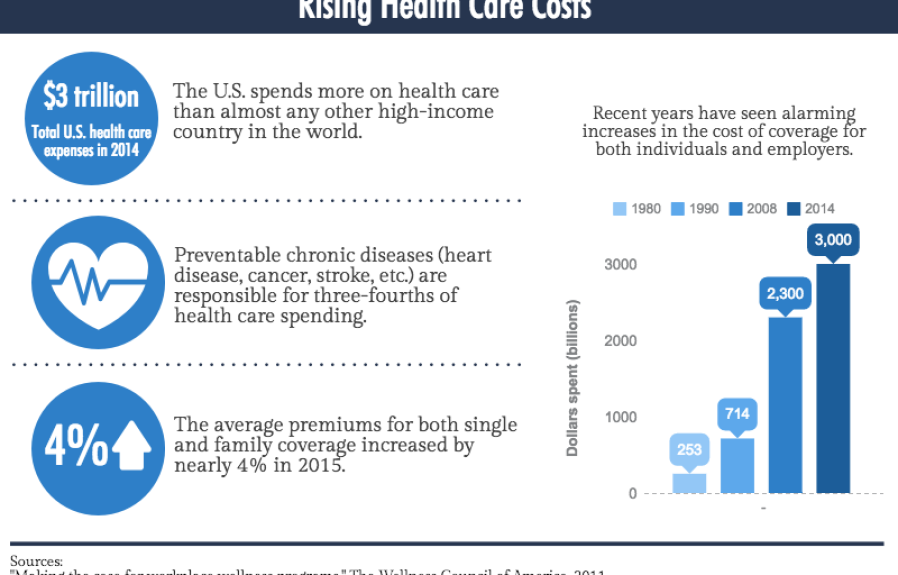

Insurance coverage prices can increase due to various factors such as changes in risk profiles, inflation, market conditions, and claim histories. However, predicting exactly when these price increases will occur can be challenging.

Understanding Insurance Cost Increase

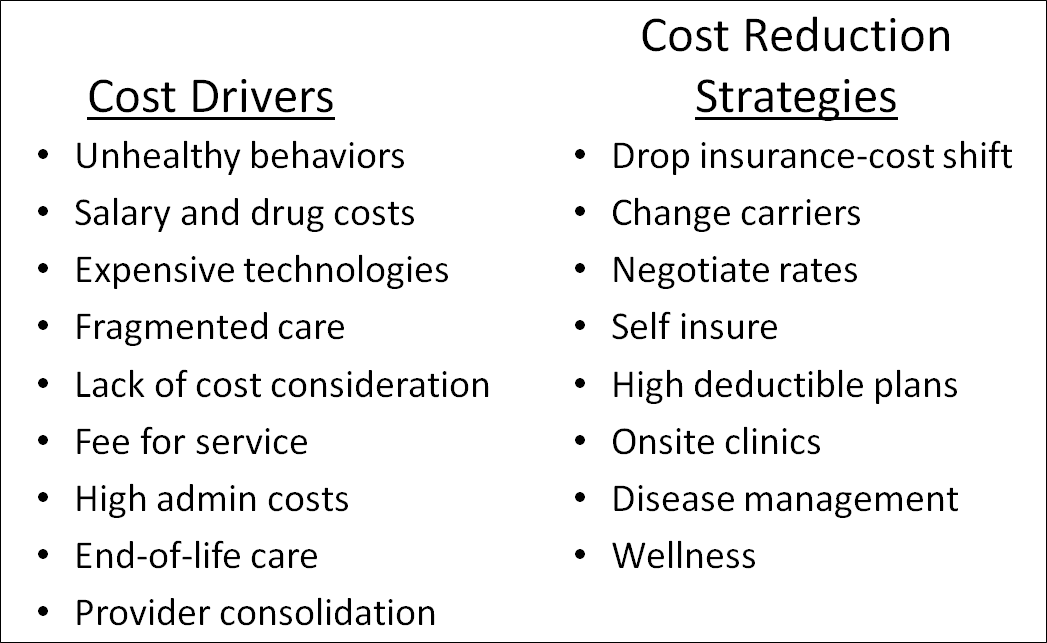

Some factors that can impact your insurance premiums include:

