new machinery or equipment, or changing the nature of your operations may require adjustments to your coverage. Failing to update your policy accordingly can leave you underinsured or without coverage at all. Regularly reviewing and updating your policy ensures that you stay protected.

Legal Requirements For Employers Liability Insurance In The Uk

Employers in the UK are legally required to have Employers Liability Insurance, which covers the cost of compensation if an employee becomes injured or ill due to work. This insurance provides financial protection and is mandatory for most businesses.

Compulsory Insurance Limit

In the UK, employers are required to have Employers Liability Insurance with a minimum cover of £5 million.

Exceptions To The Requirement

Sole traders or businesses with no employees are exempt from the requirement of Employers Liability Insurance.

Importance Of Seeking Professional Advice

Leveraging professional guidance for Employers Liability Insurance UK cost can lead to sound decisions.

Consulting With Insurance Brokers

Brokers possess expertise in navigating insurance complexities, aiding in cost-effective solutions.

Understanding Policy Terms And Conditions

Clarifying policy terms ensures comprehensive coverage and eliminates potential misunderstandings.

Credit: http://www.nimblefins.co.uk

Frequently Asked Questions For Employers Liability Insurance Uk Cost

What Is Employers Liability Insurance?

Employers Liability Insurance provides protection for businesses in the event of a claim made by an employee.

Why Is Employers Liability Insurance Important In The Uk?

It is a legal requirement for most businesses with employees in the UK, providing essential financial protection.

How Is The Cost Of Employers Liability Insurance Calculated?

The cost is based on factors such as the nature of the business, number of employees, and insurance limits.

What Does Employers Liability Insurance Cover In The Uk?

It covers compensation costs and legal fees if an employee sues for illness or injury caused by work.

Conclusion

Employers liability insurance is essential for businesses in the UK to protect against legal claims and financial losses. By understanding the factors that determine the cost of this insurance, employers can make informed decisions and ensure their businesses are adequately covered.

As the cost may vary depending on various factors, it is advisable to seek expert advice and compare different insurance providers to find the best coverage at a competitive price. Safeguarding your business with employers liability insurance is a wise investment for long-term success and peace of mind.

Leave a comment