Group health insurance refers to a policy that provides coverage for a specific group of individuals, such as employees of a company or members of an organization, under a single master contract. This type of insurance offers benefits and medical coverage to multiple individuals within the group, typically at lower rates than individual health insurance plans.

It provides financial protection and access to healthcare services for members of the group, including doctor visits, hospitalization, prescription drugs, and preventive care. Group health insurance is often offered as an employee benefit by employers, helping to attract and retain talented employees while ensuring their healthcare needs are met.

Credit: bailyagency.com

Benefits Of Group Health Insurance

Benefits of Group Health Insurance:

Cost-effectiveness

Group health insurance offers cost-effective coverage for a group of people.

Comprehensive Coverage

Group health insurance provides comprehensive healthcare coverage for employees.

Employee Retention And Satisfaction

Group health insurance boosts employee retention and satisfaction levels.

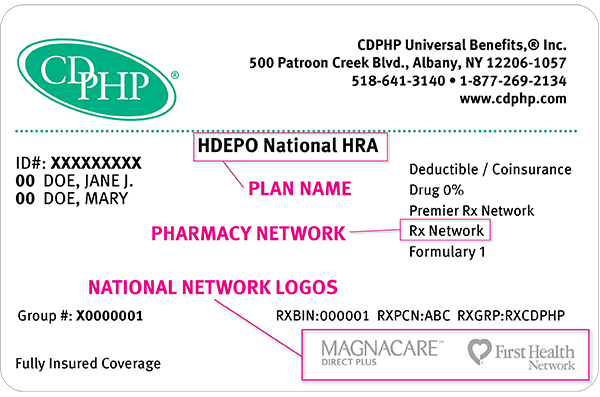

Credit: blog.cdphp.com

Types Of Group Health Insurance Plans

Group health insurance plans offer coverage to members within an organization. These plans typically provide comprehensive benefits at lower costs compared to individual health insurance policies. Types of group health insurance plans include HMO, PPO, and POS, catering to diverse needs and preferences.

Health Maintenance Organizations (hmos)

Health Maintenance Organizations, commonly known as HMOs, are a popular type of group health insurance plan. With an HMO, you have access to a network of healthcare providers, including doctors, specialists, and hospitals, who have contracted with the insurance company to provide healthcare services at reduced rates.

When you enroll in an HMO plan, you will typically choose a primary care physician (PCP) from within the network. Your PCP will act as your main point of contact for all of your healthcare needs. If you need to see a specialist, you will generally need a referral from your PCP.

HMOs offer comprehensive healthcare coverage and emphasize preventive care. They often require lower out-of-pocket costs compared to other types of group health insurance plans. However, one limitation of HMOs is that you are typically required to receive all of your healthcare services from providers within the network, except in case of emergencies.

Preferred Provider Organizations (ppos)

A Preferred Provider Organization, or PPO, is another popular option for group health insurance. These plans offer a greater level of flexibility when it comes to choosing healthcare providers. With a PPO, you have the freedom to see any provider you choose, whether they are in or out of the insurance company’s network.

If you receive care from a provider within the network, you will typically pay lower out-of-pocket costs, such as copayments and deductibles. However, even if you go out of network, the plan will still provide some coverage, although you may be responsible for a higher percentage of the costs.

PPO plans are well-suited for individuals who desire more choice and flexibility in their healthcare options. They offer greater access to specialists without the need for a referral, allowing you to seek care from the provider of your choice. However, it is important to note that PPO plans generally come with higher premiums compared to HMOs.

Point Of Service (pos) Plans

A Point of Service, or POS, plan is a hybrid type of group health insurance plan that combines elements of HMOs and PPOs. With a POS plan, you have the option to choose a primary care physician and receive coordinated care within the network, similar to an HMO. However, you also have the flexibility to go out of network and see providers without a referral, like a PPO.

POS plans typically require members to choose a primary care physician and get referrals for specialist visits within the network. If you decide to go out of network, you may be required to pay higher out-of-pocket costs. However, some POS plans offer out-of-network coverage, although at a reduced level compared to in-network services.