- Driving record

- Age and gender

- Type of coverage

- Location

Insurance pricing trends are influenced by:

- Economic conditions

- Frequency of claims

- Regulatory changes

Strategies To Manage Rising Insurance Costs

Rising insurance costs can put a strain on your budget, affecting both personal and business expenses. It’s crucial to find effective strategies to manage these increasing prices without compromising your coverage. By evaluating your current coverage and needs, exploring alternative insurance providers, adjusting deductibles and coverage limits, implementing risk management practices, bundling insurance policies for discounts, and improving workplace safety measures, you can take proactive steps to mitigate the impact of rising insurance costs.

1. Evaluate Current Coverage And Needs

Regularly assessing your current insurance coverage and needs is essential to ensure that you’re not overinsured or underinsured. Analyze your policies, including coverage limits, deductibles, and premiums, to determine if any adjustments are necessary. This evaluation will help identify any gaps or redundancies that may exist and allow you to make informed decisions about your insurance requirements.

2. Look For Alternative Insurance Providers

Research and explore alternative insurance providers to find competitive rates and better coverage options. Shopping around allows you to compare quotes and negotiate better terms, finding insurers that specialize in your specific needs. By taking the time to do your due diligence, you can potentially find cost-effective alternatives without sacrificing quality coverage.

3. Opt For Higher Deductibles And Lower Coverage Limits

Choosing higher deductibles can help lower your insurance premiums. Assess your risk tolerance and financial capabilities to determine if you can comfortably manage a higher deductible in the event of a claim. Additionally, consider lowering your coverage limits to align with your actual needs, avoiding unnecessary expenses that might be driving up your premiums.

4. Implement Risk Management Practices

Mitigating risks can help control insurance costs. Identify potential hazards and implement risk management practices specific to your situation. This might include installing security systems, training employees on safety protocols, conducting regular inspections, and documenting maintenance procedures. By proactively addressing risks, you can reduce the likelihood of incidents and potentially lower your insurance premiums.

5. Bundle Insurance Policies For Discounts

Consider consolidating your insurance policies with one provider to take advantage of bundled discounts. By grouping policies such as home, auto, and business insurance, you can often negotiate lower rates and streamline the management of your coverage. Bundling is not only cost-effective but also provides the convenience of dealing with a single insurance company for any claims or inquiries.

6. Improve Workplace Safety Measures

Prioritizing workplace safety can lead to fewer accidents and lower insurance costs. Review your safety protocols, provide appropriate training, and ensure compliance with industry standards. Regularly assess your workplace for potential hazards, maintaining a safe environment for employees and customers alike. By taking preventative measures and continuously improving safety, you can minimize the risk of accidents and potentially reduce your insurance premiums.

Communication With Insurance Provider

Effective communication with your insurance provider is crucial when dealing with insurance coverage price increases. Keeping an open line of dialogue can help you stay informed about your policy and make adjustments as needed, ensuring you are getting the best value for your coverage.

Negotiating Premiums

When facing a price increase, negotiating premiums with your insurance provider can be beneficial. Express your concerns about the hike in pricing and inquire about potential discounts or lower premium options that may be available to you. Being proactive about negotiating can often lead to a more favorable outcome for your insurance costs.

Reviewing Policies For Cost-saving Opportunities

Regularly reviewing your insurance policies for cost-saving opportunities can help mitigate the impact of a price increase. Consider speaking with your insurance provider about policy adjustments or discounts that may be applicable to your situation. Evaluating your coverage thoroughly can potentially lead to cost savings without sacrificing the protection you need.

Utilizing Technology For Cost Management

When Insurance Coverage Price Increases, it is essential for businesses to utilize technology for effective cost management. Leveraging digital tools and data analytics can significantly help in managing insurance costs while ensuring comprehensive coverage and risk assessment.

Implementing Digital Tools For Insurance Tracking

Implementing digital tools allows businesses to efficiently track and manage their insurance coverage. By utilizing dedicated software and applications, organizations can easily monitor upcoming policy renewals, track claims, and analyze coverage details. This not only ensures that coverage remains up to date but also helps in identifying areas where cost-saving measures can be implemented.

