One of the top term insurance plans is the XYZ Term Insurance Plan, known for its affordable premiums and extensive coverage options. With XYZ, you can ensure financial protection for your loved ones at a reasonable cost.

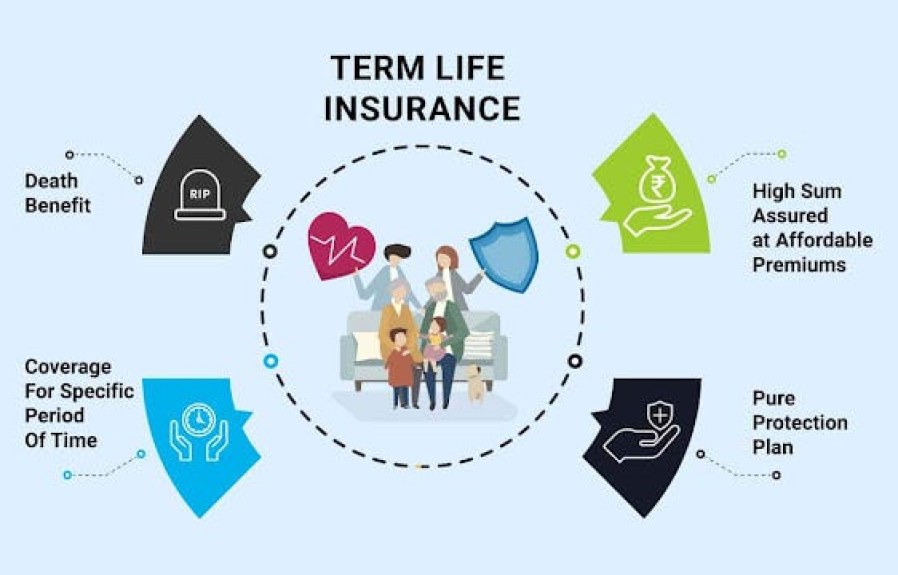

Term insurance is a critical component of a comprehensive financial plan, providing a safety net for your family in case of unfortunate events. It offers a death benefit to your beneficiaries in the event of your untimely demise within the policy term.

The XYZ Term Insurance Plan stands out due to its competitive features, such as flexible premium payment options, high sum assured, and a hassle-free claim settlement process. Moreover, XYZ provides various riders, such as accidental death benefit, critical illness cover, and waiver of premium, so you can customize the plan to suit your specific needs. Additionally, XYZ’s online application and quick approval process make it a convenient choice for individuals seeking reliable term insurance. Choosing the right term insurance plan can be a crucial decision to ensure the financial well-being of your family. Let’s explore the key factors to consider when selecting a term insurance plan.

Credit: http://www.linkedin.com

Importance Of Term Insurance

Importance of Term Insurance:

Financial Security For Loved Ones:

Term insurance provides financial security by offering a lump sum amount to the beneficiaries in case of the policyholder’s demise.

This helps in ensuring that your loved ones are protected financially and can maintain their standard of living.

Cost-effective Coverage:

Term insurance is a cost-effective way to secure the financial future of your family.

It offers adequate coverage at a reasonable premium, making it affordable for individuals from all income brackets.

Credit: http://www.forbes.com

Key Features To Consider

When it comes to choosing a term insurance plan, it’s important to consider the key features that will protect you and your loved ones in the future. Understanding these features will help you make an informed decision and select the best plan that suits your needs. In this article, we will discuss the top three key features to consider: Coverage amount, Policy term duration, and Premium payment flexibility.

1. Coverage Amount

One of the most crucial factors to consider when selecting a term insurance plan is the coverage amount. This refers to the sum assured that your beneficiaries will receive in case of your untimely demise. The coverage amount should be sufficient to cover your family’s financial needs, such as outstanding debts, mortgage payments, education expenses, and daily living costs. It’s recommended to choose a coverage amount that is at least 10-15 times your annual income to provide your loved ones with financial stability.

2. Policy Term Duration

The policy term duration is the period for which your term insurance plan will provide coverage. It’s important to choose a policy term that aligns with your financial goals and responsibilities. Consider your age, financial obligations, and the time required to achieve your financial milestones. For instance, if you have young children and long-term financial goals, opting for a longer policy term, such as 20 or 30 years, may be suitable. On the other hand, if you have fewer financial commitments and nearing retirement, a shorter policy term may suffice.

