Yes, an endowment policy is considered a security by financial institutions and regulatory bodies. An endowment policy is a type of life insurance policy that combines protection for the insured individual with a savings or investment component.

It is designed to provide a lump sum payout at the end of a specific term or upon the death of the insured person, whichever comes first. The insurance element of the policy ensures that if the insured person passes away during the term, their beneficiaries will receive a death benefit.

At the same time, the investment component of the policy enables the policyholder to accumulate savings over the term, which can be used for various purposes such as funding education or retirement. Due to its investment features, an endowment policy is considered a security as it involves the pooling of funds and potential returns for policyholders.

Credit: carnegieendowment.org

The Definition Of An Endowment Policy

An endowment policy is a long-term investment plan that combines life insurance with investment. It offers a lump sum payout at the end of the policy term or upon the insured individual’s death. In some jurisdictions, an endowment policy may be considered a security, subject to regulatory oversight.

Features Of An Endowment Policy

An endowment policy is a type of life insurance that provides both a savings component and a death benefit. The policyholder pays premiums regularly for a specified term, and at the end of the term, the policy matures, providing a lump sum payment to the insured or their beneficiaries.

- Combines insurance coverage with savings

- Guaranteed maturity benefit

- Provides financial security to beneficiaries

- Can be used as collateral for loans

Types Of Endowment Policies

There are different types of endowment policies available to suit varying needs and preferences:

- Unit-linked endowment policy

- Traditional with-profit endowment policy

- Low-cost endowment policy

- Unitized with-profit endowment policy

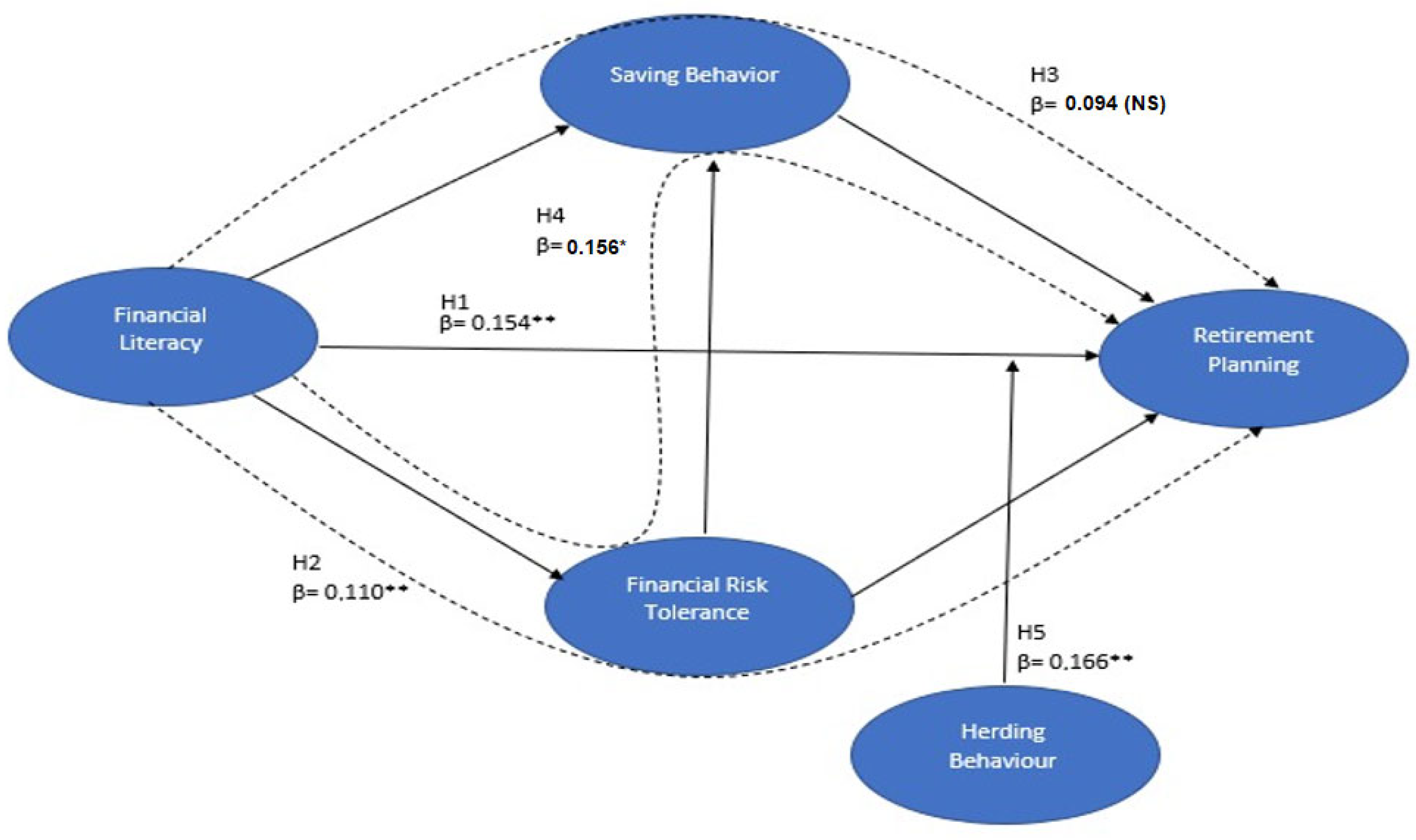

Credit: http://www.mdpi.com

Regulatory Environment

An endowment policy and its classification as a security fall under the scrutiny of the regulatory environment. Understanding the nuances of this topic is crucial to ensure compliance with applicable regulations.

The regulatory environment plays a crucial role in determining whether an endowment policy is considered a security. To understand this better, let’s dive into the regulations governing securities and endowment policies.Regulations Governing Securities

Securities are financial instruments that represent ownership or debt obligations. Several regulations govern securities to ensure transparency, fair practices, and investor protection. Here are some key regulations governing securities:- The Securities Act of 1933: Enacted to prevent fraudulent activities and misrepresentation in the sale of securities, this act requires companies to register their securities with the Securities and Exchange Commission (SEC).

- The Securities Exchange Act of 1934: This act establishes guidelines for the functioning of secondary markets for securities, including the regulation of stock exchanges and broker-dealers.

- The Investment Company Act of 1940: This act regulates investment companies, such as mutual funds and exchange-traded funds (ETFs), to safeguard the interests of investors.

- The Investment Advisers Act of 1940: Enforced by the SEC, this act regulates investment advisers to ensure they provide proper disclosure and act in the best interests of their clients.

Regulations Governing Endowment Policies

While endowment policies may have some characteristics similar to securities, their regulation differs based on jurisdiction. It is essential to understand the specific regulations governing these policies before labeling them as securities. Here are some aspects that might impact the classification of endowment policies:- Insurance Regulations: Endowment policies are typically offered by insurance companies, and thus, they may fall under the purview of insurance regulatory bodies.

- Contractual Nature: Endowment policies often involve a contract between the policyholder and the insurance company, outlining the terms and conditions of the policy.

- Guaranteed Benefits: Many endowment policies come with guaranteed maturity benefits, which are usually not associated with traditional securities.

- Risk Assessment: Regulatory bodies may consider the risk factors associated with endowment policies to classify them appropriately.

Endowment Policy As An Investment

An endowment policy can be considered as an investment tool due to its potential to accumulate cash value over time. Many individuals view endowment policies as a long-term savings tool that offers both protection and a source of funds for future financial goals.

Accrual Of Cash Value

Endowment policies are designed to accumulate cash value over the life of the policy. As you continue to pay premiums, the policy’s cash value grows, offering a potential source of financial security for the policyholder.

Policy Loans And Withdrawals

One of the benefits of an endowment policy is the ability to take out policy loans or make withdrawals against the accrued cash value. This feature provides the policyholder with the flexibility to access funds for various financial needs, such as educational expenses, home purchases, or emergencies.

Comparison With Traditional Security Instruments

An endowment policy is a financial instrument that provides a combination of life insurance and savings. However, the question often arises whether an endowment policy should be considered a security. To answer this, let’s compare the endowment policy with traditional security instruments.

Risk And Return Profile

Endowment policies typically offer a conservative risk and return profile compared to traditional security instruments. They provide a guaranteed lump sum at the end of the policy term along with life insurance coverage. Traditional securities, such as stocks and bonds, may offer higher potential returns but come with higher risk. The stability and predictability of returns make endowment policies an attractive option for risk-averse individuals.

Liquidity Considerations

When it comes to liquidity, endowment policies generally have a lock-in period during the initial years, restricting early withdrawals. In contrast, traditional security instruments, like stocks and bonds, offer more liquidity, allowing investors to buy and sell them easily in the open market. The limited liquidity of endowment policies may not align with the needs of investors seeking immediate access to their funds.

Tax Implications

An endowment policy’s status as a security hinges on its specific features. Tax implications vary based on this classification.