Leveraging Data Analytics For Risk Assessment

Leveraging data analytics provides companies with valuable insights into their risk profiles. By analyzing historical claims data, industry trends, and risk factors, businesses can accurately assess their insurance needs. This proactive approach enables organizations to tailor their coverage and risk management strategies, ultimately reducing the likelihood of unforeseen costs and coverage inadequacies.

Employee Education On Insurance Benefits

Employee education on insurance benefits is crucial in helping them understand changes in coverage prices. By providing adequate education, employers can empower their employees to make informed decisions about their insurance plans. This can also help employees take advantage of cost-saving opportunities and develop healthier habits to impact insurance premiums positively.

Providing Workshops On Understanding Insurance Plans

One effective way to educate employees on insurance benefits is to provide workshops that focus on understanding insurance plans. These workshops can cover various aspects, such as the different types of coverage, deductibles, co-payments, and out-of-pocket expenses. Employees can learn about the changes in coverage price and the reasons behind them, enhancing their understanding of insurance plans.

Workshops can also delve into specific areas, such as how to navigate the insurance provider’s website or how to submit claims effectively. By offering these workshops, employers can empower employees to handle insurance-related tasks with confidence, reducing any confusion or frustration.

Encouraging Healthy Habits For Lower Premiums

Another way to educate employees on insurance benefits is to encourage healthy habits that can lead to lower premiums. Employers can provide information on the correlation between lifestyle choices and insurance costs. For example, employees can be educated on the benefits of regular exercise, maintaining a healthy diet, and not smoking.

In addition to education, employers can incentivize healthy habits through various means. This can be done by offering wellness programs that provide rewards or discounts on insurance premiums for participating employees. By promoting healthy habits, employees can actively contribute to reducing insurance costs while also improving their overall well-being.

Utilizing these educational approaches can have long-term benefits for both the employees and the employer. Employees become more informed and engaged, gaining a deeper appreciation for their insurance benefits. Employers, on the other hand, can see reduced insurance costs and healthier employees, leading to increased productivity and overall satisfaction within the workplace.

Credit: http://www.mercer.com

Government Regulations And Compliance

Government regulations and compliance play a crucial role in insurance coverage price increases.

Staying Updated On Insurance Laws And Requirements

Regularly reviewing insurance laws helps understand recent changes impacting coverage cost.

- Attend seminars and workshops

- Consult legal experts

By staying informed, one can adapt insurance policies to comply with current regulations.

Seeking Tax Deductions Related To Insurance Costs

Exploring tax deductions related to insurance expenses can help reduce overall financial burden.

- Consult a tax advisor for insights

- Document all insurance expenses diligently

Utilizing tax deductions effectively can offset insurance coverage price increases.

Reviewing And Adjusting Coverage Periodically

Regularly reviewing and adjusting your insurance coverage is a crucial step in managing your business risks effectively. By taking the time to evaluate your policies on an annual basis, you ensure that your business is adequately protected and prepared for any potential risks or changes in your operations.

Annual Policy Reviews

Performing annual policy reviews is essential to stay up-to-date with your insurance needs. As your business grows or changes over time, your insurance requirements may also evolve. Conducting regular reviews enables you to determine if your current coverage aligns with the specific risks you face and make any necessary adjustments.

During an annual policy review, consider the following:

- Review your existing coverage and policy limits to ensure they still meet your needs.

- Assess any changes in business operations and identify potential new risks that may need additional coverage.

- Compare quotes from multiple insurance providers to ensure you’re getting the most competitive rates.

- Examine the terms and conditions of your policy to ensure you understand any changes or updates.

Evaluating Changes In Business Operations

Changes in your business operations can have a significant impact on your insurance needs. Whether you’ve expanded your product line, moved to a new location, or hired additional employees, it’s crucial to evaluate these changes and adjust your coverage accordingly.

Consider the following when evaluating changes in your business operations:

- Update your insurance policies to reflect any new products or services you offer.

