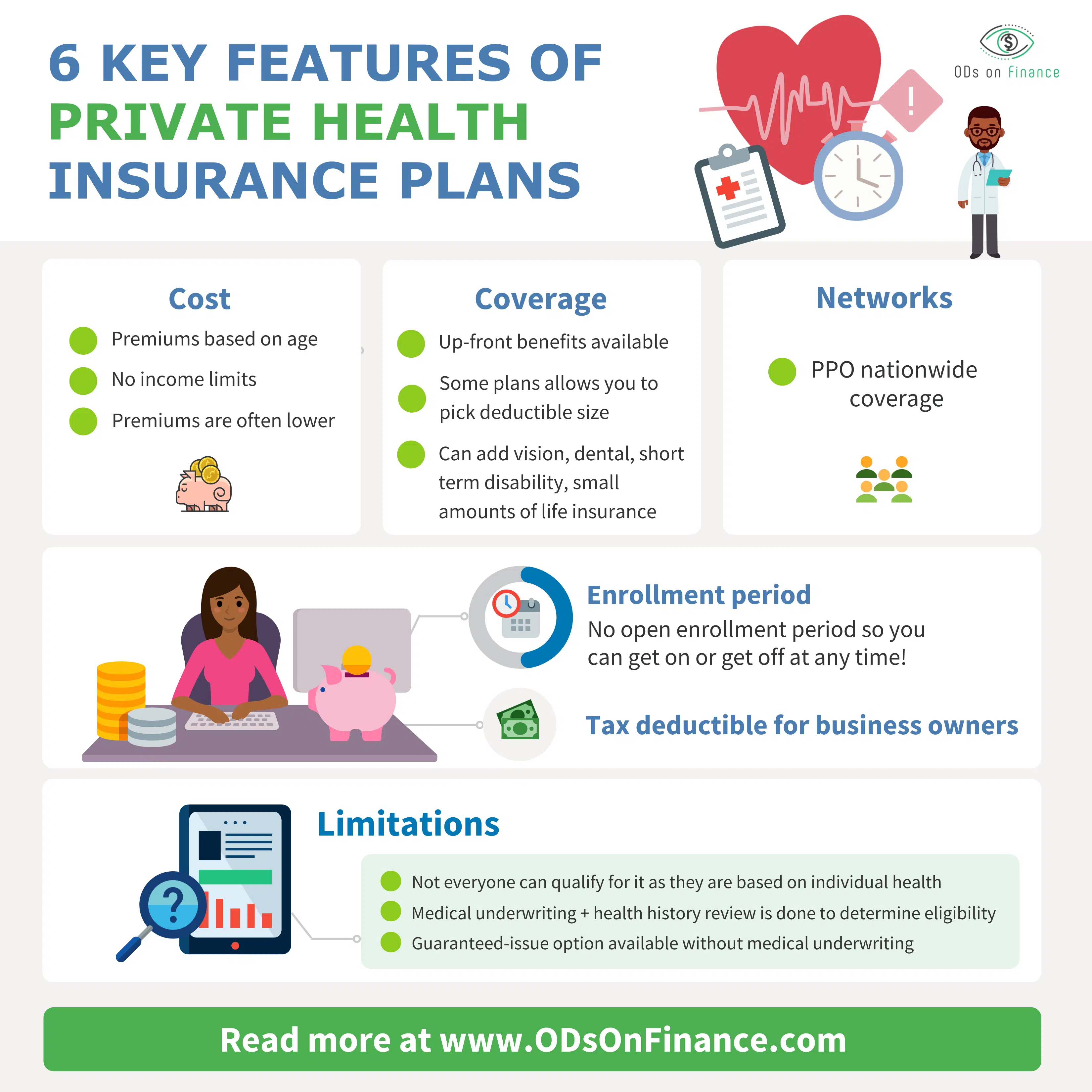

The best health insurance plan depends on individual needs and circumstances. In order to make an informed decision, it is important to consider factors such as coverage, cost, network of healthcare providers, and customer satisfaction ratings.

With countless options available, it is essential to research and compare plans to find the one that aligns with your specific healthcare needs. Remember to take into account factors such as deductibles, co-pays, and premiums, as well as the coverage provided for prescription drugs, specialist visits, hospital stays, and preventive services.