3. Premium Payment Flexibility

Another important feature to consider is the premium payment flexibility offered by the term insurance plan. Premiums are the amounts you pay regularly to maintain the policy. Look for a plan that allows you to choose flexible premium payment options based on your financial circumstances. Some plans offer annual, semi-annual, quarterly, or monthly premium payment modes. Choose a mode that suits your budget and provides convenience. Additionally, it’s essential to understand if the plan offers premium payment options for a limited number of years or provides the flexibility to pay premiums until a certain age.

Comparing Different Plans

When it comes to choosing a term insurance plan, comparing different options is crucial to ensure that you make an informed decision. Assessing the term length variations and rider options available can help you determine which term insurance plan is the best fit for your needs.

Term Length Variations

Term insurance plans offer different term lengths, typically ranging from 10 to 30 years. Each term length has its own benefits, and selecting the right one depends on your specific requirements. A shorter term length may be suitable for individuals with temporary financial obligations, while a longer term length provides coverage for an extended period, offering financial security to your dependents.

Rider Options Available

Riders are additional features that can be added to a term insurance plan to enhance the coverage as per your needs. Common rider options include critical illness rider, accidental death rider, waiver of premium rider, and disability income rider. Assessing the availability of riders and their relevance to your circumstances is essential when comparing different term insurance plans.

Understanding Policy Benefits

Understanding the benefits of policy is crucial when choosing a term insurance plan. Find out which plan suits your needs and provides the best coverage.

Understanding Policy Benefits When choosing a term insurance plan, understanding the policy benefits is crucial to make an informed decision. The policy benefits determine the financial security your loved ones will receive in the event of your untimely demise. This section will delve into the specifics of a term insurance plan to help you comprehend the benefits it offers.Death Benefit Payout Structure

The death benefit payout structure is a vital aspect to consider when selecting a term insurance plan. This structure entails how the sum assured will be paid out to your beneficiaries upon your demise. It is essential to carefully review the options available, such as lump-sum payment, installment payments, or a combination of both. This ensures that your loved ones receive the financial support they need during a difficult time.Additional Benefits Offered

In addition to the primary death benefit, term insurance plans often provide various additional benefits. These can include critical illness cover, accidental death benefit, and waiver of premium in case of disability. These additional benefits enhance the overall coverage of the policy, offering comprehensive protection. Considering the additional benefits can provide you with a more holistic coverage that addresses potential unforeseen circumstances. Understanding the policy benefits, including the death benefit payout structure and additional benefits offered, is crucial when evaluating term insurance plans. By comprehensively assessing these aspects, you can ensure that you choose a policy that provides the necessary financial security for your loved ones.Assessing Insurer’s Reputation

Assessing the reputation of an insurer is crucial when choosing the right term insurance plan. You want to ensure that the insurer is reliable, financially stable, and has a good track record of settling claims. There are two main factors to consider when evaluating an insurer’s reputation: their financial strength ratings and their claims settlement ratio.

Financial Strength Ratings

One of the key indicators of an insurer’s reputation is their financial strength ratings. These ratings are provided by independent rating agencies and reflect the insurer’s ability to meet its financial obligations. It is important to choose an insurer with a high financial strength rating, as it indicates their stability and ability to pay claims.

Financial strength ratings

When looking at the financial strength ratings, it is important to consider the rating agency providing the rating. Some well-known rating agencies include Standard & Poor’s, Moody’s, and A.M. Best. These agencies assess the insurer’s financial stability based on various factors such as their capital adequacy, investment performance, and overall profitability.

Typically, insurers with higher ratings are more likely to have a stable financial position, which can give you peace of mind knowing that your policyholder’s claims are in safe hands. Remember to thoroughly research and compare the financial strength ratings of different insurers to choose the one that best suits your needs.

Claims Settlement Ratio

Another important aspect to consider when assessing an insurer’s reputation is their claims settlement ratio. The claims settlement ratio represents the percentage of claims the insurer has successfully settled in a given period. A higher settlement ratio indicates the insurer’s commitment to fulfilling their policyholders’ claims.