- Ensure your coverage accounts for any new or updated equipment, machinery, or property.

- Address any employment-related changes, such as new hires or changes in employee roles, to mitigate potential liability risks.

- Discuss any operational changes with your insurance provider to identify gaps in coverage and explore suitable solutions.

By regularly reviewing and adjusting your insurance coverage, you can protect your business from unexpected expenses due to inadequate coverage. Stay proactive in managing your insurance needs and keep your business prepared for any potential risks or changes.

Credit: tigadvisors.com

Engaging Insurance Brokers For Cost-effective Solutions

When insurance coverage prices increase, it’s crucial for businesses to seek out cost-effective solutions to manage their expenses. Engaging insurance brokers can be an effective strategy to navigate through the complexities of insurance pricing and find tailored options that align with the company’s budget and needs.

Leveraging Broker Expertise For Cost-saving Advice

Insurance brokers possess valuable expertise in navigating the insurance market and can provide insightful advice on cost-saving strategies. Leveraging their knowledge allows businesses to make informed decisions and optimize their insurance coverage without compromising on quality.

Exploring Customized Insurance Packages

Insurance brokers have the ability to tailor insurance packages to fit the specific requirements of businesses. By exploring customized packages, companies can ensure that they are only paying for the coverage they need, potentially saving costs while maintaining comprehensive protection.

Credit: http://www.wellsteps.com

Frequently Asked Questions On When Insurance Coverage Price Increase

Why Do Insurance Coverage Prices Increase?

Insurance coverage prices can increase due to inflation, increased risk factors, or changes in government regulations. Insurers may also adjust prices to stay competitive in the market and reflect the rising cost of claims and operational expenses.

How Can I Prevent Insurance Coverage Price Increases?

To prevent insurance coverage price increases, you can maintain a good driving record, upgrade your home security, or bundle policies with the same insurer. Regularly reviewing and updating your coverage needs can also help in managing costs and preventing unexpected increases.

What Factors Influence Insurance Coverage Price Increases?

Various factors, such as the frequency and severity of claims, economic trends, and natural disasters, can influence insurance coverage price increases. Additionally, changes in your credit score, driving record, and lifestyle choices may impact the pricing of insurance coverage.

Can I Negotiate Insurance Coverage Price Increases?

You can negotiate insurance coverage price increases by comparing quotes from different insurers, reviewing your policy with an agent, and discussing potential discounts or adjustments to your coverage. Loyalty discounts, bundled policies, and a good claims history may also help in negotiating lower premiums.

Conclusion

As insurance coverage prices increase, it is essential for individuals to understand the factors contributing to these changes. By staying informed about industry trends and regularly reviewing policy options, people can make informed decisions that meet their needs and budget.

It is also crucial to consult with insurance professionals who can provide guidance and ensure comprehensive coverage. Taking proactive steps will help individuals navigate the evolving insurance landscape and secure the best possible coverage at the most reasonable price.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Why do insurance coverage prices increase?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Insurance coverage prices can increase due to inflation, increased risk factors, or changes in government regulations. Insurers may also adjust prices to stay competitive in the market and reflect the rising cost of claims and operational expenses.” } } , { “@type”: “Question”, “name”: “How can I prevent insurance coverage price increases?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To prevent insurance coverage price increases, you can maintain a good driving record, upgrade your home security, or bundle policies with the same insurer. Regularly reviewing and updating your coverage needs can also help in managing costs and preventing unexpected increases.” } } , { “@type”: “Question”, “name”: “What factors influence insurance coverage price increases?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Various factors, such as the frequency and severity of claims, economic trends, and natural disasters, can influence insurance coverage price increases. Additionally, changes in your credit score, driving record, and lifestyle choices may impact the pricing of insurance coverage.” } } , { “@type”: “Question”, “name”: “Can I negotiate insurance coverage price increases?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can negotiate insurance coverage price increases by comparing quotes from different insurers, reviewing your policy with an agent, and discussing potential discounts or adjustments to your coverage. Loyalty discounts, bundled policies, and a good claims history may also help in negotiating lower premiums.” } } ] }

Leave a comment