Disability insurance provides financial protection to individuals who are unable to work due to injury or illness. It replaces a portion of their income, ensuring they can cover their living expenses and maintain their standard of living.

Disability insurance is a crucial form of coverage that safeguards individuals in case they are unable to work due to a disabling condition. Whether the disability is the result of an accident or an illness, this insurance policy provides financial support to cover a portion of the individual’s lost income.

The aim of disability insurance is to help individuals maintain their lifestyle and meet their financial responsibilities during their time away from work. It offers peace of mind, ensuring that even if a person becomes disabled, they will still have a reliable source of income to rely on. Additionally, disability insurance can be customized to fit specific needs, offering various coverage options and benefits.

The Basics Of Disability Insurance

What Is Disability Insurance?

Disability insurance provides financial protection if you are unable to work due to an injury or illness.

Why Is Disability Insurance Important?

Disability insurance ensures you have income to cover expenses if you cannot work.

:max_bytes(150000):strip_icc()/4-types-of-insurance-everyone-needs.aspx-final-f954e12eb3074b178e4b53a882729526.jpg)

Credit: http://www.investopedia.com

Types Of Disability Insurance

Disability insurance is designed to provide financial protection in the event that you are unable to work due to a disability. There are two main types of disability insurance: Short-Term Disability Insurance and Long-Term Disability Insurance.

Short-term Disability Insurance

Short-Term Disability Insurance provides coverage for a limited period of time, typically up to six months. This type of insurance is ideal for individuals who are looking for temporary financial protection in the event of a short-term disability that prevents them from working.

Short-Term Disability Insurance policies generally have a waiting period before benefits kick in. During this waiting period, the policyholder is responsible for covering their own expenses. Once the waiting period is over, the insurance policy will provide a percentage of the policyholder’s income, typically ranging from 50% to 70%. This helps to alleviate the financial burden of being unable to work due to a disability.

Short-Term Disability Insurance is often offered as an employee benefit by employers or can be purchased individually. It can provide a vital safety net, ensuring that individuals are able to cover their living expenses and maintain their standard of living during a temporary disability.

Long-term Disability Insurance

Long-Term Disability Insurance, on the other hand, offers coverage for an extended period of time, typically until the age of retirement. This type of insurance is suitable for individuals who want long-term financial protection in the event of a severe disability that prevents them from working for an extended period.

Long-Term Disability Insurance policies also have a waiting period, but it is typically longer compared to short-term policies. Once the waiting period is over, the insurance policy will provide a percentage of the policyholder’s income, similar to short-term policies.

Long-Term Disability Insurance ensures that individuals and their families have financial stability in the face of a long-term disability. It provides a continued stream of income to cover living expenses, medical bills, and other financial obligations.

It is important to note that the coverage and details of disability insurance policies can vary significantly from one provider to another. Therefore, it is crucial to carefully review the terms and conditions of each policy before making a decision.

Key Features Of Disability Insurance

Coverage Options

Disability insurance provides coverage for individuals who are unable to work due to illness or injury. The coverage options typically include short-term and long-term disability insurance, offering financial support during the period of disability. Short-term disability insurance usually covers a shorter period, such as three to six months, while long-term disability insurance provides coverage for an extended period, often lasting for several years.

Benefit Limits

The benefit limits of disability insurance define the maximum amount a policyholder can receive during a disability period. The benefit amount is often expressed as a percentage of the individual’s regular income, with some policies providing up to 60% or more of the pre-disability earnings. It’s essential for individuals to carefully review the benefit limits when choosing a disability insurance policy to ensure sufficient coverage in the event of a disability.

Elimination Period

The elimination period, also known as the waiting period, refers to the duration an insured individual must wait after becoming disabled before receiving benefits. It acts as the waiting period between the onset of disability and the commencement of benefit payments. The elimination period can range from a few days to several months, and a shorter elimination period often results in higher premiums.