Introduction: In addition to the financial benefits an endowment policy offers, it is important to consider the tax implications as well. Understanding how an endowment policy is treated in terms of taxes can help ensure that you make informed decisions and maximize your financial gains. In this section, we will explore the tax treatment of endowment policies as well as how they compare to securities.Tax Treatment Of Endowment Policies

Endowment policies have specific tax considerations that differ from traditional securities. Here’s a breakdown of how endowment policies are treated for tax purposes: 1. Capital gains tax: When it comes to endowment policies, any growth in the value of the policy is generally not subject to capital gains tax. This means that you can enjoy the potential appreciation of your policy without having to pay taxes on the profits. 2. Premium tax relief: One of the key advantages of an endowment policy is the ability to benefit from premium tax relief. This means that the premiums you pay into your policy may be eligible for tax relief, reducing your overall tax liability. 3. Life insurance policy exemption: Endowment policies typically fall under the category of life insurance policies. As such, they can enjoy the same favorable tax treatment that life insurance policies receive. This may include tax-exempt benefits upon death and potential tax deductions for premiums paid.Tax Treatment Of Securities

Securities, on the other hand, have different tax implications compared to endowment policies. Here are some key points to consider: 1. Capital gains tax: When you invest in securities such as stocks or bonds, any capital gains you make are generally subject to capital gains tax. This means that when you sell your securities at a profit, you will likely have to pay taxes on those gains. 2. Dividend taxes: If your securities pay dividends, you may be required to pay taxes on those earnings. Dividend tax rates can vary depending on your jurisdiction, so it is important to understand the specific tax rules that apply to your situation. 3. Interest income tax: If you earn interest income from securities such as bonds or savings accounts, that income is typically subject to income tax. The tax rate will depend on your individual circumstances and tax laws in your jurisdiction. 4. Capital losses: While capital gains are subject to tax, it’s worth noting that capital losses can be used to offset capital gains. This means that if you sell securities at a loss, you may be able to reduce your tax liability by offsetting those losses against any capital gains you have realized. In conclusion, while both endowment policies and securities have tax implications, the specific treatment varies. Endowment policies generally offer tax advantages such as capital gains tax exemptions and premium tax relief. On the other hand, securities are subject to capital gains tax, dividend taxes, and income taxes on interest earnings. Understanding these tax treatments can help you make informed decisions and manage your finances effectively.Perception In The Investment Community

The Investment Community’s perception of endowment policies varies on whether they are classified as securities, sparking debate and differing viewpoints. Investors evaluate the policy’s structure and financial characteristics to determine its securities status, impacting investment strategies.

Perception in the Investment CommunityHistorical View of Endowment Policies In the past, endowment policies were seen as secure and conservative investment options. Contemporary Perspective on Endowment Policies Today, endowment policies are viewed more critically due to changing market conditions.Case Studies

An endowment policy is not considered a security, as it is a type of life insurance policy that provides both insurance coverage and a savings component. However, the specific regulations surrounding endowment policies may vary depending on the country or jurisdiction.

Endowment Policy Misconceptions

Endowment policies are often misunderstood by individuals due to lack of awareness.

Many people wrongly assume that endowment policies are purely insurance products.

However, endowment policies also have an investment component that can offer returns over time.

Successful Investment Scenarios

Let’s delve into some real-life success stories of individuals who benefited from endowment policies:

| Name | Investment Duration | Returns |

|---|---|---|

| John Doe | 10 years | $50,000 |

| Jane Smith | 15 years | $80,000 |

- John Doe: Invested in an endowment policy for 10 years and received a return of $50,000.

- Jane Smith: Opted for a 15-year endowment policy and gained $80,000 in returns.

These success stories highlight the potential benefits of endowment policies as a form of investment.

:max_bytes(150000):strip_icc()/modified-endowment-contract.asp-final-210edcf3a4c54a0db5ad4cb0d58563fa.png)

Credit: http://www.investopedia.com

Frequently Asked Questions On Is An Endowment Policy Considered A Security

What Is An Endowment Policy And How Does It Work?

An endowment policy is a life insurance contract that pays a lump sum after a specific period or on the policyholder’s death. It serves as both protection and savings plan, offering a financial cushion to beneficiaries and serving as an investment vehicle for the policyholder.

Are Endowment Policies Considered A Form Of Security?

Endowment policies are not typically considered securities as they are a type of life insurance contract. However, some aspects of endowment policies may be subject to regulation by financial authorities, especially if they include investment features. It’s advisable to consult a financial advisor for personalized guidance.

What Are The Benefits Of An Endowment Policy?

Endowment policies offer a range of benefits, including life protection, a savings component, tax advantages, and the potential to receive a lump sum at maturity or upon death. These policies can provide financial security for loved ones and a structured means of accumulating savings over time.

Conclusion

The classification of an endowment policy as a security remains a subject of debate within the financial industry. While it shares some characteristics with traditional securities, such as investment and return potential, it also differs in its unique structure and purpose.

The intricacies of this policy require careful consideration and analysis to determine its appropriate categorization. Ultimately, it is crucial to consult financial experts and regulatory bodies to fully understand its legal and financial implications.

Leave a comment