Travel insurance jobs can vary depending on the specific role and company.

Importance Of Travel Insurance For Different Professions

Travel insurance is crucial for professionals in various industries due to the unpredictable nature of travel. It offers a safety net against unforeseen events that can disrupt travel plans and impact work responsibilities.

Coverage Benefits For Frequent Travelers

- Medical Expenses: Covers emergency medical treatment during travels.

- Trip Cancellation: Protects against unexpected trip cancellations.

- Lost Baggage: Reimburses for lost or stolen luggage.

Specific Considerations For Business Travel

- Business Equipment Coverage: Insures valuable equipment used for work purposes.

- Work Interruption: Covers work-related interruptions due to travel issues.

- Emergency Assistance: Provides access to 24/7 emergency assistance services.

:max_bytes(150000):strip_icc()/Termination-employment_final-4aad1375426e43c29891f6e7782bd296.png)

Credit: http://www.investopedia.com

Choosing The Right Coverage

Selecting the right travel insurance coverage for your job is essential. It is crucial to consider the type of work you do and the potential risks involved to ensure you have adequate protection during your travels. Different job roles may require specific coverage, so it’s important to carefully assess your needs before making a decision.

Analyzing Your Travel Needs

Before you embark on your next adventure, it’s essential to carefully analyze your travel needs to ensure that you choose the right coverage for your trip. Consider factors such as the duration of your trip, your destination, and any activities you plan to engage in. When determining the duration of your trip, think about how long you will be away from home. If you’re planning a short getaway for a few days, a basic travel insurance policy may be sufficient. However, if you’re embarking on a longer trip, such as a month-long backpacking adventure, you may need a more comprehensive policy that covers emergencies, medical expenses, and trip cancellation. Next, consider your destination. Are you traveling within your own country, or are you venturing abroad? Different countries have varying healthcare systems, so it’s crucial to choose a travel insurance policy that provides adequate coverage for medical expenses and emergencies. Additionally, some destinations may have higher levels of theft or natural disasters, and it’s important to have insurance that protects against these risks. Finally, think about the activities you plan to participate in during your trip. If you’re an adventure seeker, engaging in high-risk activities such as skiing, scuba diving, or bungee jumping, it is essential to have coverage that includes adventure sports. Many standard policies may exclude coverage for these activities, so make sure to read the fine print and choose a policy that suits your needs.Comparing Premiums And Benefits

Once you have analyzed your travel needs, the next step is to compare premiums and benefits offered by different insurance providers. We all want the best value for our money, but don’t fall into the trap of choosing the cheapest policy without considering its benefits and coverage. When comparing premiums, take note of any deductible amounts, co-payments, and limits on coverage. A lower premium may seem enticing, but it might come with higher deductibles or limited coverage, resulting in more out-of-pocket expenses in the event of a claim. Additionally, carefully review the benefits offered by each policy. Does it cover emergency medical expenses, trip cancellation or interruption, lost or delayed baggage, or emergency medical evacuation? These are all crucial aspects to consider when selecting the right coverage. Look for policies that provide a wide range of coverage and benefits that align with your specific travel needs. To simplify your comparison process, create a table that lists the different insurance providers, their premiums, deductible amounts, coverage limits, and benefits. This will allow you to easily compare the offerings side by side and make an informed decision based on your requirements. Remember, when choosing travel insurance, prioritize finding the right coverage that adequately protects you and your loved ones during your trip. By analyzing your travel needs and comparing premiums and benefits, you can make an informed decision that provides you with peace of mind throughout your journey.Tailored Policies For Various Job Types

Options For Remote Workers

Remote workers have unique insurance needs due to their flexible work arrangements. Our travel insurance policies for remote workers provide coverage for trip cancellations, emergency medical expenses, and personal liability protection. With customizable options, remote workers can ensure their insurance policy aligns with their specific travel plans and work requirements.

Coverage For Healthcare Professionals

Healthcare professionals often travel for work-related purposes, such as medical conferences or locum tenens assignments. We understand the distinctive demands of the healthcare industry, offering tailored insurance that covers professional liability, medical malpractice, and emergency medical evacuation. Our policies provide peace of mind for healthcare professionals while they focus on delivering quality patient care.

