No, disability insurance is not deductible on Schedule C. Disability insurance is an important safeguard for individuals in case they are unable to work due to a disability. But when it comes to filing taxes, the question arises whether the premiums paid for disability insurance are deductible on Schedule C. However, disability insurance premiums are not deductible on Schedule C, as they are considered personal expenses rather than business expenses.

Schedule C is used to report income or loss from a business, and only expenses directly related to the operation of the business can be deducted. So, unfortunately, disability insurance premiums cannot be claimed as a deduction on Schedule C.

Credit: http://www.irs.gov

Tax Deductions

Disability insurance premiums may be tax-deductible for entrepreneurs who file taxes on Schedule C. These deductions can help reduce taxable income, potentially lowering tax liabilities. Entrepreneurs should consult with a tax professional to determine eligibility and ensure compliant deductions.

Tax Deductions Qualifying for Deductibility Limitations on Deductions Disability insurance premiums are deductible on Schedule C if the policy is taken out in the name of the business. To be eligible for this deduction, the taxpayer must be considered the owner of the business. This type of insurance is generally seen as an ordinary and necessary business expense. Thus, it can be deducted as such on Schedule C. This deduction can lower the total taxable income of the business, reducing overall tax liability. When it comes to the qualifications for deductibility, it is essential to ensure that the disability insurance policy is directly related to the business. This means that the policy must primarily benefit the business owner or employees. However, there are limitations on the deductibility of disability insurance premiums for Schedule C filers. The deduction cannot exceed the business’s net profit. It’s important to note that any excess premiums cannot be carried over to future years. Moreover, if the business owner is also covered by another disability insurance policy not connected to the business, the premiums for that policy would not be deductible on Schedule C. In summary, disability insurance is deductible on Schedule C if the policy is in the name of the business, benefiting the business owner or employees. However, limitations exist based on the business’s net profit and the direct relation of the policy to the business.Benefits Of Deducting Disability Insurance

As a self-employed individual, protecting yourself and your financial security is of utmost importance. One aspect of this protection is disability insurance, which can provide invaluable benefits in times of unexpected sickness or injury that result in an inability to work. However, what many self-employed individuals might not be aware of is the potential tax advantage that comes with deducting disability insurance premiums on Schedule C. In this article, we will discuss two key benefits of deducting disability insurance.

Reduction In Taxable Income

One of the significant advantages of deducting disability insurance premiums on Schedule C is the reduction in taxable income that it offers. By deducting these premiums, self-employed individuals can effectively lower their overall tax liability. This reduction in taxable income can make a considerable difference in tax savings, providing the opportunity to keep more of your hard-earned money. Additionally, the more you can deduct, the less taxable income you have, resulting in potential tax savings that can be reinvested back into your business or personal finances.

Protection For Self-employed Individuals

In addition to the tax benefits, deducting disability insurance premiums on Schedule C provides invaluable protection for self-employed individuals. As a business owner, if you become disabled due to illness or injury, you may face a sudden loss of income. Disability insurance ensures that you have a financial safety net during this challenging period, helping to cover your living expenses and any additional costs related to your disability. By deducting disability insurance premiums, you are not only protecting your income but also safeguarding your quality of life and enabling yourself to focus on recovery without the added stress of financial strain.

So, when it comes to disability insurance for self-employed individuals, the benefits of deducting premiums on Schedule C are clear. Not only does it provide a reduction in taxable income, but it also offers valuable protection against unexpected circumstances. By taking advantage of these deductions, you can secure your financial future while mitigating potential tax liabilities. Make sure to consult with a tax professional or expert to ensure that you fulfill all necessary requirements and maximize your deductions.

Irs Guidelines

When it comes to determining whether disability insurance is deductible on Schedule C, it is crucial to understand the guidelines provided by the Internal Revenue Service (IRS). By adhering to IRS regulations, self-employed individuals can ensure compliance with tax laws while documenting their disability insurance expenses.