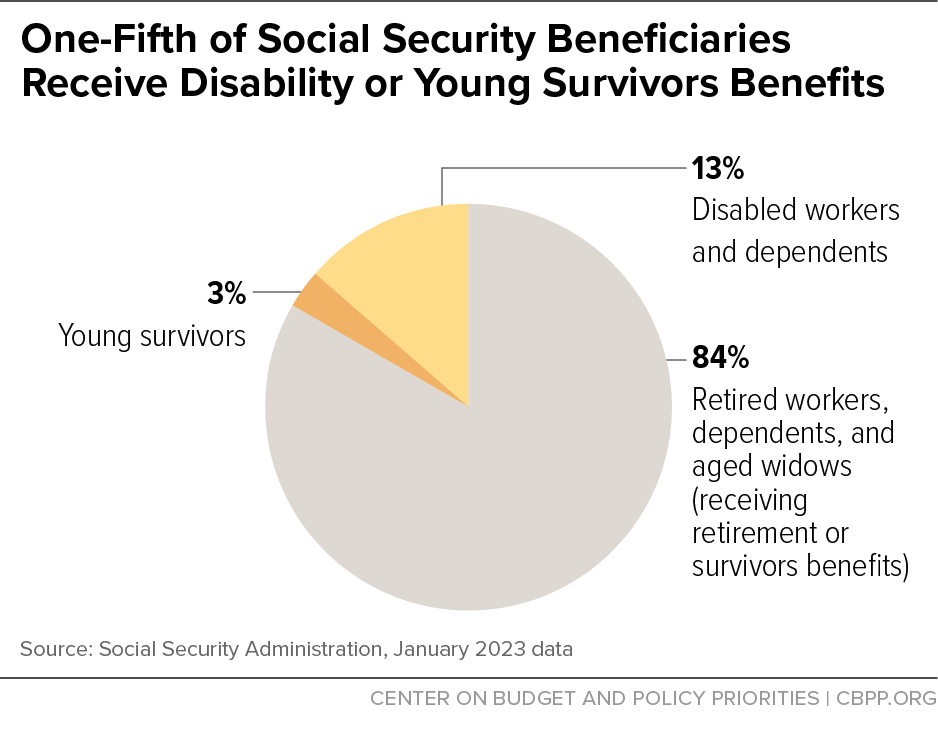

Credit: http://www.cbpp.org

Who Needs Disability Insurance?

Disability insurance is a crucial financial tool that provides income protection for individuals who are unable to work due to an illness or injury. This form of insurance is designed to offer financial stability and peace of mind by replacing a portion of the individual’s income if they become disabled and are unable to work. But who specifically should consider disability insurance? Let’s delve into the different categories of individuals who can greatly benefit from this type of coverage.

For Employees

Employees who rely on their income to support their livelihood should strongly consider disability insurance. It provides a safety net in the event they are unable to work due to a disability, ensuring they can continue to cover their living expenses and maintain their quality of life.

For Self-employed Individuals

Self-employed individuals must be especially proactive in securing disability insurance since they do not have the benefit of employer-provided coverage. Without this insurance, they may face financial insecurity if they are unable to work due to a disability. Therefore, disability insurance is critical for protecting their income and livelihood.

For Stay-at-home Parents

Even stay-at-home parents contribute significantly to the household and family dynamic. Disability insurance provides a layer of financial protection for them as well, ensuring they can still support their family if they are unable to perform their caretaking duties due to a disability.

Understanding The Claims Process

When it comes to disability insurance, understanding the claims process is vital. Should the unfortunate need arise for you to file a claim, it is essential to be aware of the steps involved in the process. This article examines the three key stages: filing a claim, evaluating the claim, and receiving benefits. By familiarizing yourself with these steps, you can navigate the claims process with confidence and ensure a smoother experience.

Filing A Claim

Filing a claim is the first step towards securing your disability benefits. To initiate the process, you will need to provide your insurance carrier with detailed information about your disability and its impact on your ability to work. This includes medical records, doctor’s notes, and any relevant documentation that supports your claim. Timeliness is crucial, so be sure to submit all required documents promptly and accurately. Remember to notify your employer about your intent to file a claim as well.

Evaluating The Claim

Once you have filed your claim, the insurance company will begin the process of evaluating it. This involves a thorough review of your medical records, treatment history, and any additional supporting documents. The insurer may also require you to undergo medical evaluations or assessments by their own appointed professionals. It is important to cooperate fully with the insurance company and provide any requested information to expedite the evaluation process. The insurer will assess your claim based on the policy’s definition of disability and determine if you meet the criteria for benefits.

Receiving Benefits

If your claim is approved, you will start receiving disability benefits according to the terms of your policy. These benefits are designed to provide financial support during your period of disability. It’s important to note that there may be a waiting period before benefits begin, typically ranging from a few weeks to several months. You will need to adhere to any ongoing reporting requirements specified by the insurance company, such as providing updates on your medical condition and employment status. If your claim is denied, you have the right to appeal the decision, and it is crucial to seek legal advice to understand your options.

Credit: http://www.ballstatedaily.com

Factors To Consider When Choosing Disability Insurance

When choosing disability insurance, several crucial factors need to be taken into consideration to ensure you select the most suitable coverage for your needs.