POS plans provide a balance between cost savings and provider choice. They are suitable for individuals who want the option to see specialists without referrals while still enjoying the advantages of coordinated care within a network. However, it’s important to carefully review your plan’s terms and restrictions before seeking care outside the network.

Advantages Of Group Health Insurance

Group health insurance provides various advantages for both employers and employees. Understanding the benefits of this type of insurance can help businesses make informed decisions when it comes to their employees’ healthcare coverage.

Lower Premiums

Group health insurance often comes with lower premiums compared to individual health plans. As the risk is spread across a larger group of people, the overall cost is reduced, making it more affordable for both employers and employees.

Enhanced Benefits

One of the key advantages of group health insurance is the enhanced benefits it offers. Employers can negotiate with insurance providers to offer a comprehensive package that includes medical, dental, and vision coverage. This comprehensive coverage provides employees with a wide range of benefits, leading to greater satisfaction and retention.

Continued Coverage

Group health insurance ensures continued coverage for employees even if they have pre-existing conditions. This can alleviate concerns about being denied coverage based on their medical history. Additionally, employees can maintain their coverage even if they leave their job, thanks to the option of continued coverage through COBRA or other continuation policies.

How Group Health Insurance Works

Group health insurance is a type of health insurance coverage that employers offer to their employees. It provides medical coverage to a group of individuals and can be more cost-effective and inclusive than individual health plans. Understanding how group health insurance works is essential for both employers and employees.

Employer Contribution

Employer contribution refers to the portion of the insurance premium that the employer pays on behalf of the employees. The employer’s financial support helps reduce the overall cost of the insurance for the employees. The percentage of the premium that the employer covers varies depending on the specific insurance plan and the employer’s policies.

Employee Enrollment

Employee enrollment is the process by which employees sign up for the group health insurance plan. Typically, there are specific enrollment periods during which employees can enroll in the plan or make changes to their coverage. It is crucial for employees to carefully review their options and understand the benefits and costs associated with each plan before making their selections.

In-network Providers

In-network providers are healthcare professionals, facilities, and hospitals that have an agreement with the insurance company to provide services at a discounted rate. When employees seek medical care from in-network providers, they can benefit from lower out-of-pocket costs. It’s important for employees to be aware of the network of providers covered by their insurance plan to maximize the benefits and minimize expenses.

Factors To Consider When Choosing A Group Health Insurance Plan

Understanding group health insurance is crucial for businesses. Factors to consider include coverage options, network availability, cost, and employee needs. Selecting the right plan ensures comprehensive healthcare benefits for all members.

