Get a quick homeowners insurance quote in just a few moments by filling out a short form online. Finding the right homeowners insurance coverage is essential for protecting your investment in your home and belongings.

We will explore the benefits of getting a quick homeowners insurance quote and provide some tips for finding the best policy for your needs. Whether you are a first-time homeowner or looking to switch insurance providers, obtaining multiple quotes can help you compare rates and coverage options.

By using online quote tools, you can quickly gather information from multiple insurers and make an informed decision about your homeowners insurance.

Credit: http://www.bankrate.com

The Importance Of Homeowners Insurance

Homeowners insurance is crucial for safeguarding your property and possessions against unexpected events. Having the right coverage ensures you are protected financially from potential risks.

Protecting Your Home And Belongings

Homeowners insurance shields your property and personal items from damages such as fire, theft, or natural disasters.

Liability Coverage

Liability coverage protects you in case someone gets injured on your property, covering legal expenses and medical bills.

Benefits Of Quick Homeowners Insurance Quotes

Get quick homeowners insurance quotes for instant coverage at competitive rates, saving time and money. Easily compare multiple quotes online to find the best policy tailored to your home’s needs. Secure your property with a simple, efficient process that provides peace of mind.

Obtaining homeowners insurance for your precious abode is not just a smart move, but a necessity. Your home is your sanctuary, and protecting it from unforeseen events is of utmost importance. When it comes to securing the ideal coverage for your home, you need a quick homeowners insurance quote that saves both time and money. Let’s explore the benefits:

Time-saving

Time is of the essence, and a quick homeowners insurance quote is designed to respect that. With a swift and efficient process, you can receive multiple quotes from various insurance providers in minutes. This eliminates the need for tedious and time-consuming research, consultations, and back-and-forth negotiations. You can now devote your valuable time to what truly matters, like enhancing the comfort and security of your home.

Cost-effective

A quick homeowners insurance quote not only saves time but also puts money back in your pocket. By receiving instant quotes, you can compare the coverage and prices offered by different insurance companies. This empowers you to make an informed decision and select the policy that best fits your needs and budget. Additionally, instant quotes eliminate the need for intermediary agents, reducing the overall cost of obtaining homeowners insurance.

With quick homeowners insurance quotes, you can streamline the insurance shopping process, saving both time and money. Don’t let a lengthy and expensive endeavor stand between you and the security of your home. Embrace the convenience and benefits of instant quotes and safeguard your beloved sanctuary today!

What To Consider When Getting A Quick Quote

When you’re in the market for homeowners insurance, getting a quick quote can be a convenient first step. However, it’s important to take into account several key factors to ensure you’re adequately covered in the event of a claim. Here’s what to consider when aiming for a quick homeowners insurance quote.

Coverage Options

Before obtaining a homeowners insurance quote, it’s crucial to be aware of the different coverage options available. Typically, policies include coverage for the physical structure of your home, personal belongings, and liability protection. Be sure to understand the specifics of what each policy covers and determine the level of coverage that best fits your needs.

Policy Limits And Deductibles

When seeking a quick quote for homeowners insurance, pay attention to the policy limits and deductibles. Policy limits refer to the maximum amount an insurance company will pay for a covered loss, while deductibles represent the out-of-pocket expense you would be responsible for before the insurance coverage kicks in. Understanding these aspects will assist you in selecting the appropriate coverage levels and deductibles that align with your budget and risk tolerance.

