Contents in flood insurance typically cover the material possessions, such as furniture and electronics, that are damaged or destroyed in a flood. Flood insurance provides vital protection for homeowners and renters in areas prone to flooding.

It helps to safeguard their belongings from the devastating effects of flood damage. One crucial aspect of flood insurance is its coverage of contents. When a flood occurs, it can wreak havoc on personal possessions, leading to significant loss and financial strain for the policyholder.

However, contents coverage in flood insurance ensures that these material belongings, such as furniture, appliances, and electronics, are included in the policy, protecting them from the potential aftermath. Understanding what is covered under contents in flood insurance is essential for homeowners and renters to secure appropriate coverage and peace of mind.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Credit: http://www.investopedia.com

Importance Of Flood Insurance

Contents in flood insurance cover belongings like furniture, electronics, and clothing damaged by floods. It safeguards personal property, providing financial protection in case of water-related disasters. Including contents in flood insurance policies is crucial for comprehensive coverage in the event of a flood.

What Does Home Insurance Cover?

Home insurance typically covers damage caused by fire and theft but does not include flood damage.

Why Is Flood Insurance Necessary?

Flood insurance is essential as it provides financial protection against the costly damages that natural disasters like floods can cause to your property.

Credit: http://www.youtube.com

What Is Covered By Flood Insurance?

Flood insurance typically covers personal belongings damaged in floods, including furniture, appliances, and clothing. This insurance safeguards your possessions against water damage, providing financial protection in case of a flood. It’s important to understand what falls under the coverage of contents in flood insurance to ensure adequate protection.

Flood insurance is a crucial safeguard against the devastating financial impact of flood damage. Understanding what is covered by flood insurance can help you make informed decisions and protect your assets. Flood insurance covers two main aspects: structural coverage and personal property coverage.

Structural Coverage

Structural coverage includes the physical elements of your property that are permanently attached, such as the foundation, walls, electrical systems, plumbing, and more. It also covers important components like built-in appliances, permanently installed carpeting, and cabinets. If these elements are damaged by a flood, flood insurance will help cover the cost of repairs or replacement.

In addition to the main structure, structural coverage also extends to detached garages and certain types of outdoor property, like swimming pools. However, it’s important to note that features like decks, patios, or fences may not be fully covered. Reviewing your policy and discussing these details with your insurance provider can help you understand the extent of your structural coverage.

Personal Property Coverage

Personal property coverage aims to protect your valuable belongings inside the flood-affected property. This includes furniture, electronics, clothing, appliances, and other personal possessions. Flood insurance can reimburse you for the repair or replacement of these items if they are damaged or destroyed due to flooding.

It is worth noting that there are certain limitations to personal property coverage. Items like cash, valuable papers, and precious metals may have limited coverage, so it’s best to consult your policy and insurer for specific details. Taking inventory and documenting your possessions can help streamline the claims process.

Furthermore, it is vital to stay informed about the difference between actual cash value (ACV) and replacement cost value (RCV) when it comes to personal property coverage. While ACV covers the current value of your possessions, RCV offers reimbursement for the cost of replacing the damaged items with new ones. Understanding these distinctions can help you evaluate the extent of your coverage accurately.

In Conclusion

With flood insurance, protecting your property and personal belongings from the devastating impact of floods becomes easier. Understanding the coverage provided for structures and personal property is crucial to ensure you have the right level of protection. Discussing your specific needs with your insurance provider will help you make informed decisions and safeguard your assets against flood damage.

Limits And Exclusions

When it comes to flood insurance, it’s crucial to understand the coverage limits and common exclusions associated with it. Being aware of these aspects can help you make informed decisions and ensure that you have adequate protection in place.

Coverage Limits

A vital aspect of flood insurance is the coverage limits it provides. These limits determine the maximum amount of compensation you can receive in the event of a flood-related loss. It’s important to review and understand these limits to ascertain whether they align with your property’s value and potential risk exposures.