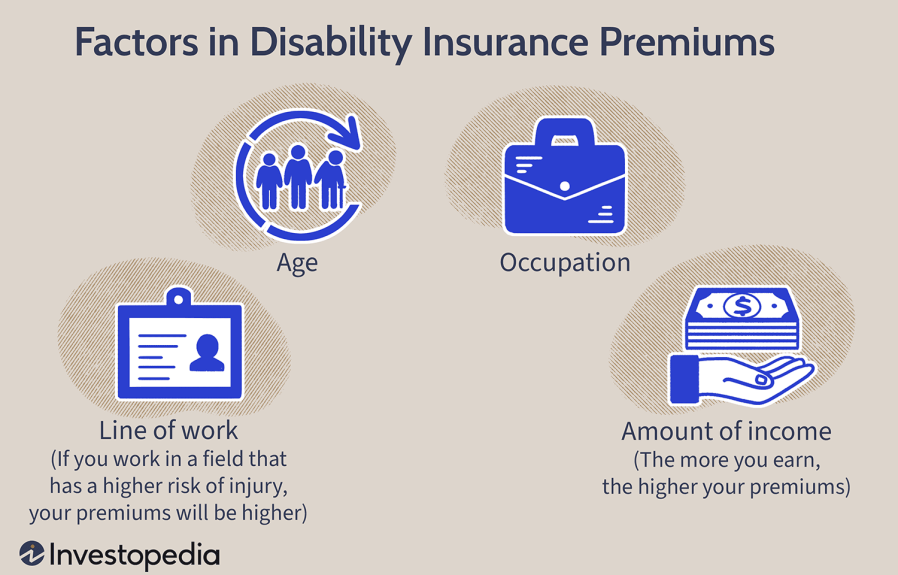

Premium Costs

- 1. Premiums directly impact your budget so pick wisely.

- 2. Compare costs among different insurance providers.

Coverage Details

- 1. Thoroughly review the coverage features provided.

- 2. Check for any limitations or exclusions in the policy.

Carrier Reputation

- 1. Research the reputation of the insurance company.

- 2. Look for customer reviews and ratings for insights.

Common Misconceptions About Disability Insurance

Common misconceptions about disability insurance can lead to misunderstandings about its purpose and coverage. It’s important to debunk these misconceptions to help individuals make informed decisions about protecting their financial security in the event of a disability.

Only For Severe Disabilities

Disability insurance is often associated with covering only severe disabilities. In reality, it can provide financial support for a wide range of disabilities, including temporary injuries or illnesses that prevent an individual from working. It’s not just limited to severe and permanent disabilities, but also extends to temporary conditions that may hinder the ability to earn a living.

Covered By Workers’ Compensation

Another common misconception is that disability insurance is redundant for those covered by workers’ compensation. However, disability insurance provides a broader scope of coverage, including off-the-job injuries and illnesses, whereas workers’ compensation typically only covers workplace-related incidents. Therefore, having disability insurance complements workers’ compensation by offering additional protection for various disabling conditions.

Conclusion: Securing Your Financial Future With Disability Insurance

Discover how Disability Insurance secures your financial future by providing protection in case of unexpected disability. Ensure peace of mind with this crucial safeguard for your income and assets. Prepare for life’s uncertainties with Disability Insurance.

Peace Of Mind

Disability insurance provides the peace of mind that comes with knowing you are financially protected in case of an unexpected event. This type of insurance ensures that you and your loved ones will be taken care of if you are unable to work due to a disability.

Imagine the relief of not having to worry about how you will pay your bills or support your family if you are unable to earn an income. Disability insurance offers you the peace of mind that comes with knowing you have a safety net in place.

Financial Stability

One of the most significant benefits of disability insurance is its ability to provide you with financial stability during difficult times. Whether you are temporarily or permanently disabled, this insurance ensures you will continue to receive a portion of your income, allowing you to maintain your standard of living.

With disability insurance, you can rest assured that you won’t have to drain your savings or rely on others for financial support. This stability allows you to focus on your recovery and regain your independence without the added stress of financial hardship.

In conclusion, disability insurance is a crucial tool for securing your financial future. It provides peace of mind by offering financial protection in case of disability, ensuring that you and your loved ones are taken care of. With disability insurance, you can maintain your financial stability and focus on your recovery without worrying about the financial burden. Don’t wait for the unexpected to happen – invest in disability insurance today and safeguard your financial future.

Frequently Asked Questions For How Would You Define Disability Insurance

What Is Disability Insurance?

Disability insurance provides financial protection if you become unable to work due to illness or injury. It offers a replacement income to help cover living expenses, medical bills, and other costs.

Who Needs Disability Insurance?

Anyone who relies on their income to meet financial obligations should consider disability insurance. Regardless of age or occupation, unforeseen circumstances can impact your ability to work, making this coverage essential for financial security.

How Does Disability Insurance Work?

If you’re unable to work due to a qualifying disability, the insurance provides a portion of your income. It ensures you can maintain your standard of living, covering expenses like mortgage, bills, and daily living costs until you’re able to return to work.

What Does Disability Insurance Cover?

Disability insurance typically covers a percentage of your pre-disability income. It helps with ongoing expenses such as mortgage, groceries, and other essential costs while you’re unable to work due to a disability.

Conclusion

Disability insurance is a vital safety net that provides financial protection when unexpected circumstances arise. By offering income replacement in the event of disability, this type of insurance allows individuals to maintain their standard of living and cover essential expenses.

With its invaluable benefits, disability insurance offers peace of mind and a sense of security for individuals and their families. Don’t underestimate the importance of this coverage; consider assessing your needs and exploring suitable options today.

Leave a comment