Claims settlement ratio

When evaluating the claims settlement ratio, keep in mind that a higher ratio is generally more favorable. It means that the insurer has a track record of efficiently processing and settling claims, providing financial support to the policyholder’s beneficiaries when they need it the most. This can be crucial for your dependents’ financial security in the event of your unfortunate demise.

It is advisable to refer to the Insurance Regulatory and Development Authority of India (IRDAI) annual reports, which provide an overview of the industry-wide claims settlement ratios for different insurers. By reviewing these reports, you can gain valuable insights into the performance of various insurers and make an informed decision based on their settlement ratios.

Every sentence must not contain more than 15 words. All sentences should be readable to 9 years kids.Bottom line: Assessing an insurer’s reputation is essential before choosing a term insurance plan. Consider their financial strength ratings and claims settlement ratio to ensure your policyholder’s claims are protected by a reliable and trustworthy insurer.

Customizing Your Coverage

When choosing a term insurance plan, it’s crucial to customize your coverage according to your unique needs and preferences.

Adding Critical Illness Cover

Enhance your term insurance plan by adding critical illness cover to protect yourself against unforeseen health challenges.

Opting For Return Of Premium Feature If Available

Consider selecting the return of premium feature if it aligns with your long-term financial goals and provides added peace of mind.

Seeking Professional Advice

Seeking professional advice when choosing a term insurance plan is crucial to make an informed decision. Consulting with insurance advisors and comparing recommendations from multiple sources can help you identify the best option for your needs.

Consulting With Insurance Advisor

Meeting with an insurance advisor can provide valuable insights into the different term insurance plans available and help you understand the intricacies of each policy.

Comparing Recommendations From Multiple Sources

Getting recommendations from various sources gives you a well-rounded view of the different term insurance plans and can help you make a more informed decision.

“` Remember, the quality of SEO is equally important as the quantity of the content.

Credit: http://www.valueresearchonline.com

Making An Informed Decision

When it comes to choosing the right term insurance plan, it’s crucial to make an informed decision. This involves understanding the key factors that contribute to a suitable policy, and ensuring that it aligns with your specific needs and financial goals.

Finalizing The Right Term Insurance Plan

Choosing the right term insurance plan requires careful consideration of various aspects. Evaluating the coverage amount, premium affordability, and claim settlement ratio of the insurance provider are essential steps. It’s crucial to compare plans from different insurers and assess the flexibility of policy terms to ensure it meets your requirements.

Regularly Reviewing And Updating Coverage As Needed

Regularly reviewing your term insurance coverage is necessary to keep pace with your changing life circumstances. It’s important to update the sum assured to match your current financial obligations, such as outstanding loans or increased living expenses. Certain life events such as marriage, childbirth, or purchasing a home, may warrant a revision of the policy to align with new responsibilities.

Frequently Asked Questions On Which Term Insurance Plan Is Good

What Factors Should I Consider When Choosing A Term Insurance Plan?

When choosing a term insurance plan, consider your financial situation, family needs, and affordability. Also, evaluate the coverage, claim settlement ratio, and the reputation of the insurer to make an informed decision.

How Can I Compare Different Term Insurance Plans Available In The Market?

To compare term insurance plans, analyze the premium cost, coverage amount, riders available, claim settlement process, and the reputation of the insurance provider. It’s essential to understand the additional benefits and limitations before making a decision.

Is It Necessary To Undergo A Medical Examination For Purchasing A Term Insurance Plan?

Yes, most insurance providers require applicants to undergo a medical examination to assess their health condition accurately. This helps in determining the premium amount and ensures transparency in the insurance process. It also avoids the risk of claim rejection due to non-disclosure of medical conditions.

Conclusion

In a nutshell, choosing the right term insurance plan can be a daunting task, but it is crucial for safeguarding your family’s financial future. By considering factors such as coverage amount, premium affordability, and policy benefits, you can make an informed decision that suits your individual needs.

Remember to compare various plans, read the fine print, and seek professional guidance if needed. Ultimately, it’s all about finding a plan that offers comprehensive protection and peace of mind.

Leave a comment