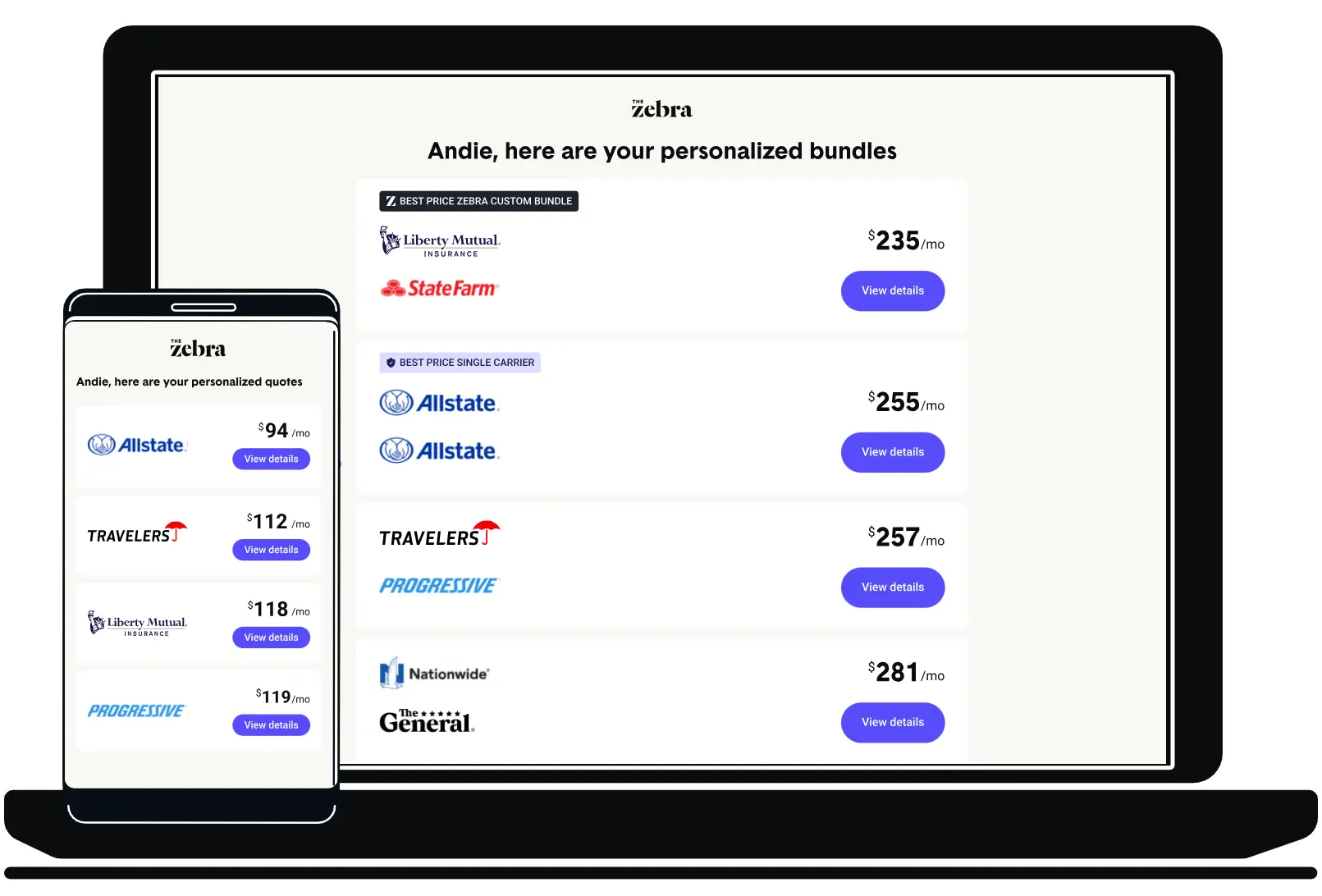

Credit: http://www.thezebra.com

How To Obtain A Quick Homeowners Insurance Quote

When it comes to protecting your home, having the right homeowners insurance is essential. But obtaining a quick homeowners insurance quote can be challenging. By following the right steps, you can easily secure the coverage you need without the hassle. Here’s how to obtain a quick homeowners insurance quote.

Online Insurance Providers

One of the fastest and most convenient ways to obtain a homeowners insurance quote is through online insurance providers. By using their websites or mobile apps, you can quickly input your information and receive an instant quote. This allows you to compare the rates of different insurers and select the best option that suits your needs.

Contacting Local Agents

If you prefer a more personal approach, contacting local insurance agents can also yield quick homeowners insurance quotes. They can provide you with custom quotes tailored to your specific requirements, and some may even offer discounts for bundling policies. Getting in touch with multiple agents can help you compare the quotes and make an informed decision.

Factors That Impact Homeowners Insurance Premiums

Factors impacting homeowners insurance premiums include location, home age, deductible amount, coverage limits, and credit score. These factors influence quick homeowners insurance quotes, affecting the overall cost and coverage options available to homeowners.

Several factors influence the cost of your homeowners insurance premium. Understanding these factors can help you make informed decisions and potentially save money. The two main factors that impact homeowners insurance premiums are Location and Regional Risks and Home Characteristics. Let’s take a closer look at each of these:

Location And Regional Risks

The location of your home plays a significant role in determining your insurance premium. Insurance companies take into account the local weather patterns and the probability of natural disasters that may affect your property. For example, if you reside in an area prone to hurricanes or earthquakes, your premium may be higher. Additionally, the crime rate in your area and the proximity to fire stations can also impact your insurance rates. Insurance providers consider these factors as they affect the likelihood of claims being filed.

Home Characteristics

The characteristics of your home also influence your insurance premium. Insurance companies consider factors such as the age of your home and the type of construction used. Older homes may have outdated electrical systems or plumbing, which can lead to a higher risk of damage and a potentially higher premium. The size and square footage of your home are also taken into account, as larger homes typically require more materials and labor to repair or rebuild.

Table:

| Factors | Impact on Premiums |

|---|---|

| Location | Higher risk areas may result in higher premiums |

| Age of Home | Older homes may have higher premiums due to outdated systems |

| Type of Construction | The construction of your home can impact premiums |

| Size and Square Footage | Larger homes may require higher premiums due to increased repair costs |

In addition to these factors, insurance companies also consider the condition of your roof, the presence of security systems in your home, and whether you have made any claims in the past. It’s important to note that while these factors may impact your insurance premium, they may also provide discounts or savings opportunities. To ensure you get the most accurate and competitive rates, it’s advisable to shop around and obtain multiple quotes from different insurance providers.