Factors to Consider When Choosing a Group Health Insurance Plan Choosing the right group health insurance plan for your business is crucial. It not only provides financial security for your employees in case of medical emergencies but also contributes to their overall well-being. To make an informed decision, there are a few key factors to consider. Let’s delve into each one below. [h3]Costs and Premiums[/h3] The cost of a group health insurance plan is an important consideration for any business. As an employer, you need to weigh the affordability of the plan against the benefits it provides. To determine the cost, there are a few aspects to take into account: [b]1. Premiums [/b]- This refers to the monthly cost of the insurance plan per employee or per family. It’s important to evaluate whether the premiums fit within your business’s budget while still offering adequate coverage. [b]2. Deductibles[/b] – These are the out-of-pocket expenses employees need to pay before the insurance coverage kicks in. Opting for a higher deductible can help reduce the premium costs, but it may also burden your employees with higher initial expenses. [b]3. Copayments and Coinsurance[/b] – These represent the portion of medical costs shared by employees. Consider the percentage employees will have to pay for doctor visits, medications, and other healthcare services before selecting a plan. [h3]Coverage and Network[/h3] The coverage and network of a group health insurance plan are essential aspects to assess when making a selection. Here’s what you need to consider: [b]1. Medical Services Covered[/b] – Ensure that the insurance plan covers a wide range of medical services, including preventive care, outpatient visits, hospital stays, surgeries, and prescription medications. This ensures comprehensive coverage for your employees’ healthcare needs. [b]2. Provider Network[/b] – Take note of the network of doctors, hospitals, and healthcare facilities associated with the insurance plan. A broad network allows your employees to choose from a wide range of healthcare providers, ensuring convenience and accessibility. [h3]Additional Benefits[/h3] Apart from basic coverage, certain group health insurance plans offer additional benefits that can enhance your employees’ well-being. Here are a few additional benefits to consider: [b]1. Dental and Vision Coverage[/b] – Providing dental and vision coverage can be an appealing addition to your group health insurance plan. Regular dental check-ups and eye exams are essential for maintaining overall health, and having coverage for these services can contribute to your employees’ satisfaction. [b]2. Wellness Programs[/b] – Some insurance plans offer wellness programs that focus on promoting healthier lifestyles. These programs can include fitness initiatives, smoking cessation support, mental health resources, and more. Considering these additional benefits can help improve employee engagement and productivity. [b]3. Employee Assistance Programs[/b] – Employee assistance programs provide support for personal and work-related challenges. These programs often include counseling services, financial advice, and legal assistance. Having such benefits can reinforce your commitment to your employees’ well-being. In conclusion, choosing the right group health insurance plan involves careful evaluation of factors such as costs, coverage, and additional benefits. Assessing these aspects will ensure you make an informed decision that meets the healthcare needs of your employees while aligning with your business’s budget and goals. Take the time to research and compare different options to find the best plan for your organization.

Credit: http://www.calhealth.net

Comparing Group Health Insurance With Individual Health Plans

Group health insurance refers to a policy that covers a group of people, like employees of a company, providing them with health coverage and benefits. This type of insurance usually offers more affordable premiums and broader coverage compared to individual health plans.

Comparing Group Health Insurance with Individual Health PlansEconomic EfficiencyGroup SizeCustomization Options Group health insurance covers multiple individuals within a group. Individual health plans cover only one person at a time. Group health insurance offers more economic efficiency. Economic Efficiency Group health insurance tends to be more cost-effective than individual plans. Group health insurance spreads risk among a larger pool of individuals. Individual plans may have higher premiums due to limited risk distribution. Group Size Group health insurance is suited for businesses with multiple employees. Individual health plans are ideal for self-employed individuals or freelancers. Larger group sizes can result in lower premiums per individual. Customization Options Group health insurance plans may offer limited customization options. Individual health plans provide more flexibility in choosing coverage. Customization options in group plans are often predetermined by the insurer. Group health insurance is beneficial for larger organizations seeking cost-effective coverage solutions.Impact Of Group Health Insurance On Small Businesses

The impact of group health insurance on small businesses is immense. It not only plays a crucial role in providing healthcare coverage to employees, but it also has far-reaching benefits for the business as a whole. In this section, we will explore three key areas where group health insurance can have a positive impact: Competitive Advantage, Employee Recruitment, and Financial Stability.

Competitive Advantage

Having a group health insurance plan gives small businesses a competitive edge in the market. With the rising costs of healthcare, offering comprehensive health coverage to employees can be a significant selling point when attracting new customers or clients. It demonstrates that the business values the well-being of its employees, creating a positive image and distinguishing itself from competitors.

Employee Recruitment

Group health insurance is a valuable tool for attracting top talent to small businesses. In today’s job market, prospective employees consider healthcare benefits as a crucial factor when deciding which company to work for. By offering a comprehensive health insurance plan, small businesses can position themselves as an employer of choice, attracting skilled and motivated individuals.

Financial Stability

Group health insurance provides small businesses with the necessary financial stability to navigate unexpected healthcare expenses. By pooling the risk among a larger group, insurance premiums are lower compared to individual health insurance plans. This allows businesses to allocate their financial resources more effectively, ensuring they can focus on growth and development without the burden of exorbitant healthcare costs.