Common Exclusions

Flood insurance also comes with common exclusions that specify scenarios or properties not covered by the policy. Understanding these exclusions is crucial to avoid any unexpected gaps in coverage. Common exclusions may include certain types of property, causes of flooding, or specific areas not covered by the policy.

Flood Insurance Costs

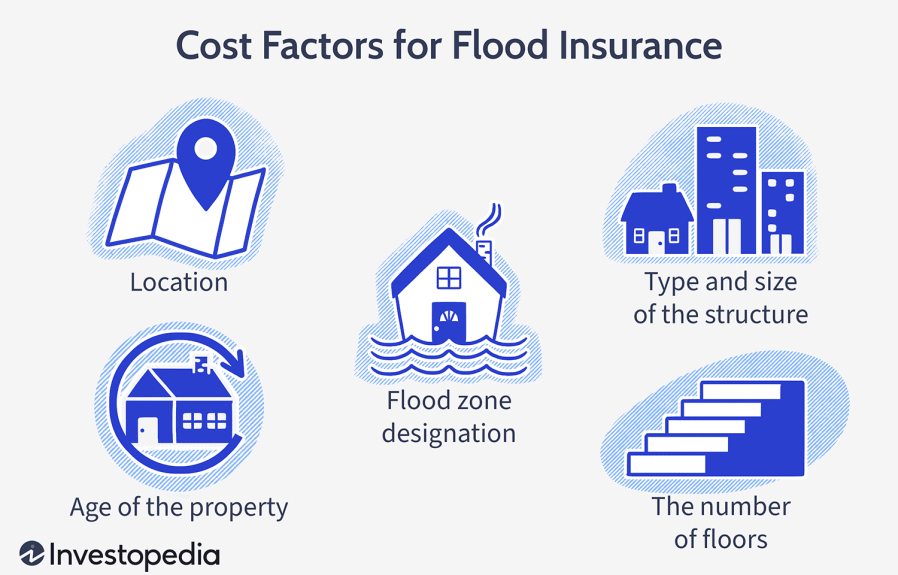

Flood insurance costs can vary based on several factors, and understanding what affects these costs can help homeowners make informed decisions. The premiums, which are the regular payments made for flood insurance coverage, are influenced by a range of elements. By exploring the key factors affecting the cost of flood insurance, homeowners can gain valuable insights into how to manage and plan for these expenses.

Premiums

The premiums for flood insurance play a crucial role in determining the overall cost. These are the regular payments that policyholders make to maintain coverage. The amount of premium can depend on various factors, such as the level of coverage, the type and age of the property, and the location of the property in relation to flood zones.

Factors Affecting Cost

Several factors can impact the cost of flood insurance premiums, including:

- Property location in a designated flood zone

- Base flood elevation of the property

- Construction of the property (e.g., building materials, elevation)

- Level of coverage and deductible chosen by the policyholder

- Previous flood claims on the property

| Factors | Impact |

|---|---|

| Property location in a designated flood zone | Influences the likelihood of flood damages and the associated risk. |

| Base flood elevation of the property | Determines the property’s susceptibility to flooding. |

| Construction of the property | Can affect the property’s resilience to flood damage. |

| Level of coverage and deductible chosen by the policyholder | Directly impacts the cost of the premiums. |

| Previous flood claims on the property | May result in higher premiums due to the property’s history of flooding. |

Understanding the premiums and the factors influencing flood insurance costs is essential for homeowners seeking adequate protection. By being aware of these elements, homeowners can make informed choices that align with their budget and provide necessary coverage for potential flood risks.

Understanding Deductibles

Contents in flood insurance refer to the possessions and personal belongings that are covered in case of flood damage. These can include furniture, electronics, appliances, clothing, and other valuable items. Understanding deductibles is important to comprehend how much you need to pay out of pocket before your insurance coverage kicks in.