Comparing And Reviewing Multiple Quotes

Before making a decision, grasp the key terms in each quote for better comprehension.

Take note of coverage details, deductibles, and policy limits.

Look for potential savings in each quote by comparing premium rates and discounts offered.

Consider bundling homeowners and auto insurance for additional savings.

Tips For Getting The Best Homeowners Insurance Deal

When it comes to finding the best homeowners insurance deal, it’s essential to know how to maximize your savings while getting the coverage you need. Here are some effective tips to help you secure the best homeowners insurance deal:

Bundle Policies For Discounts

Bundling your homeowners insurance with other policies, such as auto or umbrella insurance, can often lead to significant discounts. Insurance companies frequently offer discounts for customers who purchase multiple policies from them, so be sure to inquire about bundling options when seeking homeowners insurance quotes.

Review And Update Your Coverage Regularly

Regularly reviewing and updating your homeowners insurance coverage is crucial to ensure that you have adequate protection for your home and belongings. As the value of your home and personal possessions may change over time, it’s important to adjust your coverage accordingly. Furthermore, you may find opportunities to save by eliminating unnecessary coverage or adjusting deductibles.

Taking Action: Securing Your Home And Finances

Secure your home and finances with a quick homeowners insurance quote. Take action now to protect what matters most to you. Invest in the peace of mind you deserve.

When it comes to protecting your home and finances, quick homeowners insurance quotes are an essential step in the right direction. However, obtaining a quote is just the first part of the process. Taking action and finalizing your policy is what truly safeguards your home and family’s financial future.

Finalizing Your Policy

Once you’ve received a quick homeowners insurance quote that suits your needs, it’s crucial to take the next step and finalize your policy. This involves carefully reviewing the terms and conditions to ensure they align with your expectations and requirements. It’s recommended to read through the policy document attentively, paying attention to the coverage limits, deductibles, and exclusions. If you have any questions or concerns, don’t hesitate to reach out to the insurance provider for clarification.

Once you have a clear understanding of the policy, it’s time to make the necessary arrangements. Contact your chosen insurer and provide them with the required information, such as your personal details, property address, and any additional details they may ask for. Be sure to provide accurate information to avoid any discrepancies or complications down the line.

As you move forward with finalizing your policy, it’s important to keep in mind that your homeowner’s insurance should adequately cover the value of your property and possessions. Consider factors such as the replacement cost of your home, the value of your personal belongings, and any additional coverage you may require, such as flood insurance or coverage for high-value items.

Emergency Preparedness

Securing your home also involves being prepared for unexpected emergencies. While homeowner’s insurance provides financial protection, it’s wise to take proactive steps to minimize risks to your property and personal safety. Emergency preparedness can go a long way in preventing or mitigating damage, should a disaster strike.

Here are a few key steps to ensure you and your home are adequately prepared:

- Create an emergency evacuation plan for your family. Identify escape routes, designate a meeting point, and ensure everyone understands the plan.

- Install smoke detectors and carbon monoxide detectors in appropriate areas of your home. Regularly test and replace batteries to ensure they are in working order.

- Secure valuable items and important documents in a fireproof safe or off-site storage. This provides an extra layer of protection in case of theft, fire, or natural disasters.

- Keep an emergency kit stocked with essentials such as non-perishable food, water, medications, flashlights, and a first aid kit. Be sure to periodically check and replace expired items.

- Regularly maintain your home, addressing any potential hazards or maintenance issues promptly. This includes cleaning gutters, trimming trees, and inspecting your roof for leaks.

By taking these steps, you not only protect your home but also enhance the safety and well-being of your family. Being prepared ensures that you can quickly and efficiently respond to emergencies, minimizing potential damage and financial loss.

Credit: m.facebook.com

Frequently Asked Questions Of Quick Homeowners Insurance Quote

What Does Homeowners Insurance Cover?

Homeowners insurance typically covers damage to your home and personal belongings from covered perils such as fire, theft, and natural disasters. It also provides liability coverage if someone is injured on your property.

How Can I Get A Quick Homeowners Insurance Quote?

To get a quick homeowners insurance quote, you can contact insurance providers directly or use online comparison tools. Provide accurate information about your home and needs to receive the most accurate quote.

What Factors Affect My Homeowners Insurance Premium?

Several factors can impact your homeowners insurance premium, including the location of your home, its age and construction, the coverage limits you choose, and your claims history. Maintaining a good credit score can also positively influence your premium.

Conclusion

In just a few simple steps, you can get a quick and accurate homeowners insurance quote. By providing the necessary information about your property and coverage needs, you can easily compare quotes from multiple insurance providers. With this efficient process, you can ensure that you have the protection you need for your home, without spending unnecessary time and effort.

Start your search for the perfect homeowners insurance today!

Leave a comment