In conclusion, the impact of group health insurance on small businesses is multi-faceted. It not only enhances the competitive advantage by setting the business apart from competitors but also aids in employee recruitment by attracting top talent. Additionally, it provides financial stability, enabling businesses to allocate resources more efficiently. Implementing a group health insurance plan is a strategic choice that benefits both the business and its employees.

Regulations And Compliance In Group Health Insurance

When it comes to group health insurance, regulations and compliance are crucial factors that businesses need to consider. Understanding the legal requirements and ensuring full compliance with them is essential for employers who provide health insurance benefits to their workforce.

Aca Requirements

The Affordable Care Act (ACA) imposes several regulations on group health insurance plans. Employers with 50 or more full-time employees are required to offer affordable and comprehensive health insurance coverage which meets certain essential health benefits.

Erisa Regulations

Employee Retirement Income Security Act (ERISA) sets forth rules for employers offering health and welfare benefit plans, including group health insurance. It requires comprehensive plan information disclosure, fiduciary responsibility, and establishes minimum standards for plan participation and vesting. ERISA also mandates regular reports to the government and participants about plan operations and financial conditions.

Hipaa Compliance

The Health Insurance Portability and Accountability Act (HIPAA) includes requirements for employers providing group health insurance coverage. HIPAA aims to ensure the privacy and security of individuals’ health information and establishes standards for electronic healthcare transactions. It also limits the use and disclosure of protected health information.

Frequently Asked Questions Of What Do You Mean By Group Health Insurance

What Is Group Health Insurance?

Group health insurance is a policy that covers a defined group of people, such as employees of a company or members of an organization. It provides medical coverage to the insured individuals and often offers lower premiums and better benefits compared to individual plans.

Group policies are usually purchased by employers for their employees.

How Does Group Health Insurance Work?

Group health insurance works by spreading the risk among the members of the group, which results in lower premiums for individuals. Employers or organizations typically negotiate the terms and coverage with insurance companies, and eligible members can enroll during specified enrollment periods.

What Are The Benefits Of Group Health Insurance?

Group health insurance offers several advantages, including cost savings, comprehensive coverage, and the ability to include pre-existing conditions. It also promotes employee retention and attracts top talent for businesses. Group plans may also provide additional benefits such as wellness programs and preventive care.

Who Is Eligible For Group Health Insurance?

Eligibility for group health insurance varies, but it commonly includes full-time employees, certain part-time workers, and sometimes their dependents. Some organizations also extend coverage to retirees. Employers or group organizers typically set the eligibility criteria according to their specific rules and regulations.

Conclusion

To sum up, group health insurance offers an array of benefits for employees and employers alike. It ensures that workers have access to comprehensive healthcare coverage, promoting their overall well-being. Additionally, it provides cost savings and administrative ease for employers.

With its advantages in terms of affordability and flexibility, group health insurance is undoubtedly a valuable asset in today’s competitive job market. Make sure to explore the options available and choose the best plan that suits your organization’s needs.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is Group Health Insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance is a policy that covers a defined group of people, such as employees of a company or members of an organization. It provides medical coverage to the insured individuals and often offers lower premiums and better benefits compared to individual plans. Group policies are usually purchased by employers for their employees.” } } , { “@type”: “Question”, “name”: “How does Group Health Insurance work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance works by spreading the risk among the members of the group, which results in lower premiums for individuals. Employers or organizations typically negotiate the terms and coverage with insurance companies, and eligible members can enroll during specified enrollment periods.” } } , { “@type”: “Question”, “name”: “What are the benefits of Group Health Insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance offers several advantages, including cost savings, comprehensive coverage, and the ability to include pre-existing conditions. It also promotes employee retention and attracts top talent for businesses. Group plans may also provide additional benefits such as wellness programs and preventive care.” } } , { “@type”: “Question”, “name”: “Who is eligible for Group Health Insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Eligibility for group health insurance varies, but it commonly includes full-time employees, certain part-time workers, and sometimes their dependents. Some organizations also extend coverage to retirees. Employers or group organizers typically set the eligibility criteria according to their specific rules and regulations.” } } ] }

Leave a comment