By carefully evaluating these factors, you can choose a health insurance plan that offers the best combination of affordability and adequate coverage for your unique healthcare requirements.

Credit: hometowninsurancepros.com

Benefits Of Health Insurance

Health insurance provides various benefits that play a crucial role in safeguarding your well-being and financial stability. Understanding these benefits can help you make informed decisions when choosing a health insurance plan that suits your needs.

Financial Protection

- Avoids high out-of-pocket costs in case of medical emergencies.

- Covers hospitalization, surgeries, and other medical expenses.

- Limits financial stress related to unexpected health issues.

Access To Quality Healthcare

- Provides access to a network of healthcare providers and facilities.

- Ensures timely medical treatments without delay.

- Encourages regular health check-ups and preventive care.

Credit: odsonfinance.com

Types Of Health Insurance Plans

When it comes to selecting the right health insurance plan, it’s important to understand the different options available to you. Health insurance plans can vary in terms of coverage, cost, and provider networks. Here, we’ll break down the four main types of health insurance plans: Health Maintenance Organization (HMO), Preferred Provider Organization (PPO), Exclusive Provider Organization (EPO), and Point of Service (POS).

Health Maintenance Organization (hmo)

A Health Maintenance Organization, or HMO, is a type of health insurance plan that offers a network of doctors, hospitals, and other healthcare providers that you must use in order to receive coverage. With an HMO plan, you typically need to choose a primary care physician who will coordinate your healthcare and refer you to specialists when necessary.

- Requires you to use in-network healthcare providers

- Requires a referral from a primary care physician for specialist visits

- Typically has lower out-of-pocket costs but less flexibility in choosing healthcare providers

Preferred Provider Organization (ppo)

A Preferred Provider Organization, or PPO, is a more flexible type of health insurance plan that allows you to visit both in-network and out-of-network healthcare providers. With a PPO plan, you don’t need a referral to see a specialist and have more freedom in choosing your healthcare providers.

- Allows you to use both in-network and out-of-network healthcare providers

- No referral required for specialist visits

- Flexibility in choosing healthcare providers, but higher out-of-pocket costs compared to an HMO plan

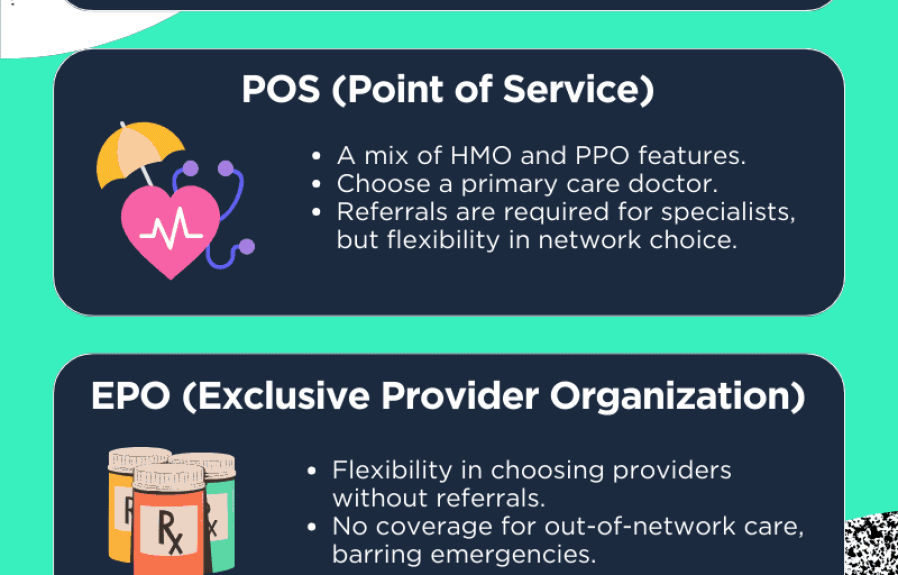

Exclusive Provider Organization (epo)

An Exclusive Provider Organization, or EPO, is a hybrid between an HMO and a PPO. Like an HMO, an EPO requires you to use in-network healthcare providers, but it does not usually require a referral to see a specialist. This type of plan offers more flexibility than an HMO but may have stricter requirements when it comes to staying within the provider network.