Documentation Requirements

The IRS requires self-employed individuals to document their disability insurance expenses carefully. This documentation should include receipts, invoices, and any other relevant records to support the deduction of these expenses on Schedule C. Furthermore, maintaining detailed and accurate records can help in case of an IRS audit.

Compliance With Tax Regulations

Compliance with IRS regulations is essential when deducting disability insurance on Schedule C. Self-employed individuals must ensure that their insurance policies meet the criteria set forth by the IRS for deductibility. It’s also imperative to stay updated on any changes to tax laws and guidelines related to disability insurance deductions.

Claiming Disability Insurance Premiums

When it comes to running a business as a self-employed individual, it’s important to consider the financial protection provided by disability insurance. Many self-employed individuals wonder if disability insurance premiums are deductible on Schedule C. Understanding the filing requirements and reporting obligations for disability insurance premiums is crucial for maximizing tax benefits while ensuring adequate protection.

Filing Requirements

Self-employed individuals who pay for disability insurance premiums are eligible to claim these expenses as a business deduction. The Internal Revenue Service (IRS) allows self-employed individuals to deduct the cost of disability insurance as an adjustment to income, which is advantageous for reducing overall tax liability. To claim this deduction, you must be the owner and operator of a business, and the policy must be in your name or in the name of the business.

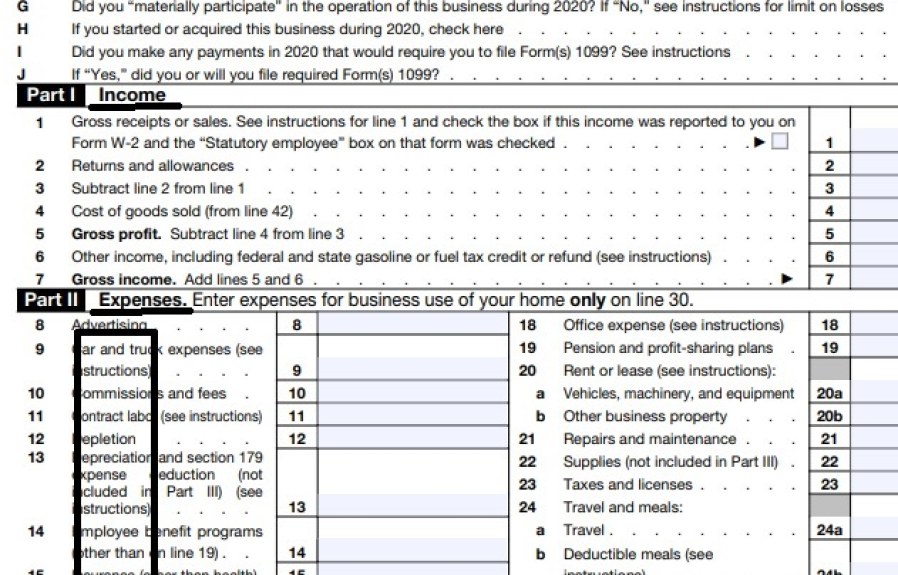

Reporting On Schedule C

When reporting disability insurance premiums on Schedule C, you’ll need to enter the total amount paid during the tax year under the “Insurance” section of the form. It’s important to carefully document and categorize these expenses to ensure accurate reporting. Keep in mind that only the portion of the premium that relates to the business is deductible, while any portion allocated for personal coverage is not eligible for the deduction.

Comparison With Other Insurance Deductions

Disability insurance deductions can be claimed on Schedule C, but it’s important to compare them with other insurance deductions for optimized tax planning. Understanding the differences and similarities can help business owners make informed decisions.

Contrast With Health Insurance

One particular area where disability insurance sets itself apart is in its treatment compared to health insurance. While health insurance premiums are generally deductible for self-employed individuals on Schedule C, disability insurance is not deductible in the same way.

Health insurance premiums can be deducted as an above-the-line expense, meaning they can be subtracted from your total income to arrive at your adjusted gross income (AGI). This reduces the amount of income subject to self-employment tax and potentially lowers your overall tax liability.