Insurance Solutions For Digital Nomads

Digital nomads lead a nomadic lifestyle, requiring insurance that accommodates their constant travel and online work. Our insurance solutions for digital nomads encompass coverage for gadgets, travel delays, and remote working equipment. Whether working from a bustling cafe in a cosmopolitan city or a tranquil beachside retreat, digital nomads can rely on our comprehensive policies to safeguard their nomadic adventures.

:max_bytes(150000):strip_icc()/Intro-cobra-health-insurance_final-80419e34cbe248bda730c7bb6904870f.png)

Credit: http://www.investopedia.com

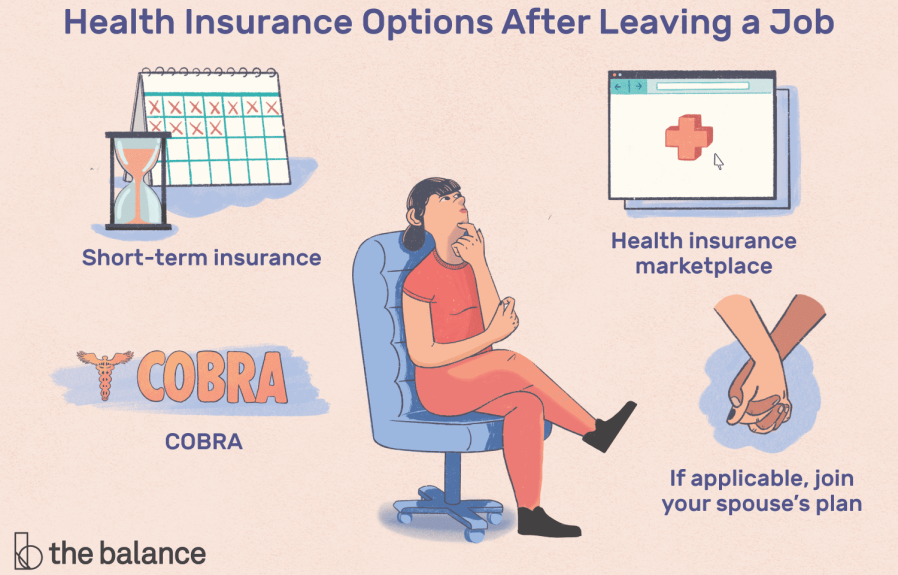

Understanding Exclusions And Limitations

Travel insurance job seekers need to understand the exclusions and limitations of their policies. Knowing what is covered can save you from unexpected expenses during your trip. Be proactive and make informed decisions to ensure a stress-free journey.

Understanding Exclusions and Limitations When it comes to choosing the right travel insurance for your job-related trips, understanding the exclusions and limitations is crucial. Common exclusions in travel insurance and limitations of coverage based on your career can impact the level of protection you receive. Being aware of these factors will help you make informed decisions for your insurance needs. Common Exclusions in Travel Insurance In travel insurance, there are several common exclusions that you should be aware of. These exclusions often include pre-existing medical conditions, high-risk activities, and incidents arising from alcohol or drug abuse. It’s important to carefully review the policy to understand what is and isn’t covered to avoid any surprises when making a claim. Limitations of Coverage Based on Career The type of work you are involved in can also impact the limitations of coverage provided by travel insurance. Certain occupations may have restrictions on coverage, especially if the job involves hazardous activities or travel to high-risk areas. Understanding these limitations can help you determine if additional coverage or a specialized policy is necessary for your specific career. When it comes to travel insurance, understanding the exclusions and limitations is key to ensuring you have the right level of protection for your job-related travels. By being aware of common exclusions and limitations based on your career, you can make informed decisions when selecting a policy that meets your needs.Tips For Maximizing Benefits

When it comes to travel insurance, getting the most out of your policy is key. By utilizing add-ons wisely and making claims hassle-free, you can ensure that you are maximizing your benefits. Here are some tips that will help you do just that:

Add-ons can enhance the coverage of your travel insurance policy, providing you with extra protection for specific situations. However, it’s important to use these add-ons wisely to make the most of your benefits. Here are a few tips:

- Assess your needs: Before purchasing any add-ons, take the time to carefully assess your needs. Determine what additional coverage you truly require based on your travel plans and personal circumstances.

- Read the fine print: When considering add-ons, always read the fine print. Ensure that you understand the terms and conditions, limitations, and exclusions of the add-on coverage before making a decision.