Deductible Amounts

When it comes to flood insurance, understanding deductibles is crucial. Deductible amounts are the out-of-pocket expenses you must pay before your insurance coverage kicks in. This is an important factor to consider when choosing a policy, as it directly impacts the amount you’ll be responsible for paying in the event of a flood.

Flood insurance deductibles can vary, and it’s important to understand the different options available to you. Typically, the deductible amounts are set as a percentage of the total insured value of your property. These percentages can range from 1% to 5%, meaning that if your property is insured for $200,000 and you have a 2% deductible, you would be responsible for paying the first $4,000 of any flood-related damages before your insurance coverage takes effect.

How Deductibles Work

It’s important to note that flood insurance deductibles work differently than deductibles for other types of insurance. Rather than being a fixed dollar amount, flood insurance deductibles are percentage-based. This means that the deductible amount will vary depending on the total insured value of your property.

For example, if your property is insured for $500,000 and you have a 2% deductible, your out-of-pocket expenses for flood damages would be $10,000. However, if your property is insured for $1 million with the same 2% deductible, your out-of-pocket expenses would increase to $20,000. It’s essential to consider the insured value of your property when determining an appropriate deductible amount.

In addition to the percentage-based deductible, it’s worth noting that there is also a maximum limit on deductibles. This limit is set by the National Flood Insurance Program (NFIP) and can vary depending on the type of policy you have. It’s crucial to review your policy’s terms and conditions to understand the maximum deductible amount.

By understanding how deductible amounts work and evaluating different options, you can choose a flood insurance policy that aligns with your budget and provides adequate coverage for your property. Keep in mind that a higher deductible may result in lower monthly premiums, but it also means a higher out-of-pocket expense in the event of a flood. It’s essential to strike a balance that meets your financial needs and offers sufficient protection for your property.

Claim Process Simplified

Understanding the claim process for flood insurance can help you navigate through the aftermath of a flood disaster with ease. This simplified guide outlines the key steps involved in filing a claim, receiving claim approval, and the disbursement of funds to assist you in the event of a flood.

Filing A Claim

- Contact your insurer immediately after the flood damage occurs.

- Provide necessary documentation such as photos, receipts, and inventory of damaged items.

- Fill out a Proof of Loss form to detail the extent of the damages incurred.

Claim Approval And Disbursement

- Submit your completed claim for review by the insurance provider.

- Approval process involves assessing the validity and extent of the damages.

- Once approved, funds will be disbursed to help you recover and repair the damage.

Additional Coverage Options

Flood insurance often includes additional coverage options to provide more comprehensive protection for policyholders. These options can be crucial in helping to minimize the financial impact of flood damage and aid in the recovery process. Let’s explore the following additional coverage options available in flood insurance policies:

Increased Cost Of Compliance Coverage

Increased Cost of Compliance (ICC) coverage is an essential aspect of flood insurance, providing financial assistance to property owners for complying with local floodplain regulations and building codes after their property has been substantially damaged by a flood. This coverage helps policyholders cover the expense of implementing mitigation measures to reduce the risk of future flood damage, ensuring that their properties are in compliance with the necessary standards and reducing the likelihood of costly repairs from future flood events.

Loss Avoidance Coverage

Loss avoidance coverage is designed to help policyholders minimize the risk of future flood damage by covering the cost of certain activities aimed at reducing the potential impact of flooding on their properties. This can include expenses related to moving, sandbagging, or other temporary measures aimed at preventing or lessening the impact of flood damage. By investing in loss avoidance measures, property owners can proactively protect their properties from the destructive effects of flooding, potentially reducing the severity of damage and the associated financial impact.

Credit: smartapple.us

Tips For Choosing The Right Coverage

When considering flood insurance coverage, it’s important to understand what is included in the contents. This may encompass personal belongings such as furniture, electronics, and clothing that could be damaged in a flood. Be sure to assess the potential value of your items to ensure you choose the right coverage for your needs.