- Requires you to use in-network healthcare providers

- No referral required for specialist visits

- Less flexibility than a PPO plan, but potentially lower out-of-pocket costs

Point Of Service (pos)

A Point of Service, or POS, health insurance plan is a combination of an HMO and a PPO. With a POS plan, you’ll need to select a primary care physician who will coordinate your healthcare. Like an HMO, you’ll need a referral to see a specialist. However, you also have the option to visit out-of-network providers, typically at a higher cost.

- Requires you to select a primary care physician

- Requires a referral from a primary care physician for specialist visits

- Allows you to visit out-of-network providers at a higher cost

Factors To Consider When Choosing A Plan

When choosing a health insurance plan, it’s crucial to carefully consider several factors to ensure that you select the most suitable option for your needs. Here are the key factors to keep in mind:

Coverage And Benefits

Check if the plan covers essential healthcare services such as hospitalization, prescription drugs, preventive care, maternity care, mental health services, and rehabilitation. Ensure that the plan provides the necessary coverage for your specific medical needs.

Network Of Providers

Review the list of healthcare providers and facilities that are included in the plan’s network. Consider if your current healthcare providers are part of the network and assess the accessibility of network facilities in your area.

Costs And Premiums

Compare the costs associated with each plan, including deductibles, copayments, and coinsurance. Evaluate the monthly premiums and assess how these expenses fit within your budget while still meeting your healthcare needs.

Prescription Drug Coverage

Examine the plan’s coverage for prescription medications, including the list of covered drugs and the associated copayments or coinsurance. Ensure that the plan provides adequate coverage for any necessary medications.

Out-of-pocket Expenses

Consider the maximum out-of-pocket expenses for each plan, including the annual limit on the amount you would have to pay for covered services. Evaluate how these expenses align with your financial capabilities and potential healthcare needs.

Comparison Of Health Insurance Plans

Health insurance is a critical part of ensuring access to quality healthcare. When selecting a health insurance plan, it’s essential to compare the available options to determine the best fit for your needs. Below, we will delve into the comparison of health insurance plans, focusing on coverage, costs, and provider network to help you make an informed decision.

Coverage Comparison

Ensuring your health insurance plan provides comprehensive coverage is crucial. When comparing plans, consider the services and treatments they cover. Assess whether they include doctor’s visits, hospital stays, prescription drugs, preventive care, maternity care, and other essential healthcare services. Make sure to also examine the coverage limits and exclusions to understand the extent of protection provided.

Costs Comparison

Understanding the financial aspects of each health insurance plan is vital. Compare the monthly premiums, deductibles, co-payments, and co-insurance for each plan. Carefully assess the out-of-pocket maximum to gauge your potential financial responsibility in case of expensive medical treatment. For a comprehensive comparison, consider the cost-sharing structure and potential additional fees such as out-of-network costs.

Provider Network Comparison

Assessing the provider network is crucial to ensure you have access to quality healthcare professionals. Compare the in-network providers, including doctors, specialists, and hospitals available under each plan. Additionally, evaluate the flexibility to seek care from out-of-network providers and the associated cost implications. Consider the geographical coverage of the provider network if you anticipate the need for healthcare services outside your local area.