On the other hand, disability insurance premiums are not deducted as an above-the-line expense on Schedule C. Instead, they are typically treated as a personal expense and cannot be claimed as a business deduction.

Implications For Business Expenses

Although disability insurance premiums may not be deductible on Schedule C, it’s important to understand the potential impact on business expenses. While disability insurance premiums themselves may not be deductible, the benefits received from the policy could play a significant role in mitigating the financial impact of a disability on your business operations.

In the event of a disability that prevents you from working, disability insurance can provide income replacement to help cover ongoing business expenses, such as rent, utilities, and payroll. By maintaining disability insurance coverage, you can ensure that your business has the financial resources to continue operating even if you become disabled.

Additionally, certain expenses related to disability insurance might still be deductible as business expenses. For example, if you hire an attorney to review disability insurance policies or seek legal advice related to your coverage, these expenses may be deductible as professional fees or legal expenses on Schedule C.

Overall, while disability insurance premiums may not be deductible on Schedule C, it’s essential to consider the potential impact on your overall business expenses and the protection it provides for your business in the case of disability.

Credit: http://www.ramseysolutions.com

Common Mistakes To Avoid

Avoiding critical errors when dealing with the deductibility of disability insurance on Schedule C is imperative for freelancers and self-employed individuals. Misunderstandings and oversights can lead to costly consequences. Here are some common pitfalls to steer clear of:

Misinterpreting Deductibility Criteria

Incorrect understanding can lead to disability insurance costs not being deducted properly. Ensure to accurately assess the eligibility of premiums for deduction. Consult with a tax professional if you are uncertain.

Failure To Maintain Records

- Lack of proper documentation can result in auditors disallowing the deduction.

- Regularly maintain comprehensive records of all disability insurance expenses.

- Keep receipts and other related documents organized and easily accessible.

Future Trends And Considerations

Evolution Of Tax Laws

Changes in tax laws impact deductions available to business owners.

Impact Of Legislative Changes

New legislation can alter the deductibility regulations.

Credit: http://www.ramseysolutions.com

Frequently Asked Questions On Is Disability Insurance Deductible On Schedule C

What Is Disability Insurance Deductible?

Disability insurance premiums paid by the business owner are typically tax-deductible. When the business itself pays the premiums, they are tax-deductible as a business expense on Schedule C.

Who Can Deduct Disability Insurance On Schedule C?

Self-employed individuals, sole proprietors, and single-member LLCs can typically deduct the cost of disability insurance on Schedule C.

Are Disability Insurance Benefits Taxable On Schedule C?

If you pay the premiums, the benefits are income tax-free. However, if the premiums are paid by the employer, the benefits are taxable income.

When Should I Report Disability Insurance On Schedule C?

The premiums paid for disability insurance should be reported on Schedule C as a business expense.

Conclusion

To summarize, disability insurance can be deducted on Schedule C if you’re self-employed. It provides important financial protection in case an unexpected disability prevents you from working. By deducting disability insurance premiums, you can lower your taxable income and potentially save on taxes.

However, it’s essential to consult with a tax professional to ensure you meet all the eligibility requirements and properly report your deductions. Understanding the nuances of deductible expenses can help you make the most of your business finances.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is Disability Insurance Deductible?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Disability insurance premiums paid by the business owner are typically tax-deductible. When the business itself pays the premiums, they are tax-deductible as a business expense on Schedule C.” } } , { “@type”: “Question”, “name”: “Who Can Deduct Disability Insurance on Schedule C?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Self-employed individuals, sole proprietors, and single-member LLCs can typically deduct the cost of disability insurance on Schedule C.” } } , { “@type”: “Question”, “name”: “Are Disability Insurance Benefits Taxable on Schedule C?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If you pay the premiums, the benefits are income tax-free. However, if the premiums are paid by the employer, the benefits are taxable income.” } } , { “@type”: “Question”, “name”: “When Should I Report Disability Insurance on Schedule C?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The premiums paid for disability insurance should be reported on Schedule C as a business expense.” } } ] }

Leave a comment