- Compare prices: Shop around and compare prices for add-ons offered by different insurance providers. However, remember that the cheapest option may not always be the best in terms of coverage and benefits.

- Consider bundling: If you require multiple add-ons, check if bundling them together offers any discounts or cost savings. Bundling can be a great way to maximize your benefits while keeping costs in check.

Filing a claim can sometimes be a complex and time-consuming process. However, by following these tips, you can make it hassle-free and ensure a smooth experience:

- Understand the claims process: Before your trip, familiarize yourself with the claims process of your travel insurance provider. Know the necessary documents, time limits, and steps required to file a claim.

- Keep documentation organized: Throughout your trip, keep all relevant documentation organized and easily accessible. This includes receipts, medical records, police reports, and any other documents that may be required for your claim.

- Notify your provider promptly: In the event of an incident or loss, notify your insurance provider as soon as possible. Promptly reporting the incident will ensure that your claim is processed efficiently.

- Follow instructions carefully: When submitting a claim, carefully follow the instructions provided by your insurance provider. This will help avoid any delays or issues with your claim.

- Keep communication open: If you have any questions or concerns about the claims process, don’t hesitate to reach out to your insurance provider. Open communication can help address any issues and ensure a smoother claims experience.

By utilizing add-ons wisely and making the claims process hassle-free, you can maximize the benefits of your travel insurance policy. Remember to carefully assess your needs and read the fine print when considering add-ons. Additionally, keep your documentation organized and follow the claims process instructions to make filing a claim easier. These tips will help you make the most of your travel insurance and provide you with peace of mind during your trips.

Case Studies: Real-life Examples

Explore real-life case studies showcasing the benefits of suitable travel insurance options for various job roles, providing insights into the importance of securing the right coverage for your profession. Learn from practical examples how tailored insurance solutions can offer peace of mind during work-related travels.

Successful Claim Stories

Instances Of Coverage Shortfalls

Travel insurance can be a lifesaver in unforeseen situations. Let’s delve into some real-life examples to understand the significance.

Successful Claim Stories

Case 1: Kathy’s delayed flight resulted in missed connections. Her travel insurance covered the additional expenses incurred.

Case 2: Mark fell ill during his trip and had to seek medical treatment. The insurance company promptly reimbursed his medical bills.

Instances Of Coverage Shortfalls

Case 1: Jamie’s lost luggage claim was denied due to inadequate documentation. It highlights the importance of thorough record-keeping.

Case 2: Sarah’s adventure activities were not covered as per the policy terms. Understanding policy exclusions is crucial.

Future Trends In Job-specific Travel Insurance

Future Trends in Job-Specific Travel Insurance are rapidly evolving to meet the unique needs of modern travelers. As the world of work continues to shift, so do the requirements for adequate insurance coverage.

Customized Plans With Ai Integration

AI technology is revolutionizing the travel insurance industry by providing customized plans tailored to individual job roles. With AI integration, policies can be dynamically adjusted based on specific job responsibilities.

Integration Of Health And Travel Policies

The seamless integration of health and travel policies ensures comprehensive coverage for travelers. By linking these policies, insurance providers can offer a more holistic approach to protecting travelers’ well-being.

Credit: enhancv.com

Frequently Asked Questions On Which Travel Insurance Job

What Does Travel Insurance Cover?

Travel insurance typically covers trip cancellations, medical emergencies, lost baggage, and other unforeseen travel mishaps. It provides financial protection and peace of mind when unexpected events occur during your trip.

How Do I Choose The Right Travel Insurance?

Consider factors like trip duration, destination, activities, and medical needs. Review policy coverage, exclusions, and add-ons. Compare quotes from different insurers and read customer reviews to ensure you select the best option for your specific travel needs.

Is Travel Insurance Worth The Cost?

Yes, travel insurance is worth the cost as it provides financial protection against trip cancellations, medical emergencies, and unforeseen events. The small investment in travel insurance can provide significant peace of mind and save you from unexpected expenses during your trip.

Conclusion

Overall, choosing the right travel insurance is a crucial decision that can protect you from unforeseen circumstances during your trip. By evaluating your needs, comparing different policies, and understanding the coverage options, you can find the perfect travel insurance that suits your specific requirements.

Remember, don’t compromise on quality, as investing in travel insurance can bring you peace of mind and financial security throughout your journey. Happy travels!

Leave a comment