Evaluating Risk

When it comes to choosing the right flood insurance coverage for your property, it is essential to evaluate the risks associated with your location. Flooding can occur in various areas, including high-risk flood zones designated by the Federal Emergency Management Agency (FEMA). To determine your risk level, consider factors such as the proximity to rivers, lakes, or coastal areas. If your property is situated in a flood-prone area, it is crucial to opt for comprehensive coverage that protects both the structure and its contents. Before making a decision, you should also take into account the history of flooding in your area. Research past flood events, rainfall patterns, and drainage systems to better understand the likelihood of flooding. This evaluation will help you select the appropriate coverage that adequately protects your valuable belongings from potential damage.Seeking Professional Advice

While evaluating the risk is an essential step when choosing flood insurance coverage, seeking professional advice adds an extra layer of certainty. Consulting with an insurance expert specializing in flood insurance can provide valuable insights and guidance tailored to your specific needs. These professionals have the knowledge and experience to assess your property’s unique characteristics and recommend suitable coverage options. Additionally, working with an insurance agent or broker can help you understand the intricacies of flood insurance policies. They will assist you in reviewing different coverage levels and policy features available, ensuring you make an informed decision. Remember that when it comes to protecting your property from flood damage, knowledge is power. Seeking professional advice not only helps you navigate the complex world of flood insurance but also provides peace of mind knowing that you have considered all the necessary factors to choose the right coverage. In conclusion, evaluating the risk associated with your property’s location and seeking professional advice are crucial steps to choosing the right flood insurance coverage. By carefully assessing the risk factors and consulting experts, you can ensure that your property and its contents remain protected in the event of a flood.Frequently Asked Questions For What Is Considered Contents In Flood Insurance

What Does Flood Insurance Cover?

Flood insurance typically covers damage to the structure and contents caused by a flood. It can also include coverage for electrical and plumbing systems, appliances, and personal belongings.

Is Flood Insurance Required For A Mortgage?

In high-risk flood areas, flood insurance is usually required by mortgage lenders. However, even if it’s not required, it’s still a wise investment to protect your property from potential flood damage.

How Can I Determine My Flood Risk?

You can determine your flood risk by using FEMA’s Flood Map Service Center. By entering your address, you can access flood maps and understand the level of flood risk in your area.

What Is Not Covered By Flood Insurance?

Flood insurance typically does not cover damage caused by sewer backups, sump pump failures, or groundwater seepage. It also does not usually include coverage for landscaping, decks, fences, or other property outside the insured building.

Conclusion

Overall, understanding what is considered contents in flood insurance is crucial for homeowners to protect their possessions. From furniture and appliances to personal valuables, having a comprehensive understanding of what is covered can help minimize financial loss and provide peace of mind.

By assessing the specific contents coverage in your flood insurance policy, you can ensure that you have adequate protection in the event of a flood. Don’t take any chances – get familiar with your policy and safeguard what matters most to you.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What does flood insurance cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Flood insurance typically covers damage to the structure and contents caused by a flood. It can also include coverage for electrical and plumbing systems, appliances, and personal belongings.” } } , { “@type”: “Question”, “name”: “Is flood insurance required for a mortgage?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “In high-risk flood areas, flood insurance is usually required by mortgage lenders. However, even if it’s not required, it’s still a wise investment to protect your property from potential flood damage.” } } , { “@type”: “Question”, “name”: “How can I determine my flood risk?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can determine your flood risk by using FEMA’s Flood Map Service Center. By entering your address, you can access flood maps and understand the level of flood risk in your area.” } } , { “@type”: “Question”, “name”: “What is not covered by flood insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Flood insurance typically does not cover damage caused by sewer backups, sump pump failures, or groundwater seepage. It also does not usually include coverage for landscaping, decks, fences, or other property outside the insured building.” } } ] }

Leave a comment