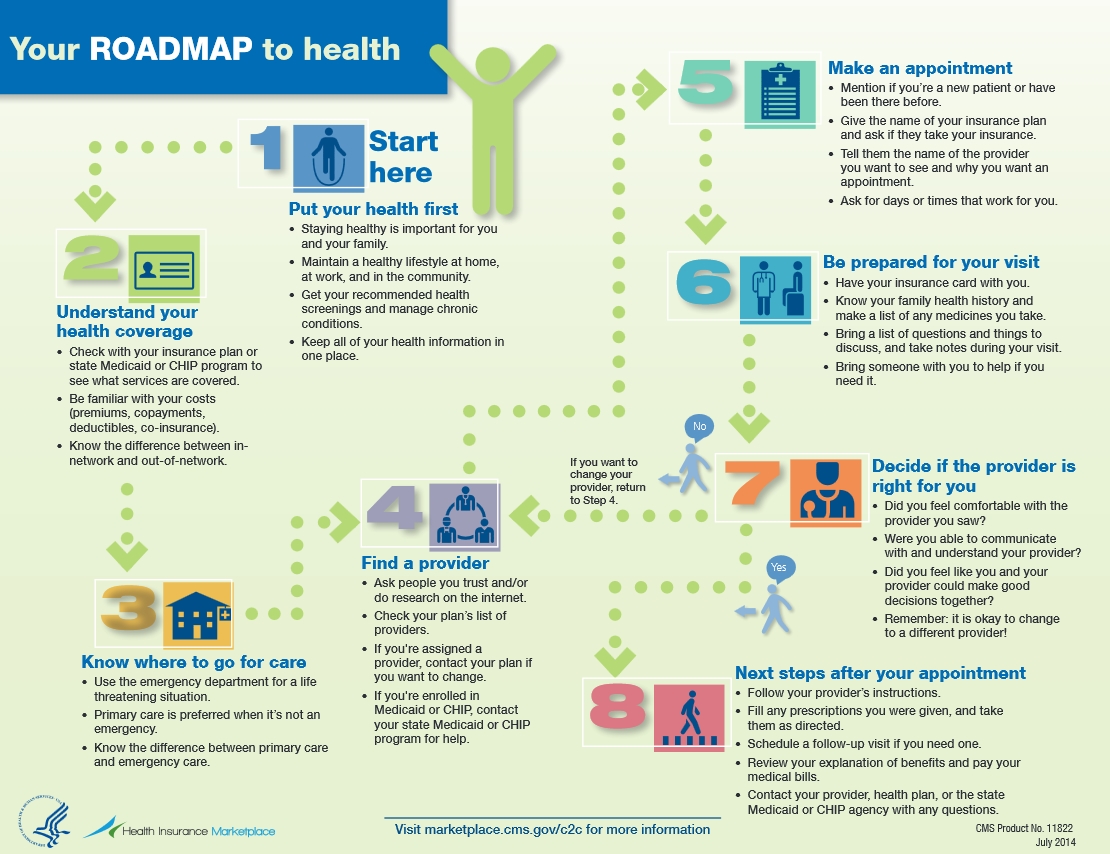

How To Determine Your Health Insurance Needs

Determining your health insurance needs is an essential step in finding the right plan for you and your family. Assessing your health needs, considering your budget, and anticipating future changes are key factors to consider. By taking the time to evaluate these aspects, you can make an informed decision and secure a health insurance plan that suits your needs and financial situation.

Assessing Your Health Needs

Assessing your health needs involves analyzing your current health condition and any potential future requirements. Consider factors such as your age, any existing medical conditions, and the frequency of medical visits you expect. Determine if you need coverage for specialized services like maternity care or mental health support. By understanding your health needs, you can select a plan that offers comprehensive coverage for the services you require.

Considering Your Budget

Your budget plays a crucial role in determining the most suitable health insurance plan for you. Consider your monthly income and expenses when evaluating different plans. Begin by examining the monthly premium costs and the extent of coverage provided. Compare deductibles, copayments, and coinsurance rates to determine how much you will need to pay out-of-pocket. Remember to also check if your preferred doctors and healthcare providers are included in the network. By considering your budget, you can find a plan that balances affordability with adequate coverage.

Anticipating Future Changes

Anticipating future changes is important, as your health insurance needs may evolve over time. Consider any potential life changes, such as starting a family or planning for retirement. Evaluate how well a plan accommodates these changes, including coverage for maternity care or long-term care. Additionally, be aware of any potential changes in your income or employment status, as this may impact your eligibility for certain plans. By proactively anticipating future changes, you can select a plan that offers flexibility and meets your evolving needs.

Credit: info.nystateofhealth.ny.gov

Tips For Finding The Best Coverage

When selecting a health insurance plan, research and compare different options to find the one that best meets your needs.

Online tools can help you compare features and costs of different health insurance plans to make an informed decision.

Consulting with a health insurance professional can provide you with personalized guidance on choosing the right coverage.

Common Mistakes To Avoid

When choosing a health insurance plan, it’s crucial to be mindful of the common pitfalls that many people fall into. By being aware of these ignoring network restrictions, overlooking deductibles and copayments, and focusing only on premiums, you can make a more informed decision that suits your needs.

Ignoring Network Restrictions

Make sure to check if your preferred healthcare providers are in-network to avoid unexpected costs.

Overlooking Deductibles And Copayments

Understanding your deductible and copayment amounts can help you plan your budget for medical expenses.

Focusing Only On Premiums

While premiums are essential, remember to consider the overall value of the plan, including coverage and out-of-pocket costs.

Making The Final Decision

As you approach the final stages in selecting the most suitable health insurance plan, it’s crucial to carefully review the policy details, choose the plan that aligns with your specific needs, and seamlessly enroll in the selected plan. Let’s dive into these key steps that will ultimately lead to securing the right health insurance coverage for you and your family.

Reviewing And Understanding Policy Details

Before making any final decisions, it’s essential to thoroughly review and understand the policy details of each health insurance plan under consideration. Take the time to examine the coverage, deductibles, co-pays, network of healthcare providers, and any potential exclusions. Compare the specifics of each plan to ensure it aligns with your healthcare requirements and budget.

Selecting The Right Plan For Your Needs

Once you’ve comprehensively reviewed the policy details, it’s time to select the health insurance plan that best meets your needs. Consider factors such as your medical history, anticipated healthcare needs, preferred healthcare providers, and financial considerations. Selecting the right plan is pivotal in ensuring that you have appropriate coverage for any future medical treatments or emergencies.

Enrolling In The Chosen Plan

After finalizing your decision, the last step is to enroll in the chosen health insurance plan. Whether it’s through your employer, the Affordable Care Act marketplace, or a private insurer, enrolling in the chosen plan will provide you with the peace of mind that you and your loved ones are covered for any unforeseen health-related expenses.

Frequently Asked Questions For Which Health Insurance Plan

What Are The Key Differences Between Hmo And Ppo Plans?

Health Maintenance Organization (HMO) plans generally require you to select a primary care physician and obtain referrals for specialists, while Preferred Provider Organization (PPO) plans offer more flexibility in choosing healthcare providers and usually involve higher out-of-pocket costs.

How Does A High-deductible Health Plan (hdhp) Work?

A high-deductible health plan typically features lower monthly premiums and a higher annual deductible. It’s often paired with a health savings account (HSA) to help cover medical expenses. With an HDHP, you pay for most routine medical care until the deductible is met.

What’s The Significance Of Network Coverage In Health Insurance Plans?

Network coverage refers to the healthcare providers and facilities that have agreements with the insurance company. In-network services typically cost less whereas out-of-network services may come with higher out-of-pocket expenses or may not be covered at all, depending on the plan.

Conclusion

Finding the right health insurance plan is crucial for your well-being. With various options available, it’s important to consider your specific needs and budget. By comparing different plans, assessing coverage, and analyzing costs, you can make an informed decision. Remember to prioritize preventive care and coverage for major medical expenses.

Consult with experts and review your options periodically to ensure your health insurance plan meets your evolving needs. Stay protected and take charge of your health!

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What are the key differences between HMO and PPO plans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Health Maintenance Organization (HMO) plans generally require you to select a primary care physician and obtain referrals for specialists, while Preferred Provider Organization (PPO) plans offer more flexibility in choosing healthcare providers and usually involve higher out-of-pocket costs.” } } , { “@type”: “Question”, “name”: “How does a high-deductible health plan (HDHP) work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A high-deductible health plan typically features lower monthly premiums and a higher annual deductible. It’s often paired with a health savings account (HSA) to help cover medical expenses. With an HDHP, you pay for most routine medical care until the deductible is met.” } } , { “@type”: “Question”, “name”: “What’s the significance of network coverage in health insurance plans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Network coverage refers to the healthcare providers and facilities that have agreements with the insurance company. In-network services typically cost less whereas out-of-network services may come with higher out-of-pocket expenses or may not be covered at all, depending on the plan.” } } ] }

Leave a comment